In our third quarter 2018 letter, we highlighted numerous risks in the credit markets and noted that we were avoiding -- and/or shorting -- those areas of the market. In recent weeks, one of those discussed areas – fallen angel risk in investment grade (IG) bonds -- has grown into a topic of daily reporting in the mainstream financial media.

This increased focus is primarily the result of the rating agencies’ downgrade last month of General Electric’s (GE) corporate credit rating two notches to BBB+. GE has approximately $115 billion of IG bonds, which is equivalent to almost 10 percent of the entire high yield (HY) credit market. The downgrade led to a precipitous price decline in GE bonds and sparked concerns regarding how a large wave of bond supply would be absorbed by the HY market.

We wrote in our September letter:

Today, many BBB bonds look almost indistinguishable from their high yield peers and are at risk of an eventual downgrade into the HY market. If those downgrades materialize, the dramatic increase in high yield supply would lead to a meaningful repricing of both the low end of investment grade bonds and higher rated high-yield bonds.

As yield-seeking investors begin to realize that they no longer need to accept the excess credit and duration risk of the BBB corporate market in order to meet their yield targets, it is likely those investors will leave the corporate bond market in favor of treasuries.

As marginal buyers no longer need to participate in the BBB-rated market to obtain acceptable yield, and credit investors re-evaluate their underwriting standards, prices in this corner of the market will face significant headwinds.

Since its downgrade to the lower rung of IG, GE’s bonds have consistently traded down and have not yet found a floor. As of the date of this letter, a five-year credit default swap (CDS) contract on GE’s unsecured credit trades for a risk premium of approximately 270 basis points, up from 60 basis points in September, indicating to us that the market is not only pricing in the likelihood of GE’s downgrade to high yield, but also pricing in a potential disorderly transition into the high yield market.

Exhibit 1: GE's Credit Risk Premium has Quadrupled Over the Last 45 Days

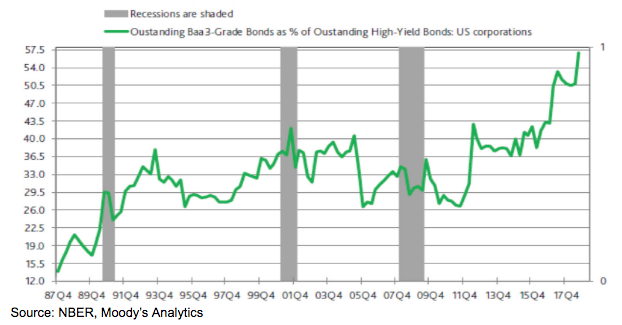

Moody’s Analytics recently published a research piece titled “Unprecedented Amount of Baa-Grade Bonds Menaces the Credit Outlook”. We half-jokingly noted that a rating agency highlighting the risk of panic caused by downgrades is like your architect warning you that it would be really bad if your house collapsed because of the low quality of his design. While we acknowledge the irony of the source, nonetheless, the report’s conclusion resonated with us:

“The now record high ratio of Baa3 bonds outstanding to high-yield bonds outstanding warns

of a potentially very disruptive surge in fallen-angel downgrades once the next deep and prolonged contraction by profits arrives.”

Exhibit 2: Record Ratio of Outstanding Baa3-Grade Bonds to Outstanding High-Yield Bonds Elevates Supply Risk Facing High-Yield Bond Market