Said Haidar is emerging as the biggest winner of 2022 among major macro hedge fund traders.

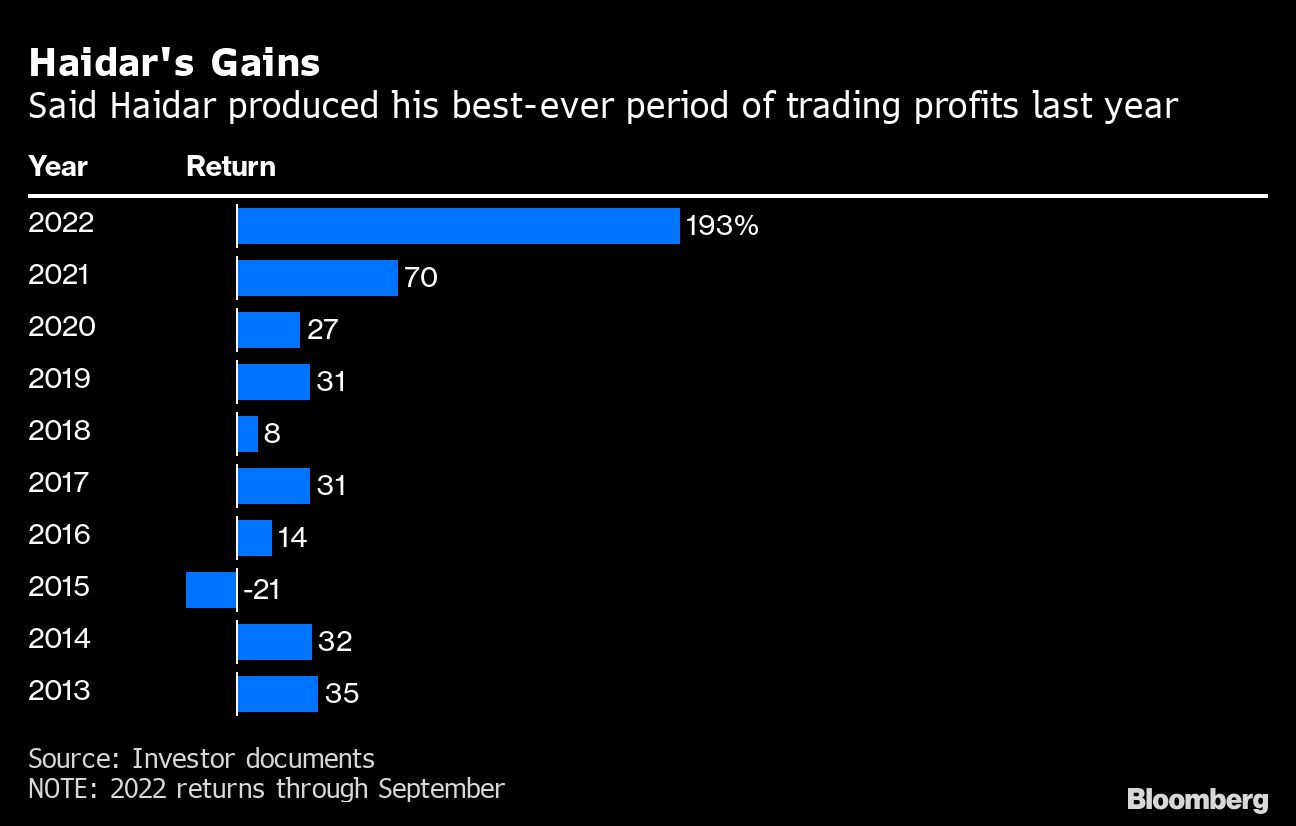

His Haidar Jupiter fund soared 193%, marking the best ever annual gain for the New York-based hedge fund manager since he started the firm more than two decades ago, according to investor documents seen by Bloomberg. The fund managed $3.8 billion at the end of November.

His highly leveraged strategy took advantage of central banks’ retreat from years of quantitative easing as they attempted to rein in spiraling inflation. The money manager was shorting rates in the US and UK, along with the G7 countries in general, which have seen bond yields soar as traders aggressively bet on the pace and extent of interest rate hikes.

His bets on commodities and stocks also helped, one of the documents shows.

“The medium-to-long-term prognosis with respect to US inflation is murkier,” Haidar told clients in a letter last month. “Time will tell whether inflation continues its recent downtrend into the latter half of 2023 or whether the Fed will need to eventually resume its policy tightening.”

While his conviction strategy has produced outsized gains in several years previously, last year was like no other. At one point, the fund was up as much as 274% but gave up some of those advances during the final quarter.

Haidar, who was among a Bloomberg group of 50 people deemed to have defined global business in 2022, outperformed in a strong year for macro traders. Crispin Odey and Neal Berger also produced triple-digit gains while many others posted their best-ever returns.

Haidar, who previously worked at Credit Suisse First Boston and Lehman Brothers, has a track record of consistently producing gains even during the years when his peers were struggling with muted returns.

This article was provided by Bloomberg News.