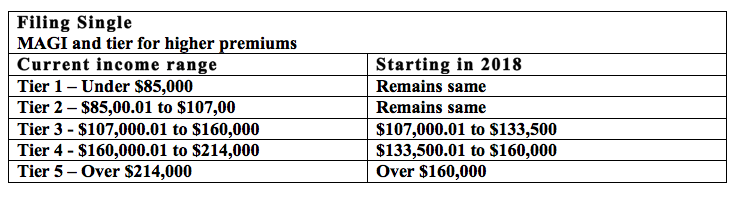

Filing Single – Income Tiers For Higher Medicare Premiums

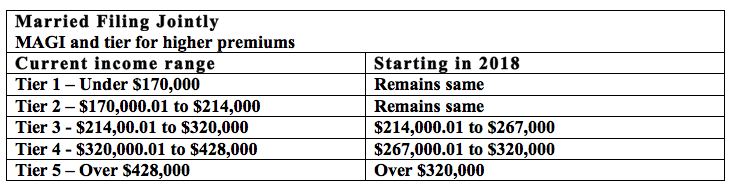

Married Filing Jointly – Income Tiers For Higher Medicare Premiums

As a result of these IRMAA changes, more Medicare beneficiaries will find themselves paying higher premiums.

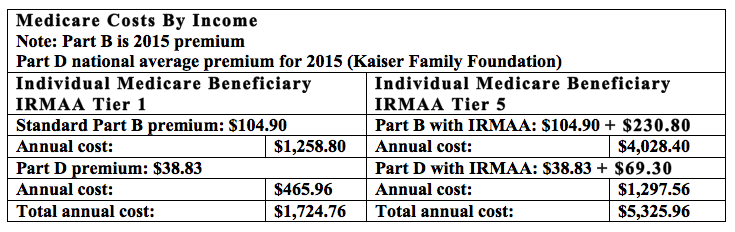

To get a sense for the impact of these costs, consider the following comparison of Medicare premiums for the lowest and highest tier beneficiaries by income based on 2015 costs:

Who falls into this group of higher-income Medicare beneficiaries? In 2015, nearly 3 million Medicare beneficiaries enrolled in Part B will pay higher premiums due to IRMAA regulations, according to the Kaiser Family Foundation.

Clearly, Medicare costs are going to increase for greater numbers of wealthier beneficiaries. When it comes to the latest changes, they only have a couple of years to prepare.

Marketplace Healthcare And Qualifying Income

While we’re on the subject of income levels and health insurance, it’s important to note the implications for the Health Insurance Marketplace. Early retirees who aren’t yet eligible for Medicare also may see some benefits to reducing their income in order to qualify for health insurance subsidies through the Obamacare marketplace.

The highest income that can qualify for subsidies is 400 percent of the federal poverty level. In a household of two people, that amount is $62,920; it's $95,400 for a family of four.

Financial advisors can work with early retirees to find methods for reducing their household income and receive subsidies amounting to hundreds or thousands of dollars a year. This can be especially valuable for retirement planning considering that some financial tools, such as traditional IRAs and health savings account deductions, are not included in the calculation of someone’s adjusted gross income through the marketplace.