Has a recession already been priced into markets? We think we are already there on this one. A nearly 30% decline in the S&P 500 Index from the February 19 record high is consistent with a typical recession. We can also point to valuations. For example, if we cut current S&P 500 earnings by 10% and apply a reduced price-to-earnings ratio (P/E) of 15, we get to an S&P 500 level of about 2,200, which we think is a reasonable recession-level downside target. We can also look at the equity risk premium, which is the difference between the earnings yield (earnings-to-price ratio of E/P rather than P/E) and the 10-year U.S. Treasury yield. At over 5%, the equity risk premium is nearing the 6% level seen at the market lows in 2008–2009.

Sentiment and technical analysis indicate limited number of sellers remaining. To assess whether most aggressive sellers have been forced out of the market, we can look at investor surveys or technical indicators. Survey data such as the CNN Fear & Greed survey and the American Association of Individual Investors (AAII) survey reflect some of the most negative readings ever registered, a potential contrarian signal that most of the selling pressure could be behind us. Additionally, a historically high number of stocks are oversold, potentially a bullish combination when combined with the extreme negative sentiment.

Will policymakers’ response be sufficient to restore confidence? We think we are getting close to getting this signal. The Federal Reserve is pretty much “all in,” having effectively cut interest rates to zero while adding another round of quantitative easing (buying bonds) and more liquidity to ensure credit markets function. We have a very aggressive monetary policy, but what is needed now is a strong fiscal policy response, including targeted support for individuals and businesses most impacted by the crisis. We expect meaningful progress to be made this week in Washington, D.C., toward what could eventually exceed $500 billion in total stimulus.

Overall, we are getting closer to reaching all of these conditions, and an inflection point for the direction of markets may be approaching. You can hear us discuss more details of our Road to Recovery Playbook in the March 16 LPL Market Signals podcast.

Revised Economic Forecasts

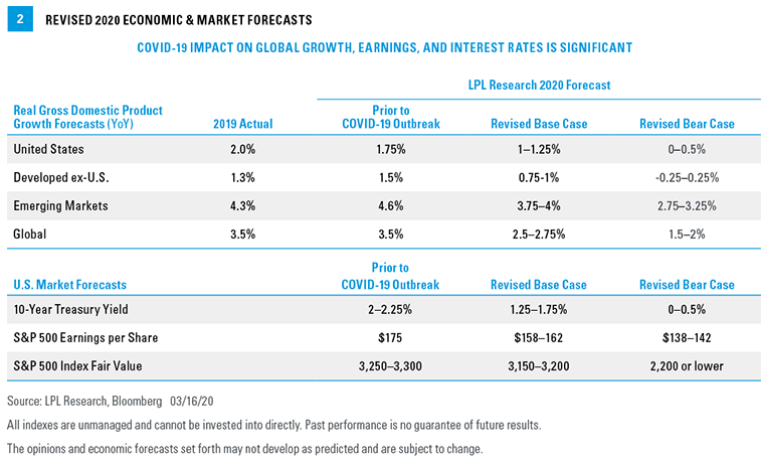

In response to the impact of the pandemic on the economy and markets, we have updated our forecasts for 2020 [Figure 2]. We have lowered our gross domestic product (GDP) forecasts for the U.S., emerging, and developed international markets, as well as global GDP. These forecasts reflect a greater than 50% chance of a short-lived economic contraction in the United States. We believe the strength of the U.S. economy prior to the outbreak may help it weather the storm.

We have also lowered our forecast for the 10-year Treasury yield, S&P 500 earnings per share (EPS) and year-end S&P 500 fair value.

We have provided our base case as well as a potential bear case, given the amount of uncertainty. Our base case GDP forecasts are all slightly below consensus expectations, based on Bloomberg forecasts where available.

Our revised S&P 500 EPS forecast of about $160 is well below FactSet’s slow-to-adjust consensus estimate of $173.

Finally, our revised year-end 2020 fair value target for the S&P 500 of 3,150–3,200 is based on a P/E of 18, supported by lower interest rates and S&P 500 EPS in 2021 of $175, a slightly above-average earnings growth forecast for next year coming off potentially depressed profits in 2020. Investors may have to wait longer for those earnings in 2021 to come through, and the outlook is clearly uncertain, but we have more confidence in next year’s earnings than this year’s. In a recession scenario in which earnings may be heavily impacted, we may see a downside scenario on the S&P 500 of around 2,200 or potentially lower.