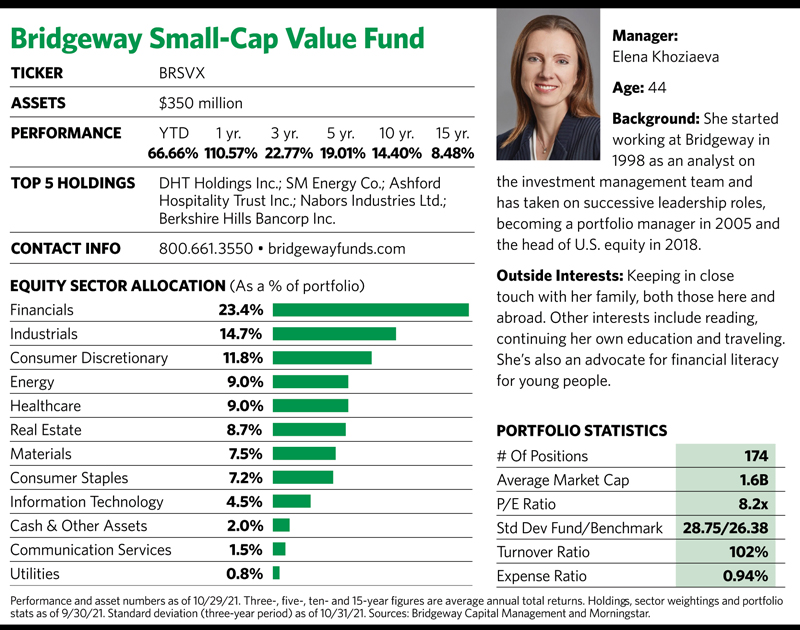

To understand why the Bridgeway Small-Cap Value Fund had a one-year return of nearly 111% through the end of October, just look at its nameplate. The words “small cap” and “value” tell you what it’s all about, and these have been good places to be as small-cap value strategies regained favor during the past year after several years of underperformance vis-à-vis the broader U.S. equity market.

Of course, if that’s all it took to shoot the lights out then every small-cap value fund would have 100%-like returns during the past year. They don’t, and they’re not even close (though the category on the whole has performed well). And there’s a reason why the Bridgeway fund has been in the top quartile among its peers in Morningstar’s small-value category during every measurable period from year to date through the past 15 years.

It remains to be seen whether the revival of the small-cap and value investment styles has staying power, but the managers of this fund believe they’ve been able to provide pretty consistent long-term results versus the small-cap value competition due to an approach that Bridgeway Capital Management describes as statistically driven and grounded in academic theory. Or, as the $5.3 billion Houston-based asset manager puts it, it follows a disciplined investment process that reflects its “passion for logic, data and evidence.”

“We look at company fundamentals such as income statements and balance sheets and cash flow statements and price data,” says Elena Khoziaeva, head of U.S. equity at Bridgeway Capital Management and co-portfolio manager of the Bridgeway Small-Cap Value Fund. “But we process everything systematically by creating factor models and having a very disciplined process at how we analyze that data.”

Factor-based investing seeks to boost returns or dampen risk by tilting toward one or more investment factors—the attributes of an asset that both explain and produce its excess returns. Structuring investment models based on factors has been around for a long time, but it came into vogue among the investing public during the past decade thanks to the widescale launch of so-called smart beta—or strategic beta—factor-based exchange-traded funds. Smart beta straddles the line between a purely active, full discretion strategy and a rules-based passive strategy. Smart beta is rules based, but the rules are derived from human input.

Khoziaeva likes that the smart beta craze brought attention to the company’s factor-based approach, but she doesn’t put Bridgeway into the smart beta camp. “It’s a great term, but I don’t think it applies to us,” she says. “We provide something else.”

What sets the company apart, she posits, is that its investment strategy is centered on deep-factor exposure and diversification.

The Bridgeway fund’s portfolio focuses on the value, quality (the company’s term for this is “financial health”) and price momentum factors. “We don’t blend these factors, nor do we expect each individual stock to have each of these characteristics,” Khoziaeva says. “It’s about deep exposure to a particular factor.”