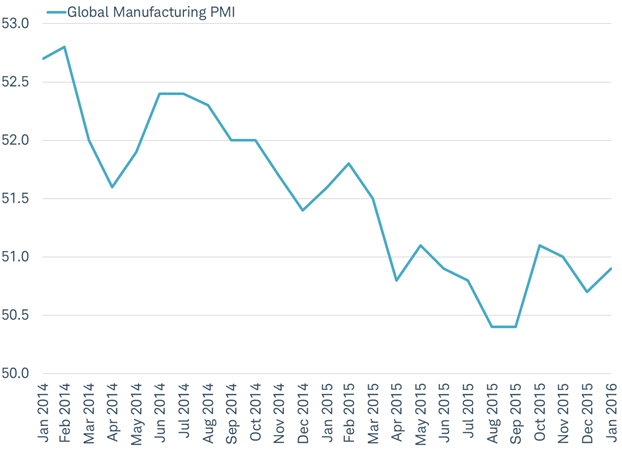

Several Fed speakers have noted that global developments could impact their decision making process. The purchasing managers indexes (PMIs) provide an early hint at how economies around the world are performing with the first look at economic data for the month of January. Fears that the global economy may slide into a recession eased a bit after last week’s release of the widely-watched measure of economic activity for January suggested the global economy is stable. The global manufacturing PMI was essentially unchanged in January, moving up slightly to 50.9 from 50.7 in December.

Recent months show stabilization in global manufacturing PMI

Source: Charles Schwab, Bloomberg, Factset. Data as of 2/3/2016.

The composite PMI for China, which like the other country PMIs is produced by a private company rather than by the Chinese government, rose to 50.1 in January as a result of higher manufacturing and service PMIs. Encouragingly, among the components of the index, the leading new orders component rebounded to 50.6 from 49.1.

So what?

Source: Charles Schwab, Bloomberg, data as of 2/3/2016.

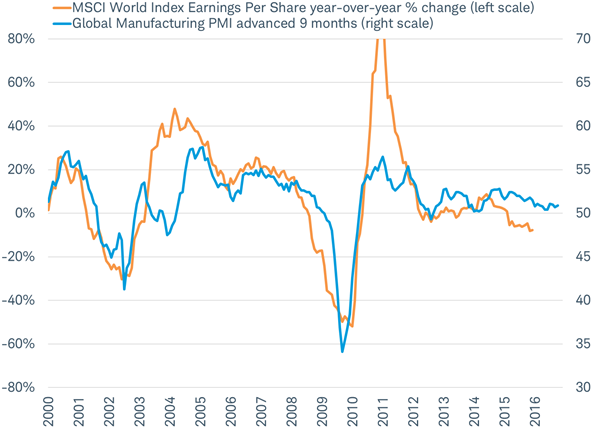

A PMI of more than 50 represents expansion, while a reading under 50 represents a contraction. Activity on this measure has stabilized over the past few months. The global manufacturing PMI was up 0.2 in January and up 0.5 above the two–year low set in September 2015. The 50 level is also the dividing line between profits and losses for companies in the MSCI World Index, as you can see in the chart below. The global manufacturing PMI has historically been a good leading indicator of profit growth three quarters later. While profits have been lagging the trend of the PMI due to the impact on earnings of plunging commodity prices; a collapse in earnings does not appear imminent. In fact, the stabilization in the manufacturing PMI at current levels points to flat-to-higher earnings per share in the coming quarters.

Global manufacturing PMI suggests no collapse in earnings ahead

Source: Charles Schwab, Bloomberg data as of 2/3/2016.

Taking a look at the January PMI readings for individual countries can offer some clarity on the stable, but mixed picture for global economic and profit growth painted by the global PMI.

Japan's results were encouraging, despite a dip in the manufacturing PMI to 52.3, as the overall composite PMI, which includes the larger services sector, rose to 52.6 continuing the rising trend from the 2014 recession low.

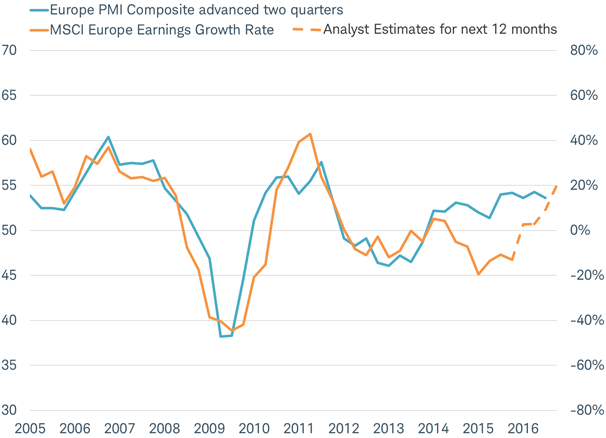

The Eurozone composite PMI slid to a still solid reading of 53.6. The Eurozone PMI has been within a tight range of half a point around 54.0 since March of last year. This suggests Europe is maintaining a solid, but not accelerating, pace of growth.

Eurozone PMI points to rebound in profits

India, the world’s fastest growing economy, saw a rise in the composite PMI to 53.3 in January, the highest level in 11 months. The increase was led by a rebound in the manufacturing PMI which jumped by 2.0, reversing its fourth quarter drop. The services PMI also continued to display steady improvement rising to 54.3.

In short, the reading from the PMI on the global economy in 2016 so far is: stable, but below average, growth.

Don’t just do something, sit there! Not panicking can be tough to do in times of increased volatility, but often the best advice to avoid emotional decisions. We continue to expect severe bouts of volatility at least until the trajectory of the U.S. and global economy is more definitive. In the meantime, the Fed is likely to become more dovish in the near-term, which could stabilize the volatility. Recent results for global PMI readings are relatively encouraging and certainly argue against the apocalyptic forecasts so prevalent today.