| • |

ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA), which tracks the Nasdaq-100 Dorsey Wright Momentum Index, is the only ETF providing a momentum-based strategy to identify the top performing stocks in the bellwether Nasdaq-100 Index, which is known for innovative and growing companies. |

| • |

Momentum is a time-tested strategy used to seek outperformance. Supporters of momentum investing include Nobel prize winners* and well-known investment managers. Momentum is a potentially compelling approach to identifying companies in the Nasdaq-100 Index with the greatest potential to outperform. |

| • |

QQQA can fill a range of portfolio applications, including potential use as a core large-cap growth allocation or a momentum factor satellite allocation. |

What Is Momentum Investing and How Does It Perform?

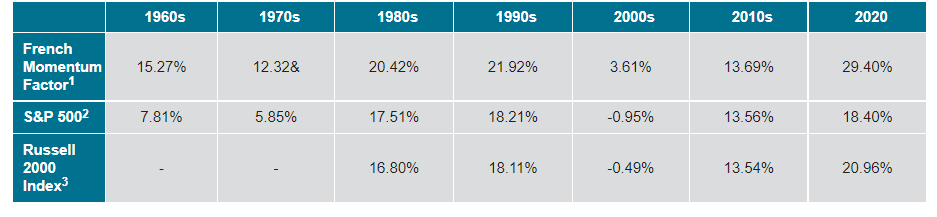

Momentum, as an investing factor, is the tendency of stocks that have been outperforming to continue outperforming. Years of research by academics and investors alike support the strategy’s merit. For example, the table below demonstrates the performance potential of momentum applied to large-cap stocks.

Momentum’s Strong Track Record

The French Momentum Factor is a well-known data set and is widely used as a benchmark for momentum. The factor has displayed persistent outperformance throughout the previous several decades relative to the S&P 500 and Russell 1000 Index.

Summary of Index Performance by Decade

mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html), Morningstar, Bloomberg, ProShares calculations. 1Calculated based on an equal-weighted composite of NYSE, AMEX and Nasdaq stocks in the top 70th percentile of momentum, based on returns for prior 2-12 month periods and market capitalization. The French Momentum Factor is shown for illustrative purposes only and does not represent the strategy or performance of the Nasdaq-100 Dorsey Wright Momentum Index or the ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA). 2S&P data available beginning 3/4/57. 3Russell 1000 Index data available beginning 1/1/84.

Dorsey Wright’s Relative Strength Approach: How It Works

Dorsey Wright’s proprietary approach to momentum investing, called “Relative Strength,” is an objective methodology based on historical point and figure technical analysis. Point and figure analysis combines the ratio of the closing price of two securities with technical charting to generate buy or sell signals. Relative Strength expands on that methodology by using those price relationships and signals to identify stocks with the greatest momentum. The Relative Strength approach:

| • |

Compares the relative performance of any group of stocks against one another. |

| • |

Determines buy or sell signals based on that relative performance. |

| • |

Adds up those buy and sell signals to determine which stocks have the greatest potential momentum and likelihood to continue outperforming. |

| • |

Charts the individual Relative Strength results as a simple matrix, making the approach easily scalable to any size group of stocks. For example, an analysis of 50 stocks would result in a straightforward 50 x 50 matrix displaying the Relative Strength rankings for each stock in the group. |

What Is Special About the Nasdaq-100 Index?

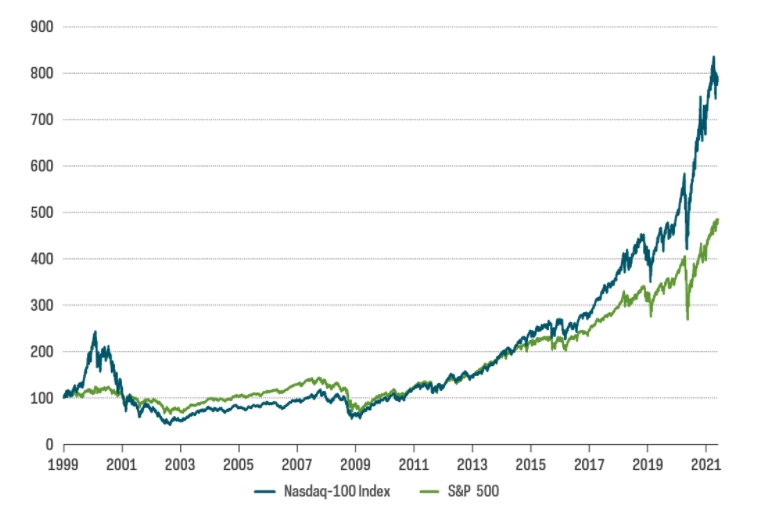

The Nasdaq-100 Index tracks the performance of the 100 largest companies that trade on the Nasdaq Stock Exchange (excluding financials). Since its inception over 30 years ago, the Nasdaq-100 Index has become the world’s preeminent large-cap growth index. Today, the index is home to some of the best-known names in technology, including Apple, Microsoft, Alphabet, Intel, NVIDIA, and Facebook. It has also historically outperformed the S&P 500, returning cumulatively 694% compared to 385% between 1999 and 2021 (see chart below). Importantly, the index also includes category-defining companies from other key industries—companies like Amgen, Starbucks and Tesla to name a few.

