Healthy investment returns coupled with rising income taxes have, for clients seeking “tax alpha,” created an ideal environment for the proliferation of private placement life insurance.

PPLI offers a tax-free environment for investments to accumulate at a time when rich clients are most acutely in need of efficient tax management.

Since 2009, the S&P 500 has averaged an annualized return of over 17% and the HRFI Equity Hedge (Total) Index has had average annualized gains of 8.39%. At the same time, federal income taxes have gone up, especially for clients with a net worth greater than $25 million.

The highest federal bracket for ordinary income is now 39.6%, up from 35.0% in 2012. The federal tax rate for long-term capital gains and qualified dividends is 20.0%, up from 15.0% in 2012. On top of these increases, the new Obamacare tax of 3.8% also applies to investors’ earnings. Essentially, without even accounting for changes to some of the phase-outs for deductions, federal taxes have risen 24% on ordinary income and 59% on long-term capital gains and qualified dividends. These increases are causing virtually all investors to seek methods of augmenting after-tax returns. Unlike most taxpayers with typical incomes who can turn to IRAs and Roth IRAs, ultra-high-net-worth clients are turning to PPLI.

PPLI is a life insurance product, and as such it enjoys the same income tax treatment as traditional life insurance:

• Tax-free growth of investment earnings (dividends, interest and capital gains) on policy assets.

• The ability to withdraw and borrow assets from the policy cash value free of income tax.

• An income-tax-free death benefit.

PPLI Economics

Put simply, the efficacy of using PPLI to invest in otherwise taxable investments hinges upon a friction analysis: the tax cost of the investment compared against the cost of the insurance fees and expenses. PPLI is only going to be a compelling structure for investments that are relatively tax-inefficient. Most clients and advisors will judge the merits of PPLI on the pre- and post-tax cash value (account value of the investment) in the policy. However, the death benefit component of PPLI should not be overlooked, as this benefit, which is always greater than the cash value or account value, is received income-tax-free just like a traditional life insurance policy death benefit.

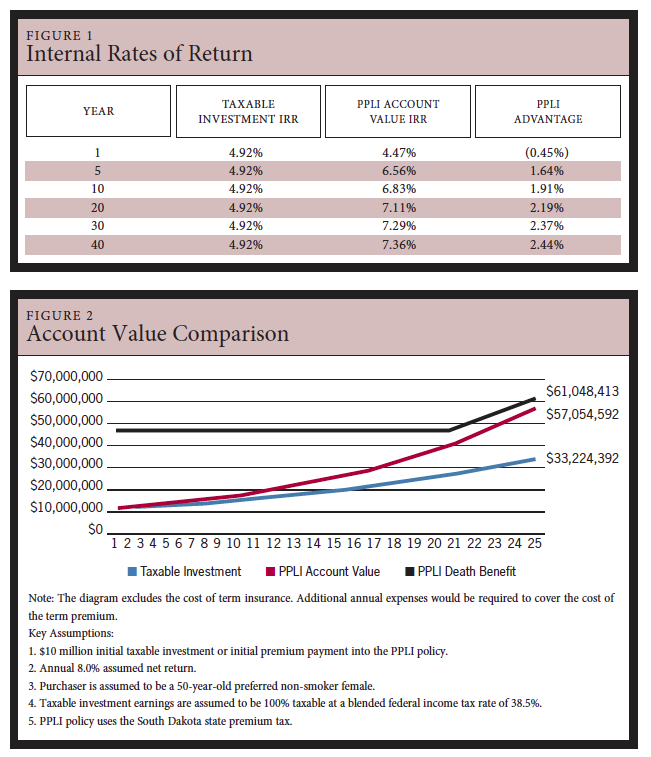

Figures 1 and 2 summarize the advantage of using a PPLI product for a $10 million investment in an otherwise taxable hedge fund. Over the long term, the PPLI policy provides over 200 basis points in “tax alpha” or 72% more ending account value: $57,054,592 versus $33,224,392 in 25 years.

PPLI Vs. Traditional Life

Don’t let any preconceived notions about life insurance scare you or your clients away. PPLI is very different from traditional life insurance in several ways. The decision to procure a PPLI policy is usually an investment decision rather than a risk-transfer decision. The actual PPLI product has several tangible distinctions from traditional life insurance products:

1. PPLI fees are usually lower and more transparent than those of traditional life insurance. For example, the average insurance fees over 30 years should be less than 110 basis points.

2. There are no surrender charges in PPLI policies; any constraint on liquidity is driven solely by the liquidity provisions of the alternative investment.

3. Consultants or brokers that specialize in PPLI implementation and oversight typically receive lower commissions and fees than with traditional life insurance.

4. Investment options within a PPLI policy are highly customized investment options or sophisticated alternative investments, whereas traditional life insurance offers retail mutual funds and index funds.

5. Purchasers of PPLI policies must meet the “qualified purchaser” and “accredited investor” guidelines outlined by the Securities and Exchange Commission.

Stars Aligned

March 10, 2015

« Previous Article

| Next Article »

Login in order to post a comment