Charter Communications, Nike and Salesforce.com are the top three companies that paid no taxes despite billions in income in 2020, according to research conducted by Tipalti, a global business consulting company with offices in California and Texas.

Each of the top 10 companies ranked by income that paid no taxes actually had negative tax rates because of millions they received in tax rebates, Tipalti said.

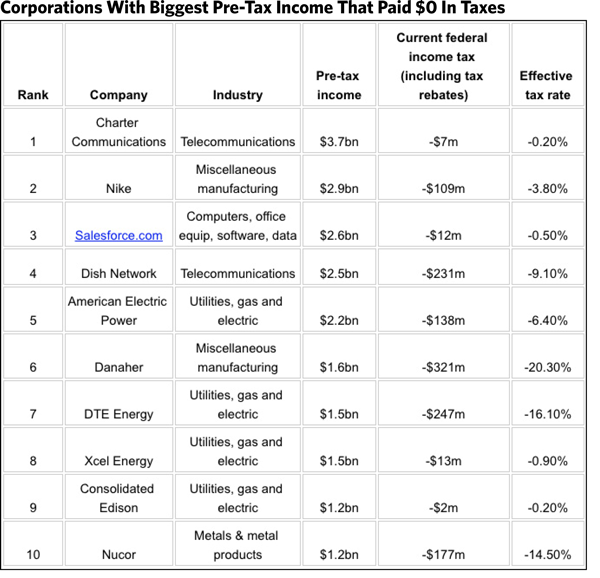

The following chart shows the corporations with biggest pre-tax income that paid $0 in taxes, the amount the companies got back in rebates and other payments and the effective tax rate, according to Tipalti.

In other research, Tipalti found that the most common tax violation corporations were charged with was failure to pay taxes. For the tax year 2020, 286,725 penalties were issued for a total in funds to be repaid of $589 million. Only 59 fraud penalties were issued against corporations and only $7.9 million in fines were assessed,

Failure to pay taxes that are owed also is the most common offense for individuals and trusts, with more than 19 million penalties issues and $7.1 billion in back taxes and fines collected.

“The volume of unpaid taxes is equivalent to about three-quarters of the entire annual federal budget deficit, and this is how much the U.S. misses out each and every year through unpaid taxes,” Tipalti said in its report, “Tax Offenses: The World’s Biggest Tax Offenders.”