It’s easy to get caught up in the specifics of a sector when looking for investment opportunities, such as prospective new drugs in health care or a new device launch in technology. But focusing too carefully on those specifics can blind you to the bigger picture. While these issues are important, at times it’s valuable to take a step back and look not just at the trees, but at the forest.

We believe the bigger-picture view is important for two main reasons: First, the macroeconomic environment can have a big impact on the performance of individual sectors and second, investors should have sector allocations that make sense in the context of the current macro backdrop.

For example, an investor may be excited about specific developments within the utilities sector, while at the same time believing that the economy is poised to grow at an increasing rate. Given that the utilities sector historically has performed better in economic downturns than when the economy is growing strongly, that investor should consider whether the small-picture positives outweigh the big-picture negatives.

So what does the big picture look like now? Here are the key points, in our view:

- The U.S. economy likely will continue to grow at a modest pace.

- The Federal Reserve (Fed) wants to boost short-term interest rates to more historically “normal” levels—but will be cautious in doing so.

- The worst of the commodities collapse is likely over, at least for now.

- The rapid strengthening of the U.S. dollar is largely behind us.

These key issues provide our initial sector outlook; after that, we look to micro issues to confirm our assessment. Given the outlook above, it makes sense from a big-picture perspective to tilt allocation slightly toward cyclical sectors—that is, those sectors that tend to outperform when the economy is strengthening, such as technology, as opposed to more-defensive sectors that often outperform in a slowing economy, such as utilities.

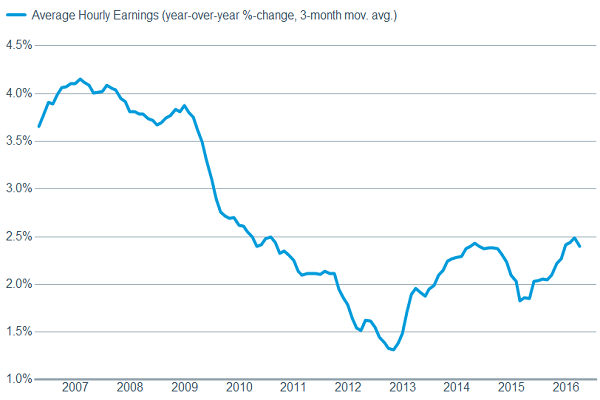

Tech and financials currently are our outperform-rated sectors, while utilities and telecom are the underperform-rated groups. Tech tends to benefit from an improving economy, while the flattening out of the dollar should help the sector, which does quite a bit of business overseas. Additionally, with wage costs going up, including minimum-wage increases gaining steam in multiple states, we believe companies will increasingly look to technology to replace more-expensive human inputs.

Higher wages could push companies toward tech solutions

Source: FactSet, U.S. Department of Labor. Data as of 4/11/2016.

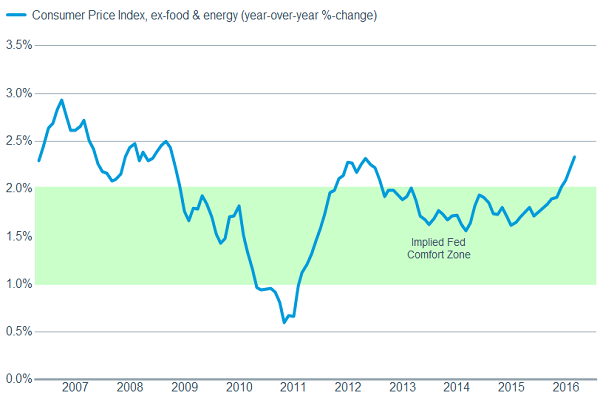

Meanwhile, we believe the outlook for the financials sector, which has had a rough go over the past few months, is improving. The sector has traditionally done quite well in the year following an initial Fed rate hike. We believe that will be the case again as the Fed appears set to raise rates at least a time or two during the course of the year. While inflation isn’t a problem now, and the Fed seems willing to tolerate a modest overshoot of its ultimate goal of keeping inflation around the 2% mark, we are seeing inflation start to post gains, which could give the Fed confidence to initiate another rate hike. Most financial companies benefit when interest rates rise – they can lend at higher rates, for example, and can often earn more on their investments. Another benefit for the sector is that consumers have paid off large amounts of debt since the financial crisis and appear to be in much better financial shape – reducing the threat of loan defaults and foreclosures, which can hurt lenders.

A rise in inflation could push the Fed to boost rates further

Source: FactSet, U.S. Department of Labor. Data as of 4/11/ 2016. The Consumer Price Index (CPI) is an index that measures the weighted average of prices of a basket of consumer goods and services, weighted according to their importance.

These macro issues flow into our underperform ratings as well. Historically, an improving economic environment has not benefited traditionally defensive sectors such as telecom and utilities. Additionally, with inflation showing signs of gaining traction and the Fed looking to raise rates, yield-seeking investors may become less interested in these typically high-dividend-paying sectors, potentially hurting performance.

Our view of the macro environment can certainly change, which would likely change our sector outlook and recommendations. For now, however, we believe our sector views align with our big-picture outlook. Of course, individual sector characteristics matter greatly too, and you can read more about each of these sectors in their own pages, but remember: The trees are important, but they have to grow in the same conditions that nurture the overall forest.

Brad Sorensen, CFA, is managing director of market and sector analysis at the Schwab Center for Financial Research.