Manufacturing earnings?

Just as we believe earnings in the United States are important to further domestic stock market gains, we also think the return of earnings growth is an important ingredient in getting global stocks to begin to move materially higher once again. Growth in global earnings is driven by economic growth and there appears to have been little of either in the first quarter. While still stuck in the middle ground here as well, potentially boding well for the future; it appears that the global economy may be showing signs of improvement, particularly in manufacturing where economic weakness has been focused.

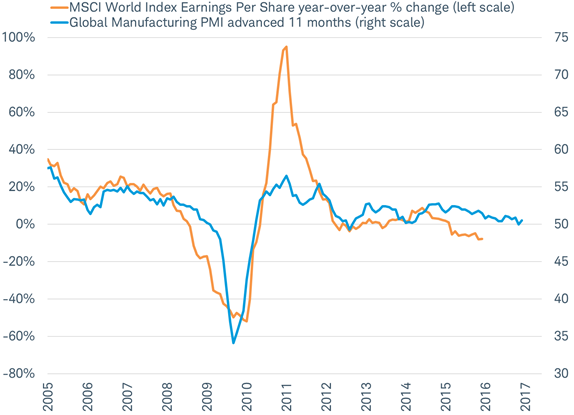

A turnaround in the global manufacturing purchasing managers index (PMI) could be good news for earnings. Historically, the global manufacturing PMI has indicated the direction of earnings growth about one year ahead, as you can see in the chart below. If February marked the end of a two-year soft spot in manufacturing, the outlook for profits in 2017 may improve.

Manufacturing index tends to lead trend in earnings growth by about a year

Source: Charles Schwab, Bloomberg and Factset data as of 4/13/2016.

The global manufacturing PMI increased 0.5 points to 50.5 in March, indicating a modest expansion in global manufacturing activity after a brush with 50 threshold. While the rebound is welcome after February's recession warning, it points to just tepid growth at best. The good news is that the new orders component of the index, which acts as a leading indicator for the overall index, rose to 51.2, above its 12 month average.

We can see the general pattern of improvement as we look at the PMIs from nine major countries and regions of the world highlighted in the chart below. After the PMI readings clustered around the intersection of the four quadrants last month—indicating a stall in manufacturing activity—March showed a clear rebound as most PMIs rose and moved above the 50 level, indicating they were expanding faster. More broadly, the share of the PMIs in over 30 countries that are in expansion (above 50) rose to 70%. Even more impressive is the fact that the share of all PMIs that rose in March surged to 77%, the highest since July 2009.

Global manufacturing returns to expansion in March

.jpg)

Source: Charles Schwab, Bloomberg data as of 4/11/2016.

Not all the PMIs improved in March. Brazil and Russia continue to be among the world’s worst. Brazil's manufacturing PMI has remained below 50 over the past year and Russia's manufacturing PMI has been below 50 for 14 of the past 16 months. Most notably, Japan was a disappointment with its PMI slumping below 50 to 49.1. The stronger yen sent the export orders component of the PMI down to the lowest reading since January 2013, when Europe was in a recession. But elsewhere in Asia, both China and Australia saw improvement. In fact, when including the service sector along with the manufacturing sector in China’s composite PMI, the rebound to 51.3 marked the best level in a year and return above the five-year average.

China’s composite PMI rebounded above the five year average

.jpg)

Source: Charles Schwab, Bloomberg data as of 4/11/2016.

The takeaway from this discussion of the global PMI readings is that while we’re still in that frustrating middle ground, the worst may be behind us in manufacturing. If so, this points to a potentially brighter outlook for global markets.

So what?

Patience and discipline. Those are the two words to commit to memory in the face of the current environment. A sluggish expansion and a cautious corporate environment leads us to have a neutral view on equities, which means investors should stick with their longer-term objectives and remain committed to their plan. There are glimmers of hope domestically and globally with strong U.S. job growth and U.S. and global manufacturing looking better.

The Soft And Frustrating Middle

April 15, 2016

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

Brad Sorensen is managing director of market and sector analysis at the Schwab Center for Financial Research.

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.

« Previous Article

| Next Article »

Login in order to post a comment