The Need For A Dynamic Process

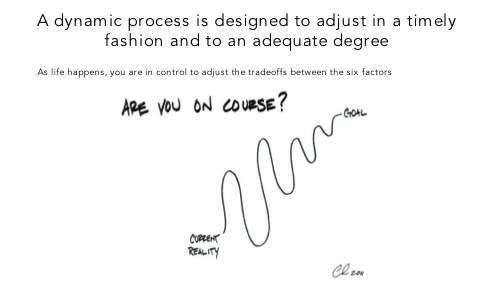

The process outlined above, focusing on the six factors that are understandable, controllable, and relevant to the client’s financial journey, provides a dynamic framework for dealing with life’s ever-changing nature - unlike the risk tolerance questionnaire. Let’s be honest, the world changes over time and therefore the nature of the six factors under the client’s control must also change at an equal pace. The world surprises, so no matter how solid a client’s financial plan, no matter how competent its initial implementation, the instant that it has been inked or implemented, it has also become stale and outdated. A “Financial Plan” is the ultimate in irrelevance. Life happens, so what is needed is a dynamic process that provides a “Continuous Planning Process.”

Such a process allows the client to reset the tradeoffs previously made between the six competing factors -- and at a pace and to a degree that matches life’s surprises. Now we can more confidently manage the unexpected and unplanned arrival of tomorrow’s new and different reality. Under such a framework, returns are not the objective. Outperformance is not the objective, and the scoring on a risk tolerance questionnaire is not the objective. The first two may contribute to a best-possible journey, but they are never the objective -- and in fact seriously distract from what is important, i.e., obtaining a best possible decision with respect to the six factors.

Through the use of software tools such as eMoneyAdviso or MoneyGuidePro, the advisor and client can reengage on a regular periodic basis (or whenever life happens) to ask the questions “How am I doing?” and “How is my funded status? (i.e., Surety level)” Competing decisions between the six factors can be reevaluated and incremental adjustments made. For example, perhaps returns were higher than projected. This would allow for a larger legacy, greater spending, lower savings, or higher surety. But now the client is in control and must make a decision between these opposing preferences. It is important to observe how changes in this simple example result from an externally imposed surprise (higher returns than had been projected) and as a result of a tradeoff decision made by the client -- and not as a result of some new score drawn from a foundationless and unstable risk tolerance questionnaire.

Finally, such an approach, focused on the six factors that actually matter, provides a significant opportunity for the advisor to build a more substantive, value-added, and ongoing relationship with his client. This benefit moves the relationship away from all too common return-chasing, questionnaire-based, one-time financial plans.

Rob Brown, PhD, CFA, is chief investment strategist and senior vice president of United Capital Financial Advisers LLC.