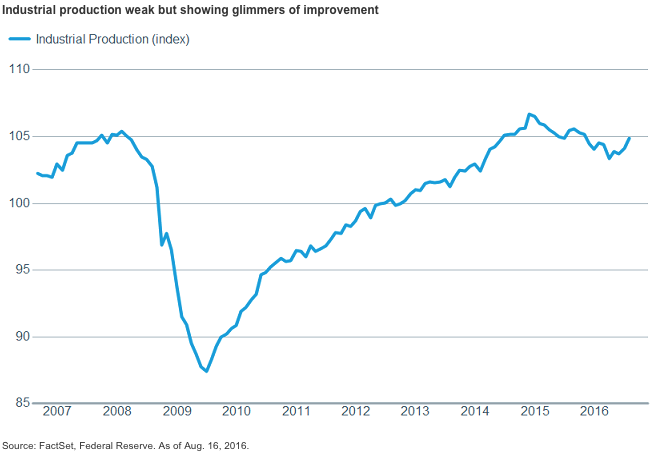

It will be difficult to get the U.S. economy rolling without an improvement in productivity. A contributing factor to weak productivity is undoubtedly ongoing tepid capital spending . The National Federation of Independent Business (NFIB) recently reported that small business optimism ticked only slightly higher to a still relatively lackluster level of 94.6. For context, from 2000-2006, this reading spent much of its time at or above the 100 mark. Additionally, industrial production has been relatively weak, but there is some hope as gains have been posted in the past two months.

Policy Makers At A Loss?

Both monetary and fiscal policy makers appear at a loss as to how to grease the economy’s gears. Employment remains strong, and wages have been rising, but spending on productivity- and efficiency-enhancing equipment remains quite weak. We also believe that low, and even negative interest rate policies globally, may be having the opposite of the intended affect. The Wall Street Journal recently showed that consumer savings rates in countries with negative interest rates have actually risen. We could be seeing the same thing among U.S. businesses, with low interest rates being used to pay off debt, buy back shares, or bolster cash reserves… but not invest in broader growth producing initiatives.

It’s Been A Hot Summer For Emerging Markets

In contrast to the sleep action of much of the developed world, this summer has been especially hot for EM stocks, after underperforming developed markets in 2015 and getting off to a cold start in 2016. As of mid-May the MSCI EM Index was flat for 2016, but has since posted an 18% gain for the year through August 16, relative to just 6% for developed market stocks tracked by the MSCI World Index.