A fundamental shift is underway in fixed income. The new era of rising interest rates is causing fixed income managers across the world to rethink how they invest. Investors should consider active managers who focus on generating alpha to help drive returns and create diversification benefits from owning fixed income in a portfolio. (Diversification does not eliminate the risk of loss.)

In the last 10 years, sustained monetary stimulus— lower interest rates aimed at keeping economies afloat after the global financial crisis—made it easy for fixed income managers to earn returns. The systemic effect throughout the market (beta) overwhelmed contributions by idiosyncratic factors (alpha). As yields fell, bond prices across the board rose. Simply being invested in the bond market was enough to earn decent returns.

That has all changed. Today, markets have mostly normalized, and it is no longer enough to just be in the market. Making active choices around duration, credit and yield curve positioning is more important than ever, and getting it wrong can lead to missed opportunities and potential losses.

The Beta Avalanche Is Ending

The stimulative policies that drove fixed income returns indiscriminately across entire markets (the beta avalanche) are being dismantled. But it is an uneven process, and the ripple effects across markets are hard to predict.

We believe the one certainty is that asset valuations will eventually normalize, migrating to levels that are in line with their idiosyncratic fundamental merits. To earn competitive returns, managers will need to identify and capitalize on those merits. Going forward, in-depth analysis of individual bonds and market segments (alpha-generating activities) will most likely take center stage as the driver of fixed income returns.

The era of beta dominance actually goes back much further than the financial crisis of 2007-2008. For close to four decades, declining yields have been a primary support for fixed income returns. In fact, from 1989-2017, the Bloomberg Barclays U.S. Aggregate Bond Index averaged a 6.4 percent annual return. Of that, 95 percent was derived from duration, the beta effect of falling yields across fixed income markets. (Data from Bloomberg Barclays U.S. Aggregate Bond Index - 1989-2017)

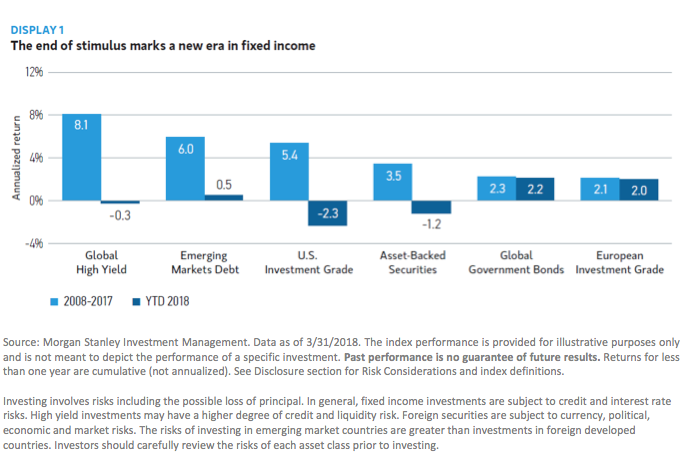

The shift from beta to alpha as the dominant driver of returns marks the beginning of a new era in fixed income. By early 2018, most major central banks had either ended or were starting to end their stimulative monetary programs. By comparing index returns so far this year to those during the 10 years of monetary stimulus (2008-2017), we see this new era unfolding: The cessation of stimulus has slowed down the beta engine that had fuelled returns in earlier years (Display 1).

Going forward, to generate healthy returns, we believe fixed income investors will need to engage active managers who have the potential to outperform the broad market through alpha-generating strategies.