• Geopolitical risks are high. Geopolitical risk is always relevant even though stocks have historically been resilient to these events. There are several potential scenarios that could impact the markets in the near term, such as the threat from North Korea, difficult Brexit talks, NAFTA renegotiations, and elections in Germany. In addition, terrorism unfortunately reared its ugly ahead again last week with the tragedy

in Barcelona.

Distractions in Washington, D.C. Each day that policymakers are focused on issues other than tax policy, the odds of corporate tax reform decrease and the possibility of budget or debt limit stumbles increase. We still believe a tax deal in early 2018 is more likely than not, with the Republicans in need of a political win, but the odds of success have fallen.

The Good News

While that is a long list of risks, we want to be clear that we are not sounding an alarm bell and turning bearish. Our decision to slightly reduce equity exposure was a small tactical move executed within a select group of portfolios more focused on a short- to intermediate-term time horizon (within the range of 3–12 months). We remain nearly fully invested with roughly benchmark-level risk in most of our tactical models. And we have shifted equities to cash rather than bonds so that we can be nimble and put the cash back to work when a more attractive opportunity emerges. In other words, we are still inclined to buy a dip when it comes.

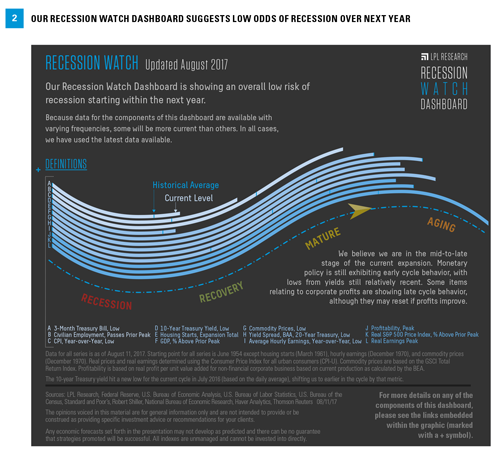

It is also important to note that we have made no changes to our strategic asset allocation recommendations, which focus on longer, three- to five-year time horizons. Our long-term equity market view remains positive primarily because of where we think we are in the business cycle. We expect the economic expansion and bull market to continue well into 2018 and likely beyond, with leading indicators pointing to further economic growth and our Recession Watch Dashboard [Figure 2] suggesting that the economic cycle is in its mature phase but not nearing its end. We see few signs of excesses (overspending, overborrowing, and overconfidence) that have historically led to the end of prior business cycles. Remember, bull markets don’t die of old age, they die of excesses.

We are also encouraged by the financial health of corporate America. Even though the market’s reaction to earnings was muted, companies delivered another excellent earnings season and balance sheets are in outstanding shape. A likely reduced tax rate to repatriate overseas cash in 2018 will only strengthen corporate America’s financial position. Consumer spending picked up in July based on the strong retail sales report last week; and data released thus far for the third quarter suggests a potential pickup in gross domestic product growth.

Conclusion

The risks have begun to stack up — some seasonal, some policy related, some geopolitical, and some simply a function of the unusually quiet year we’ve had. But the longer-term outlook still looks good. We see no recession on the horizon, the economy is showing no signs of excesses that have historically led to the ends of business cycles, and corporate America appears to be in excellent shape.

Burt White is chief investment officer and Jeffrey Buchbinder is market strategist at LPL Financial.