The Nasdaq-100 Has Outperformed the S&P 500 by More Than 300% Over the Past 20 Years

(Growth of $100, 3/4/99 - 3/31/21)

Source: Nasdaq, Bloomberg, 3/4/99 - 3/31/21. Nasdaq-100 TR data available beginning 3/4/99. Index returns are for illustrative purposes only and do not represent fund performance. Indexes are unmanaged, and one cannot invest directly in an index. Index performance returns do not reflect any management fees, transaction costs or expenses. Past performance does not guarantee future results.

How Momentum Unlocks the Outperformance Potential of the Nasdaq-100 Index

Dorsey Wright used several steps to calculate momentum rankings and create a matrix to compare all the stocks in the Nasdaq-100 Index.

| 1. |

They used historical performance data going as far back as 12/31/99 to generate rankings. |

| 2. |

Dorsey Wright then divided the matrix rankings into quintiles (20 securities in each) and equally weighted each stock. |

| 3. |

Each quintile was then reconstituted and rebalanced at the end of every month. |

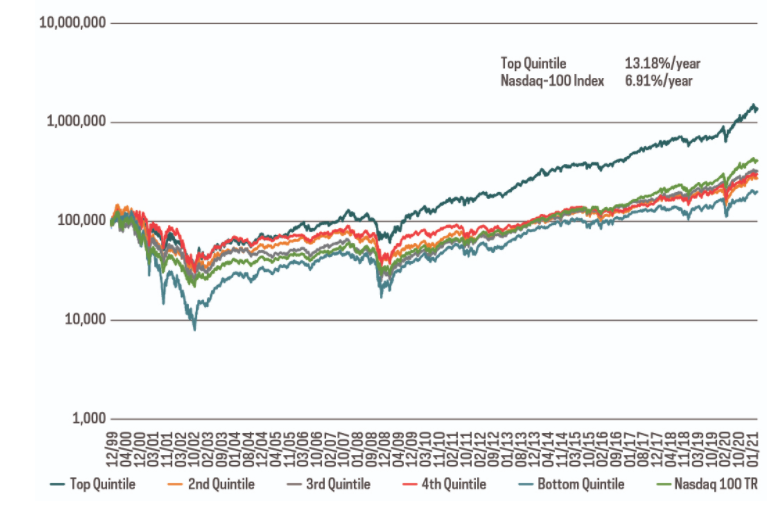

What Dorsey Wright discovered from this analysis was that the top quintile (the top 20 ranked stocks with the most momentum) outperformed the Nasdaq-100 Total Return Index by a large margin - 13.18% per year versus 6.91% per year-over the test period (12/31/99 - 3/31/21). Such significant outperformance clearly indicates the potential of applying a momentum strategy to the already strong historical outperformance of the Nasdaq-100 Index.

Interestingly, the bottom 20 stocks in their matrix (ranks 81-100) performed the worst, returning only about half as much as the Nasdaq-100 Total Return Index during the test period, further supporting the effectiveness of momentum.

The Highest Momentum Stocks Have Outperformed

(Matrix Quintile Returns for Nasdaq-100 Index, 12/31/99 - 3/31/21)

Source: Nasdaq Dorsey Wright, 12/31/99 - 3/31/21. This chart is for illustrative purposes only and does not represent fund performance. Indexes are unmanaged, and one cannot invest directly in an index. Index performance returns do not reflect any management fees, transaction costs or expenses. Past performance does not guarantee future results.

About the Nasdaq-100 Dorsey Wright Momentum Index

Dorsey Wright created the Nasdaq-100 Dorsey Wright Momentum Index to help investors take advantage of their findings about the potential of momentum.

| • |

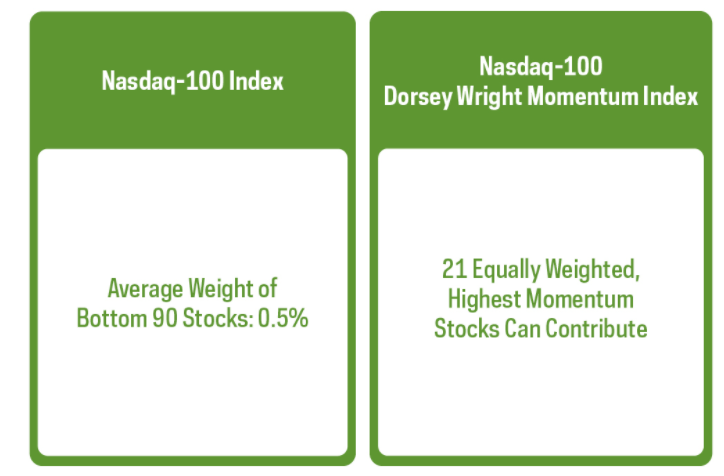

The Nasdaq-100 Dorsey Wright Momentum Index selects and equally weights the top 21 stocks ranked by Relative Strength every quarter. |

| • |

Once chosen, stocks will remain in the index until they fall to a certain sell threshold, in which case they will be replaced at the next quarterly reconstitution. |

| • |

This approach allows outperforming stocks to continue to "run" while reducing portfolio turnover. It also helps the index keep pace with changing momentum trends in the Nasdaq-100 Index. |

Equal Weighting: Less Concentration Risk

Source: Bloomberg, as of 3/31/21.

