Winners And Losers

After another day of screeching turns in the U.S. stock market, and an enthusiastic attempt by the European Central Bank to keep bond yields down, the winners and losers from the recent turbulence are growing clearer. Active managers, after a dreadful year, have enjoyed a revival. The question is how long it can last. The losers, following a script that has played out many times in the past, are the emerging markets.

Stockpickers

Let’s start with active managers. The market is so dominated by institutional investors these days that it grows ever harder for a majority of active managers to beat their benchmark, particularly after fees. Cruel mathematics suggests that after costs, most are bound to fail, and that good performance doesn’t persist.

But at least the last few months have given them an opportunity, which many have taken. One basic way to measure the opportunity for active managers is to compare the performance of the equal-weighted benchmark, in which every stock counts the same, with the market cap-weighted version. If the equal-weighted version is ahead, it means that the majority of stocks are beating the index, and that hence the opportunity set to outperform the benchmark is greater. Over history, as the equal-weighted version gives a greater weight to small companies, and small companies tend to do better over time, it does indeed tend to beat the cap-weighted version.

That has not been true recently. Over the last five years, the equal-weighted version suffered steady underperformance, which turned into a rout with the Covid shutdown. But for the last six months, the average stock has done much better than the index:

The one-word explanation for this is “FANG.” The dominance of the big internet platform companies has made beating the index very difficult in the U.S. Either they overweight the FANGs, which is very risky in the long term, or they lose.

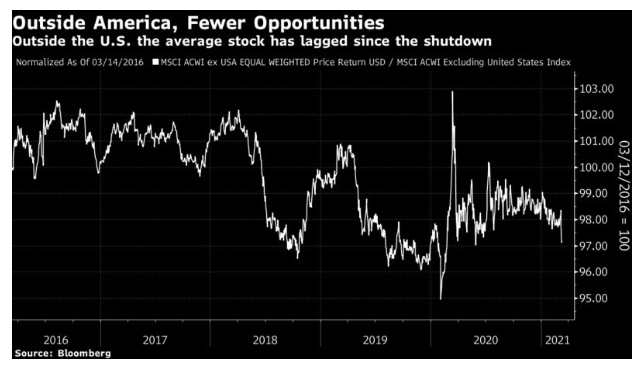

Interestingly, the trend is very different for the world excluding the U.S.. The same chart for the MSCI All-World excluding U.S. index shows a steady and much more limited underperformance, a rebound, and then poor performance of late. Outside the U.S., bigger companies have tended to do well recently. The absence of the FANGs means that the whole pattern of the last five years is far less dramatic:

Another way to measure the fate of active managers is to look at the performance of “pure” stockpickers. The equity market-neutral strategy involves going 50% “long” and 50% “short” (thus with no overall exposure to the level of the market). In a classic version, it involves a series of pairs. For example, if the manager is confident Ford Motor Co. will beat General Motors Co., it would go long Ford and short GM. There is no sector exposure, just a pure judgment on which company is more attractively priced.

Judging by the HFRX index of equity market-neutral hedge funds, these pure stockpickers have done horribly over the last five years:

After a brief dive during the shutdown last year, market-neutral funds have been making money. This is another sign of the possibilities now open to them.