Smoothing Rule

The smoothing rule determines how quickly to increase or decrease your client’s annual spending amounts based on the portfolio’s investment performance. Selecting a 90/10 smoothing rule assumes that 90 percent of the spending amount will be based on the prior year’s spending and the 10 percent will be based on the portfolio’s current valuation.

In figure 3, we are using a hypothetical four-year time frame, with high annual inflation. This determines how the endowment spending policy calculates spending, and illustrates how the policy affects the value of a hypothetical investment portfolio.

For the hypothetical we chose 5 percent as the spending rate (a $50,000 distribution from the $1 million portfolio during the first year) and a 90/10 smoothing rule. The hypothetical shows the portfolio value on January 1st of each year and the annual spending calculation.

Note how the spending amount actually increases during the two year bear market, but does not keep pace with inflation since the underlying portfolio value does not warrant it. Your client’s willingness to reduce the spending amount when the investment portfolio is not performing well is the key to having a sustainable investment portfolio. Using an endowment policy assists in maintaining a reasonable current spending amount in both bear and bull markets.

Comparing Spending Policies: Lifestyle vs. Endowment

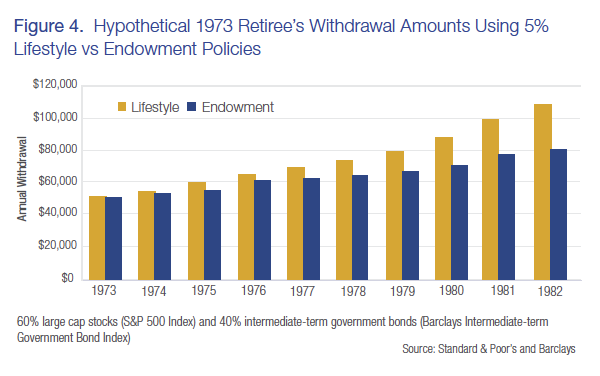

Returning to the hypothetical of the client who began taking investment portfolio distributions on January 1, 1973, it is possible to see the difference an endowment policy can make to the longevity of their retirement portfolio. Illustrated in figure 4 is a hypothetical comparing the annual spending amounts for the first ten years of portfolio distributions from both the endowment and lifestyle policies.

Note how the endowment policy reins in the spending amounts during this high inflationary bear market. In fact, over the 10-year period the spending amount was lowered by almost $102,000 in aggregate (10 percent of the initial portfolio value), allowing this amount to remain invested in the portfolio for future periods. The reduced spending amount gave the portfolio time to grow and as the assets increased in value, the investor could take advantage of improving market conditions.

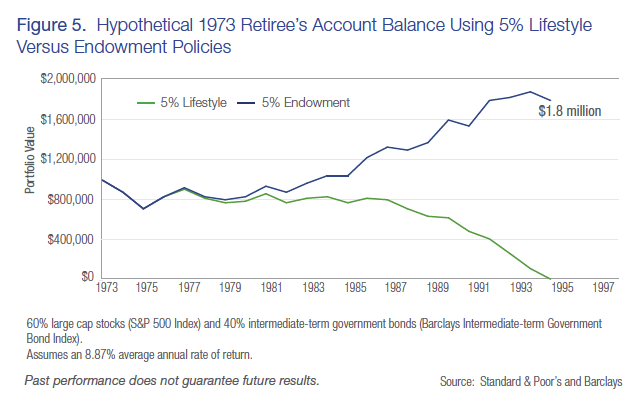

The net effect of using an endowment policy for the investor who began distributions on January 1, 1973 is quite dramatic. In the hypothetical in figure 5, which compares the impact to the value of the investment portfolio using the lifestyle versus endowment policies, the lifestyle policy portfolio is exhausted in 21.5 years, while the endowment policy portfolio actually grows to $1.8 million during the same time frame.

If you choose an endowment spending policy, you and your client should expect that spending amounts may not keep pace with the cost of living unless the value of the underlying investment portfolio grows sufficiently to support the increases. At the same time, this approach gives the opportunity for two critical factors that contribute to the longevity of long-term investment portfolios: continued growth of assets and a spending policy that supports “belt tightening” during bear markets.

Jan Blakeley Holman is the director of Advisor Education at Thornburg Investment Management. Holman is responsible for identifying and creating advisor education programs that support financial advisors as they work with their clients and prospects. She is also a frequent presenter at broker-dealer and industry conferences where she discusses women and investing; women in transition; and longevity planning. She has also written numerous articles and contributed to several books on these and other financial planning topics.