The Power of the ProShares Nasdaq-100 Dorsey Wright Momentum ETF

In May 2021, ProShares and Nasdaq Dorsey Wright partnered to launch the ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA).

| • |

QQQA is the only ETF based on the Nasdaq-100 Dorsey Wright Momentum Index. |

| • |

It is also the first ETF focusing on select Nasdaq-100 Index stocks identified as having the greatest potential to outperform. |

How to Use QQQA in a Portfolio

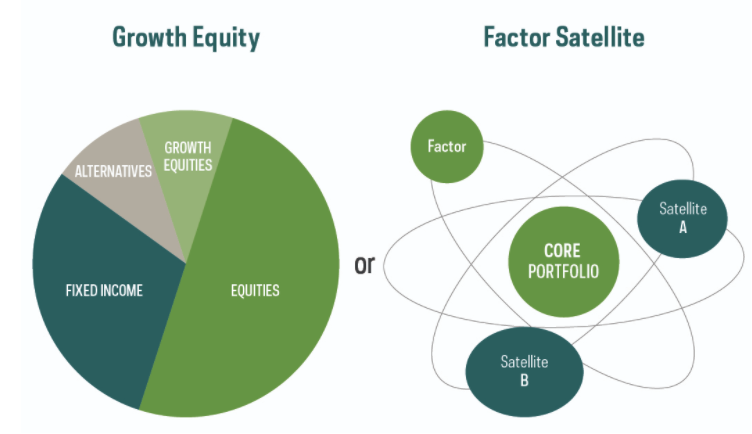

Hypothetical portfolio allocations are for illustrative purposes only. 75% calculated as either S&P Dow Jones or Morningstar Growth.

QQQA can fill a variety of needs, but there are two general portfolio allocations that it seems to fit into most naturally.

| • |

QQQA can be used as a style-consistent large-cap growth allocation. Many momentum strategies regularly change their compositions, sometimes dramatically. Some momentum investors might consider this a desirable feature. However, frequent style and sector changes can make it difficult to maintain consistency in portfolio construction. QQQA's strategy offers the potential for a more style-consistent approach. It invests in the Nasdaq-100 Index's 21 top-ranked stocks for momentum, so QQQA's strategy provides ample room for the momentum factor to “speak.” However, over 75% of Nasdaq-100 stocks are classified as growth. As a result, QQQA's portfolio should reliably maintain a large cap growth style that can be used to fill the growth sleeve in an investor's core equity allocations. |

| • |

QQQA can fill a satellite allocation. QQQA could also be deployed as a factor-based satellite allocation in a well-diversified portfolio. |

Key Takeaways

Momentum investing is a time-tested strategy used to seek outperformance.

| • |

The Nasdaq 100 Index is particularly well suited for a momentum strategy as a way of unlocking even greater potential. |

| • |

QQQA is a unique ETF providing investors access to Dorsey Wright's proprietary Relative Strength strategy, which identifies Nasdaq-100 Index stocks with the greatest potential to outperform. |

To learn more about QQQA, visit ProShares.com.

There is no guarantee any ProShares ETF will achieve its investment objective. Shares of any ETF are generally bought and sold at market price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns.

Investing involves risk, including the possible loss of principal. This ProShares ETF is non-diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Please see their summary and full prospectuses for a more complete description of risks.

Natural or environmental disasters, including pandemics and epidemics, have been and can be highly disruptive to economies and markets and have recently led, and may continue to lead, to increased market volatility and significant market losses.

Momentum investing emphasizes selecting stocks that have higher recent price performance compared to other stocks. Momentum can change quickly and changes may occur between index reconstitutions. Companies that previously exhibited high momentum may underperform other companies that did not exhibit high momentum. Certain investment styles may fall in and out of favor. If momentum investing is out of favor, the fund’s performance may lag behind other funds using different investment styles.

The fund concentrates its investments in certain sectors. Narrowly focused investments typically exhibit higher volatility.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

Nasdaq® is a registered trademark of Nasdaq, Inc. and is licensed for use by ProShare Advisors LLC. ProShares ETFs have not been passed on by Nasdaq, Inc. or its affiliates as to their legality or suitability. ProShares ETFs based on the Nasdaq-100 Dorsey Wright Momentum Index are not issued, sponsored, endorsed, sold, or promoted by Nasdaq, Inc. or its affiliates, and they make no representation regarding the advisability of investing in ProShares ETFs. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds' advisor or sponsor.