Oil exports are crucial to the Russian economy. In some years, crude oil and oil product exports accounted for up to 50% of federal budget revenues and around 20% of GDP.

The full-scale invasion of Ukraine resulted in a series of embargoes, price caps, technological sanctions and contractual disputes that have undermined sales to some countries and regions while opening opportunities to trade with others.

Embargoes And Cap

The United States imposed an embargo in March 2022. The EU was more cautious and introduced an incremental ban that eventually became a complete embargo on crude imports from Russia in December 2022 and on products in February 2023.

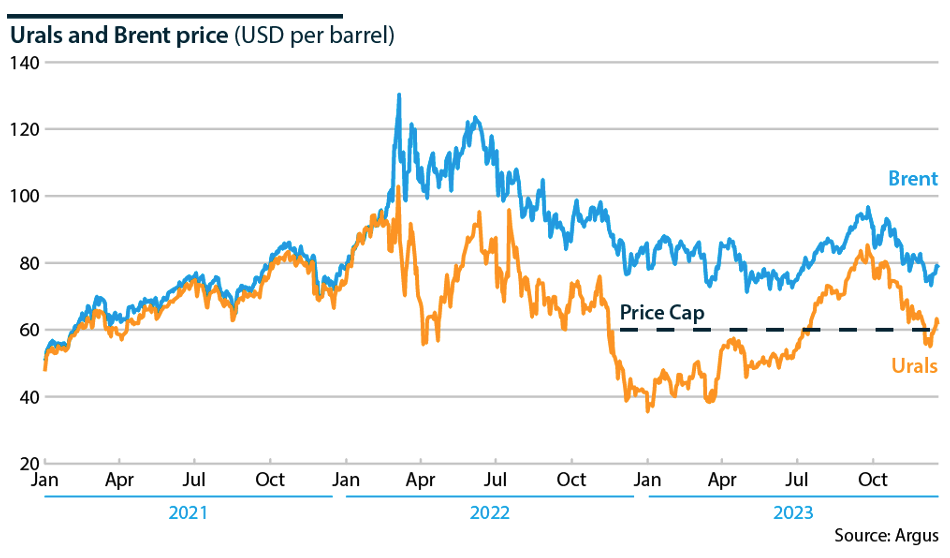

Because of concerns that a full-scale embargo could drive global oil prices significantly higher, the G7 members and their allies have since focused on enforcing a price cap of USD60 per barrel to limit Russian oil revenues.

The cap is calculated using the price of Russian Urals Blend crude oil delivered from Baltic Sea export terminals. It was introduced in December 2022, with a related price cap for Russian oil products added in February 2023.

Initially, the price cap achieved some success. The discount on Urals Blend relative to North Sea Brent grew after the cap was imposed. However, the impact has diminished over time, and the discount has narrowed.

Russian crude is now trading at levels higher than the USD60 cap, causing the US authorities to begin sanctioning some companies from Turkey and the Middle East that have been trading in Russian oil at or above the cap and prompting new G7 measures to crack down on Moscow's 'shadow fleet' of oil tankers that help circumvent Western restrictions.

The impact of the price cap on Russian budget revenues was significant. The G7 reported a 45% drop in Russian oil revenues in the first eight months of 2023 compared to a year earlier.

However, although oil export revenues in 2023 were lower than in the previous year, they remain close to the pre-war ten-year average and the single largest source of state income.

New Export Profile

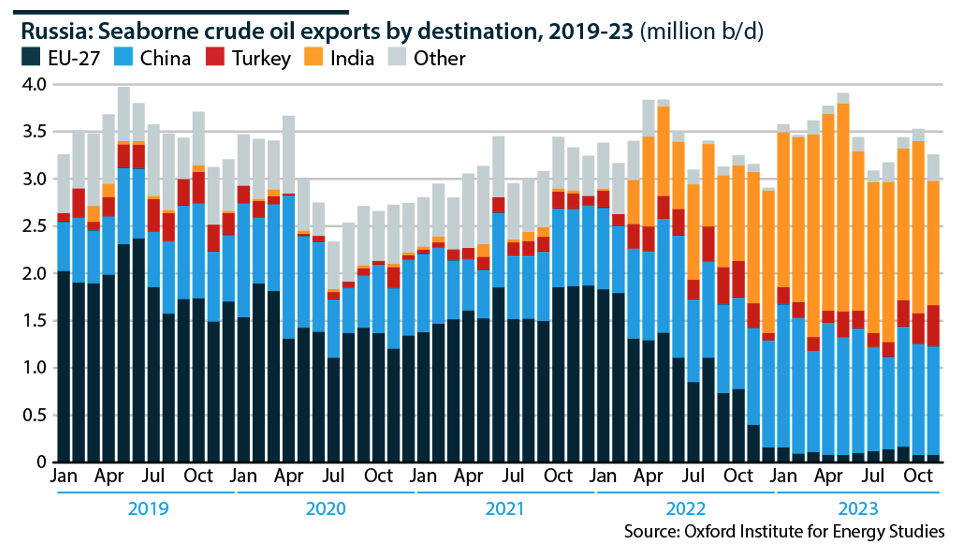

The reorientation of trade flows caused by sanctions and the price cap has been even more profound than the impact on prices.

