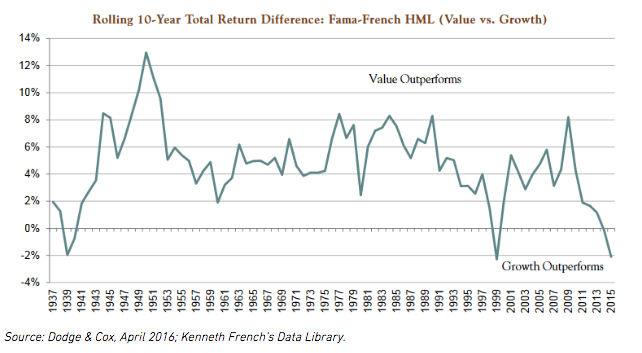

Lastly, we believe that inconsistency is a much greater risk to investors than uncontrollable variability. When a portfolio underperforms, is it because of a break away from the normal discipline or the natural result of the temporary circumstances outside the control of the discipline? We always explain to potential investors the circumstances surrounding our bouts of underperformance. Our tendency is to not do well when commodity-driven and capital intensive/labor intensive businesses lead the market for extended time periods. We also tend to underperform in years when expensive glamour growth stocks are all the rage. We are in the third biggest growth stock outperformance period in the last 80 years as seen in the chart below:

Since growth has stomped value over the last 10 years and the S&P 500 Index has produced a positive return for nine consecutive years, consultants like Morningstar have effectively begun to ask for something which can’t happen. They are asking for outperformance with low variability. This is like asking for 80-degree weather in July in Phoenix and for balmy weather in Minneapolis in the dead of winter. Using our strategy as an example, Morningstar considers our discipline “high” risk even though we beat the S&P 500 Index for seven out of the 10 years of its existence and beat the Russell 1000 Value Index in its first 10 years.

In conclusion, we believe a major reassessment needs to occur in how investors measure risk while the current bull market lasts. Mindless passive investing works great when the index has a positive return for nine years in a row, is dominated by glamour growth stocks and variability seems to have disappeared from long-duration common stock ownership. In the next 10 years, we are devoted to adding alpha despite what is likely to be a stock market which gets re-introduced to volatility and variability itself. And our opinion doesn’t need “high math.”

William Smead is CIO and CEO of Smead Capital Management.