Many of us invest in stocks for their ability to grow our wealth. So when volatility rears its ugly head, our instinct is to take our money out of the market to safeguard it. However, history shows that rather than giving in to fear, staying invested and buying stocks during volatile times can be beneficial in the long run.

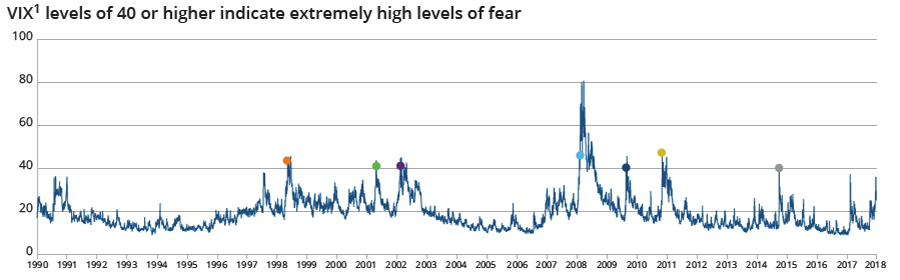

That analysis comes from examining the Cboe VIX,1 an index that measures volatility. It’s often referred to as the “fear index” because it gauges the market’s expectation of 30-day volatility. On average, the VIX measures around 20. But market events can quickly jolt it higher.

For example, fear of rising interest rates caused the largest one-day spike ever on February 5, 2018: The VIX closed near 37, an increase of more than 115%. After that, fear was subdued and hovered around 15 for several months—until concerns about trade policy stoked fears and the VIX closed at 36 on December 24, 2018.

Seasons Don’t Fear the Reaper…

Volatility is, by definition, a rapid and unpredictable change. It’s not an enjoyable experience. But there’s something to be said about staying the course despite the discomfort.

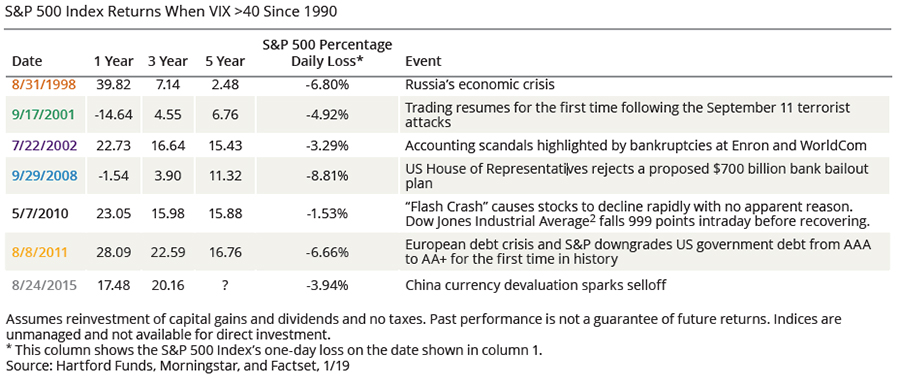

And if we step back and examine six of the previous VIX spikes above 40, indicating extremely high fear levels, there’s a trend. Within three years of volatility-induced declines, the market not only recovered its losses, but also produced additional positive returns in each case. Five years out, those gains remained positive, too.

Buying Stocks When Fear Runs High Has Historically Led to Long-Term Gains

Chicago Board Options Exchange (Cboe) Volatility Index

A takeaway, then, is that while volatility is difficult to endure, it can present opportunities for long-term investors. When the broad sentiment is fear and others are selling, it may be time to be contrarian: consider it an opportunity to not only stay invested, but to buy while prices are depressed.

…Nor do the Wind, the Sun, or the Rain…

Another advantage to resisting fear is that it’s impossible to tell when the market will resume its upward course after a bout of volatility. So remaining invested during a market dip means participating in the recovery as soon as it happens, rather than waiting until things seem to be back on track and missing the beginning of the turnaround.

In a stark example of that advantage, take the financial crisis, arguably the most challenging market environment in our collective memory. As the chart and table show, volatility picked up significantly in September 2008. This was followed by a record amount of outflows.

However, Fidelity Investments compared the returns of retirement accounts for those who stayed invested versus those who sold all their stocks in 2008.3 In the 10 years following the financial crisis, those who stayed invested saw their retirement account balances increase by 240%.

But investors who moved into cash missed out on the market’s recovery. Even if they did buy stocks again eventually, after the worst was over, that delay dampened their return potential. Ten years on, investors who sold when the market declined only saw a 157% increase from their pre-crisis account balances.

In short, although difficult, staying the course for the long term meant a better return than giving in to fear.

…We Can Be Like They Are

Now, we realize it’s easy to say volatility and market dips work themselves out in time, but we realize it’s much harder to experience in reality. It can be incredibly difficult to watch a hard-earned portfolio lose value, no matter how much of a buying opportunity it presents. And in today’s world of instant gratification, it can be difficult to keep in mind you’re more likely to recoup those losses over time, not immediately.

That’s why it’s critical to be proactive by working with a financial advisor to put a solid, long-term financial plan in place. By doing so, you can build a portfolio that’s allocated according to your personal risk tolerances, which can help you stay confident no matter the market’s movements. And when you’re confident, you can be the contrarian who sees the opportunity in fear.

1 “VIX,” commonly referred to as the “Fear Index,” is the ticker symbol for the Chicago Board Options Exchange (Cboe) Volatility Index and measures

the market’s expectation of 30-day volatility. VIX levels below 20 reflect complacency, while levels of 40 or higher refl ect extremely high levels of volatility.

2 Dow Jones Industrial Average is an unmanaged, price-weighted index of 30 of the largest, most widely held stocks traded on the NYSE.

3 “Lessons Learned 10 Years After the Global Financial Crisis Serve as Power Reminders for Investors,” Fidelity Investments, 10/26/2017

This article is written by Hartford Funds, get a free download of this piece for your clients here.

Investing involves risk, including the possible loss of principal.

This information should not be considered investment advice or a recommendation to buy/sell any security. In addition, it does not take into account the specifi c investment objectives, tax and fi nancial condition of any specifi c person. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. This material and/or its contents are current at the time of writing and are subject to change without notice. This material may not be copied, photocopied or duplicated in any form or distributed in whole or in part, for any purpose, without the express written consent of Hartford Funds.

Hartford Funds Distributors, LLC, Member FINRA.

CCWP023_0119 211727

Sponsor Insights: Don’t Fear the (Market) Reaper

April 16, 2019

« Previous Article

| Next Article »

Login in order to post a comment