This week, Amin Nasser, CEO of the Saudi state oil firm Aramco, repeated the oil industry’s new credo in the face of decarbonization that global oil demand will not peak for some time, and policymakers must “abandon the fantasy of phasing out fossil fuels.”

Yet his boss, the Saudi government, had told the company in January to cancel planned increases in its maximum sustainable capacity of crude oil production to 13 million barrels per day (b/d) from 12 million. Instead, it wants the company earmarked to fund Saudi Arabia’s ambitious modernization vision to ensure profitability in a decarbonizing world by focusing on gas, petrochemicals and downstream investment in major Asian economies.

Pulling On The Brakes

Aramco's drive to increase crude production capacity looked increasingly untenable well before the January directive.

Continued global economic weakness, especially in China (the world's largest oil importer and Saudi Arabia's biggest customer), accelerating decarbonization and Riyadh's determination to defend a price floor of around USD80 per barrel to finance its economic transformation plans ensured that oil cuts continued throughout 2023.

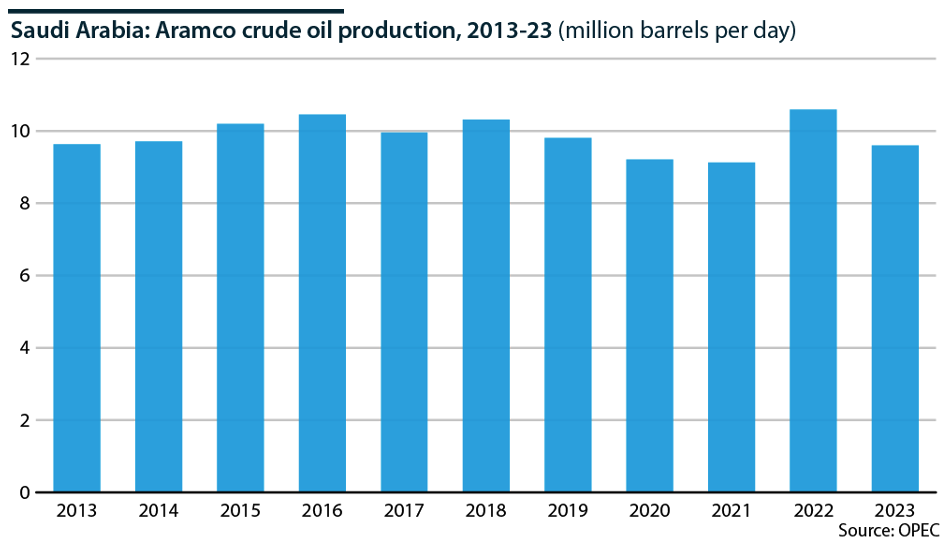

Production averaged 9.6 million b/d in 2023, a 9% decrease year over year. Given a decision to observe this ceiling until the end of June, production will likely fall further in 2024. Riyadh's fiscal needs will also preclude a dramatic reversal after that.