In the first 11 months of 2023, Russia exported approximately 4.6 million barrels of crude oil per day (b/d) and 2.7 million b/d of oil products. Together, this accounts for around 11% of globally traded oil. Most of it goes to Asia.

Seaborne crude exports by tanker to Europe have collapsed due to the embargo. Traditional European markets have been replaced by slightly higher sales to China and a massive jump in sales to India as Delhi took advantage of the price discounts offered by Russia, which reached as much as USD30-40 per barrel.

This shift has not stopped India from criticizing the war in Ukraine. Delhi has refrained from significant high-level political interactions with Moscow of the sort provided by China. Russian President Vladimir Putin did not attend the G20 meeting in Delhi in September 2023, suggesting that India views its decision as driven by economic considerations rather than politics.

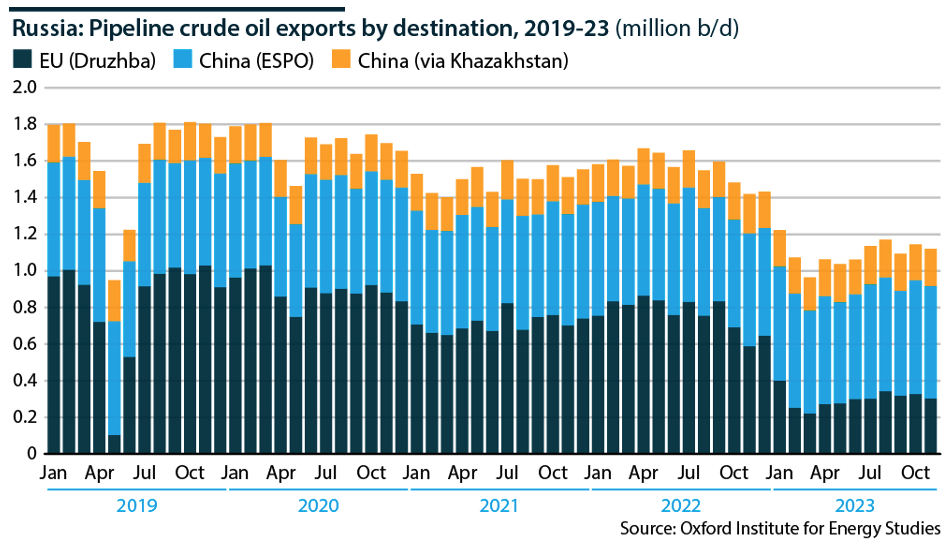

China has emerged as the largest importer of crude oil by pipeline. This has not happened because of any substantial increase in flows through the Eastern Siberia-Pacific Ocean (ESPO) pipeline and via Kazakhstan. Instead, its share rose because sales to Europe have collapsed.

Combined seaborne and pipeline crude sales to China now total around 2.05 million b/d, just over 45% of Russian oil exports over the first nine months of last year. Sales to India averaged a further 1.8 million b/d during 2023, so 83% of Russian crude exports went to just two countries.

This leaves the Kremlin exposed to two very significant but price-sensitive markets. Moscow has achieved its pivot to the East but at the expense of being extraordinarily dependent on only two sources of demand.

Relations With OPEC+

Russia's relationship with OPEC+, particularly Saudi Arabia, has also changed.

Its relationship with the cartel is one factor that has allowed it to increase its influence among the Gulf states, even though it has often failed to agree on quotas or meet production targets.

However, Moscow now finds itself increasingly dependent on the OPEC+ group to keep oil prices at a level that will allow it to generate the revenues it needs to balance a budget burdened by increased military spending.

As a result, the Kremlin has been very keen to demonstrate its commitment to two pledges to cut supplies made in 2023, with Russian output down to the promised levels in the first nine months of 2023 and with Putin himself confirming his stance on the OPEC+ agreement in October 2023.

This commitment will be tested further in 2024 as Russia has pledged to cut output by a further 500,000 b/d from the first quarter as part of a broader OPEC+ agreement. Moscow says its cuts will include oil products, suggesting it is reluctant to cut crude oil output, which could create tensions with other cartel members.