In his letter to shareholders for the third quarter of last year, Jayme Wiggins, manager of the Intrepid Small Cap Fund, began with a quote from the legendary pitcher Tom Seaver, who said, "If you dwell on statistics, you get shortsighted. If you aim for consistency, the numbers will be there in the end."

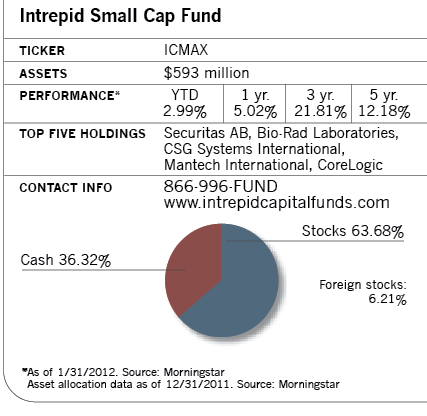

While comparing fund performance to sports has been done more than once, the parallels between Seaver's Steady Eddie record and the performance of Wiggins' fund are hard to ignore. From its inception in October 2005 through the end of 2011, a $10,000 investment in the fund would have grown to more than $20,000, while the fund's Morningstar small-cap value peers would have seen growth to less than $12,000. Last year, the fund gained 1.72%, while the Russell 2000 Index, its small-cap benchmark, dropped 4.17%. And yet the Intrepid fund experienced only half as much volatility.

The fund aims to do better than its competitors when the market tanks, rather than shooting out the lights in bull markets, and that approach has allowed it to outperform. The strategy is to buy the stocks of companies whose public value is well below his firm's calculation of what the company's worth would be in a private sale, and the fund sells those companies without hesitation when they reach the intrinsic value estimate.

That strict sell discipline means the firm has moved out of positions and parked money in cash, sometimes lots of it, when attractively priced stocks are in short supply. In early 2008, the fund was so convinced that the market was overvalued that it built up cash totaling more than 40% of fund assets. With so much money on the sidelines, Intrepid Small Cap lost just 7% that harrowing year, some 30 percentage points less than the S&P 500 index. But by 2009, after former manager Eric Cinnamond had deployed assets back into attractively valued stocks, the cash levels had fallen to almost zero.

"This isn't market timing," says the 31-year-old Wiggins, who assumed control of the $593 million fund in September 2010 when Cinnamond joined another firm. "It's sticking to a discipline that we know works. As markets rise, we sell holdings that cross our intrinsic value estimates. If we cannot identify other cheap securities, then cash builds."

But cash also has some downsides, since the managers can miss out on the early leg of a market upturn. That happened in the last three months of 2011, when the fund rose only 8.85% as the Russell 2000 gained 15.48%.

The strict sell discipline has also led to higher-than-average turnover from time to time, especially when the market is very volatile and some stocks reach their price goals quickly. Though rising stocks are good news, the downside is higher-than-expected capital gains distributions. At the end of fiscal 2011, as a number of stocks pushed past their intrinsic value, shareholders received a capital gains distribution that amounted to more than 11% of net asset value-a sharp hit in a year when the fund itself posted only a small gain.

"We have opted to not let the tax tail wag the investment dog," says Wiggins. Although the holding period for some stocks can be just a few months, a two-to-three-year holding period is more typical, he says.

By the time the Russell 2000 hit an all-time high in July 2011, the fund's cash position had reached 41% of assets. That cushion later helped when stocks subsequently plummeted, sending the benchmark down 24.7% and the fund down by only a mild 10.5% from the market peak on July 7 through the end of September.

With an ample cash war chest at his disposal, Wiggins has taken advantage of the drop by picking up a number of stocks that looked undervalued, and by the end of September cash levels had dropped to 28% of assets. The market upturn at the end of the year led him to sell a number of stocks that had reached intrinsic value, and by early January of this year cash was up to 37% of assets.

Today, he says, he's not in any rush to restock the equity shelves again because small-cap stocks are "far from cheap," as they were in 2008 and 2009. "I think there's a lot of money chasing small caps, but in our opinion valuations aren't all that appealing," he says.

Since government and personal debt is still high, he believes that signs of economic improvement, such as the lower unemployment numbers that could help companies' bottom lines, are largely illusory. "Sadly," he wrote in a colorfully worded letter to shareholders, "the government's monetary Pine-Sol is more like cleaning with gasoline-it may cover up the original mess, but leaves a lingering problem."

Wiggins believes the 40 or so stocks in the fund are well prepared to face any continuation of tough economic times. "We're buying businesses that will generate lots of cash even if the economy doesn't do well," he says. "We prefer those to fast-growth situations with lots of uncertainty or economically sensitive companies that will benefit from a big uptick in the economy."