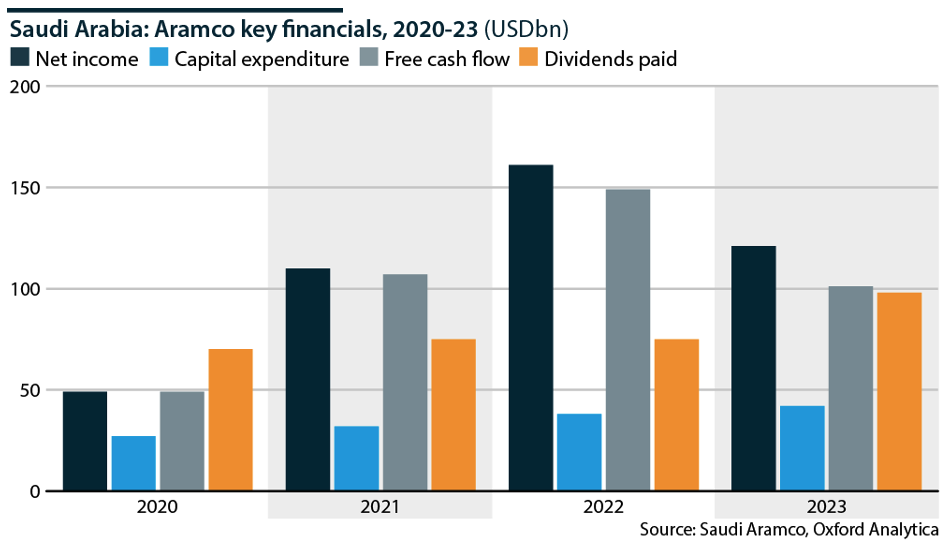

The upward trend in the proportion of Aramco's income appropriated by the state via dividends derived from its 98% shareholding is likely to persist even as the company's overall income falls, owing to the government's vast public investment drive.

However, the company's new capital expenditure guidance signaled that, at least in the near term, the money saved by abrogating the MSC hike would not all go directly to the government.

Capital spending discipline will make Aramco more attractive to institutional investors ahead of a planned second initial public offering.

Capital Redeployed

Expected spending in 2024 is USD48-58bn, compared with USD49.7bn in 2023. A further rise is expected in 2025. Nasser said the company would focus on gas and petrochemicals, using these as hedges against declining oil consumption.

Pre-existing goals call for domestic gas production to rise by 60% compared with 2021 levels (9.2 billion cubic feet per day) and for 4 million b/d of the company's crude to be converted into chemicals by 2030.

Gearing Up For Gas

The shift in the domestic upstream focus towards gas accelerates a trend underway since the turn of the decade.

Increased gas will be channeled primarily into Saudi power generation, freeing up oil for export and helping reduce the economy's carbon intensity. It will also be used for petrochemical production.

Aramco remains notionally committed to producing 11 million tonnes per year of blue hydrogen (gas-based with carbon capture) by 2030.

The company's concentration on gas also extends to its overseas operations. In September 2023, it made its debut international LNG investment, paying USD500mn for a strategic minority stake in US-based MidOcean Energy. Thus, Aramco gained indirect interest in four Australian LNG export projects.

There have also been reported discussions with California-based Sempra Infrastructure to revisit the possible co-development of the US company's Port Arthur LNG export scheme in Texas, which would be Aramco’s first direct entry into the US LNG sector.

In Asia, where its trading operations are focused, Aramco is on the shortlist to acquire Singapore's Pavilion Energy, an LNG trading and shipping firm, from the country's sovereign wealth fund, Temasek.

Petrohemicals

Downstream investment, both domestically and overseas, is focused on petrochemicals. This aims to lock in long-term demand for (and add value to) Saudi crude. The assumption is that petrochemical use, especially in major emerging Asian economies, will constitute the principal source of incremental oil demand over the next two decades.

Aramco pioneered the integration of refining with petrochemical production some 15 years ago, but the execution of the strategy is sharply accelerating. It seeks to expand the integrated downstream business, focusing on China, India and Southeast Asia. It already part-owns a massive refining and petrochemicals complex in Malaysia.

Talks are reportedly continuing to fulfill a long-standing ambition to enter the Indian market. However, for Aramco, China is the overriding priority.

Several co-investments in refining and petrochemical projects with state-affiliated and private companies are at various stages of finalization. Recent deals with state-owned Sinopec and privately owned Rongsheng Petrochemical (in which Aramco acquired a 10% stake in 2020) to invest reciprocally in each other's domestic downstream projects signal the depth of the strategic energy relationship.

Retail

Aramco is also looking to expand its position in fuel distribution and retail. This is especially important as the overall demand for conventional vehicles and combustible fuels in developed markets is entering an incipient decline.

Aramco agreed in December 2023 to purchase a 40% stake in fuel retailer Gas & Oil Pakistan. Earlier this month, it completed the acquisition of Chilean fuels and lubricants retailer Esmax Distribucion. Both moves open fresh outlets for refined products and Valvoline-branded lubricants.

Bottom Line

Expansion in petrochemicals, LNG, and retail aligns with a strategy to create an integrated downstream portfolio of refining, marketing, lubricants, trading and chemicals outlets for Aramco’s crude.