The ‘almost-everything rally’ of 2023 is drawing to a close, and the picture is a world apart from what market mavens predicted at this time last year.

The consensus view back then was that a tough year lay ahead for high-risk assets, as interest rates rose, recession loomed and inflation stayed high. Instead, returns have been skewed almost overwhelmingly toward the riskiest parts of the market.

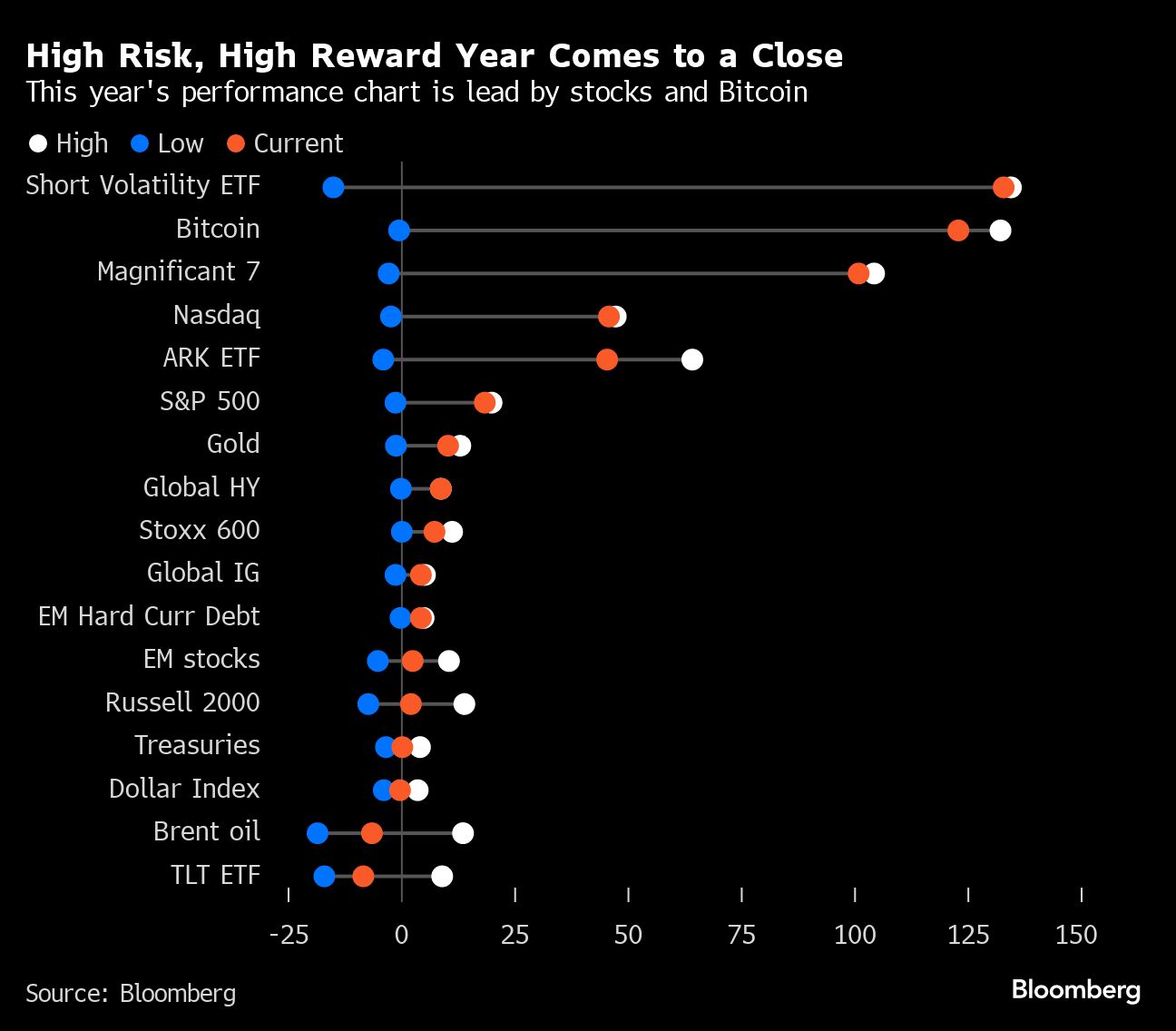

The biggest reward, a whopping 150%, was earned betting against stock market volatility. Bitcoin exposure was an unexpected second. They were followed by shares in the so-called Magnificent Seven — the cohort of Big Tech firms which normally would react badly to higher interest rates.

That said, some “classic” trades paid off too. The US S&P 500 has gained 19% year-to-date as the long-awaited recession failed to materialize. Gold has rallied 10%.

The slowing economy has weighed on oil prices, however, putting them on track for the worst year since 2020 when the pandemic was raging. US Treasuries with maturities of 20 years or more have also lost out big-time.

Now, market-watchers are already looking into 2024. Most reckon on a continuation of risk-taking, with equities outperforming bonds. But their predictions hinge yet again on what kind of economic recession hits — a soft and short lived downturn could mean forecasters have better luck this time.

This article was provided by Bloomberg News.