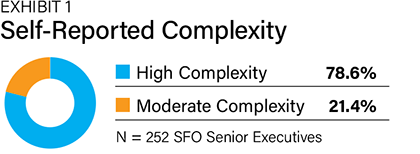

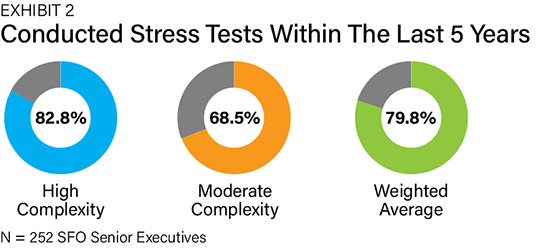

Single-family offices (SFOs) often look to ensure they are taking the best course of action on behalf of their wealthy family clients. A study of 252 SFO senior executives found that the extent of stress testing tends to vary based on the self-reported complexity of their business and family situation (Exhibits 1 and 2). Eighty percent of SFOs engaged in stress testing within the last five years, and this is more prevalent when there is high complexity.

The Nature Of Stress Testing

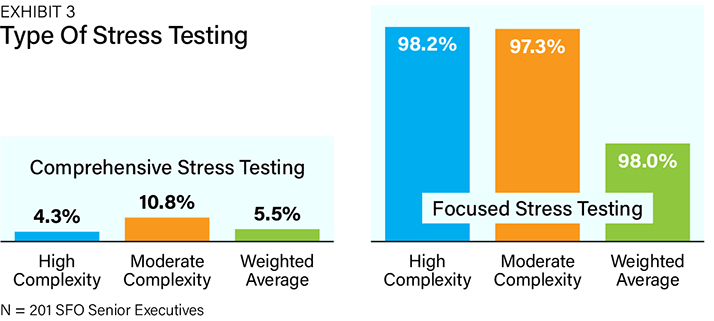

At any one time, stress testing can be comprehensive (i.e., three or more sets of services or products such as the estate plan or the investment portfolio) or selective (i.e., less than three sets of services or products such as the estate plan or the investment portfolio) initiated in the same 18-month period. Multiple or sequential focused stress testing is not the same as comprehensive stress testing because of the timing as with focused stress testing there are substantial gaps between the different occurrences.

Comprehensive stress testing is more time-consuming, involving and costly than focused stress testing. Comprehensive stress testing is more likely when a system fails, causing severe problems that can be tied to previous actions or a significant transition, such as heirs taking over the SFO.

Just about all the SFOs that stress-tested engaged in focused stress testing. Less than 5% of SFOs with high complexity and about 10% of those with moderate complexity conducted comprehensive stress testing (Exhibit 3).

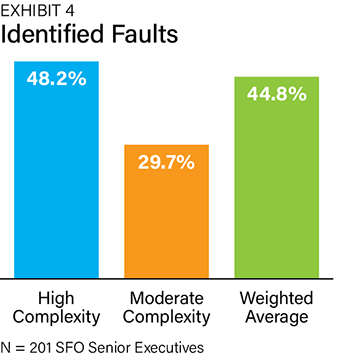

What is very telling is that two-fifths of the SFOs found faults because of stress testing (Exhibit 4). This was proportionately more the case for those reporting high complexity than those reporting moderate complexity. Even employing some of the finest professionals, the SFO senior executives are strongly inclined to trust but verify, and evidently, with good reason.

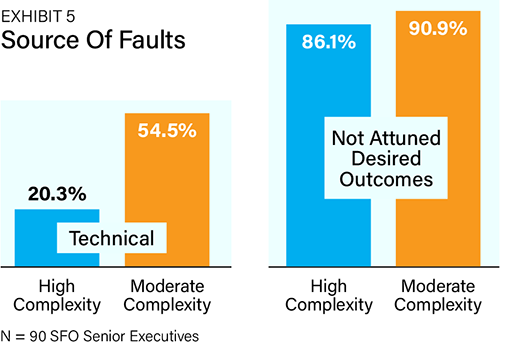

Where faults were identified, the issue was almost always that the actions were not in sync with what the family wanted to accomplish (Exhibit 5). At the same time, there were technical errors for a fifth of the faults identified where the senior executives reported high complexity and for about half of the SFO with moderate complexity,

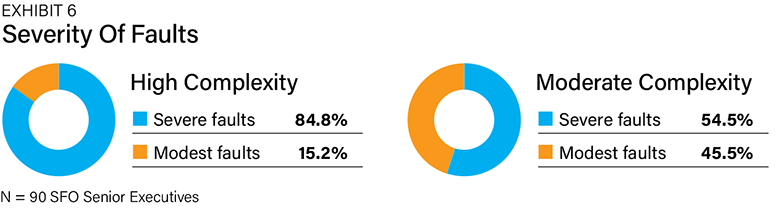

In the world of SFOs, when faults are found, and there is high complexity, they tend to be considered severe overall (Exhibit 6). At this level of affluence and involvement, errors usually produce significant complications and occasionally horrendous disasters. If not severe, the faults were rated as moderate. Nothing uncovered was considered minor or inconsequential. So, if not for stress testing, these faults would have gone unnoticed, resulting in significant problems for the wealthy family sometime down the line.

Without question, high-end technical proficiencies are critical. But, those failures are most often preceded by a failure due to misunderstanding what the wealthy family truly wants to achieve. Many excellent technical experts do not deliver the results the family desires. Why? Because they are habitually wrapped up in their technical prowess and are not attuned enough to what truly matters to the wealthy family. When the emphasis is primarily on the mechanics of operations of the wealth management solutions, for example, there is a greater possibility that the stress testing is being poorly done and may produce a better technical solution that still falls short.

Stress testing is proving to be a commanding way to ensure a family’s wealth management solutions are on target and delivering the desired results or offsetting the stage for them to be “fixed” or changed. Stress testing allows SFO senior executives, on behalf of their wealthy families, to look at their situation in a focused or comprehensive manner, ensuring their goals and objectives are achieved.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm.

Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.