Americans are living in a multi-dimensional tax world, the way CPA and tax educator Robert Keebler sees it. First, You have the regular rules. Those sneaky phaseouts of itemized deductions and personal exemptions form another dimension, in Keebler’s view. Yet a third consists of what he calls the “super rates” on the highest incomes, 39.6% for ordinary income and 20% for long-term gains and qualified dividends.

Who can deny that the alternative minimum tax is a slice of reality all its own? And don’t overlook the health-care-reform taxes, 0.9% on earned income and 3.8% on net investment income for big earners.

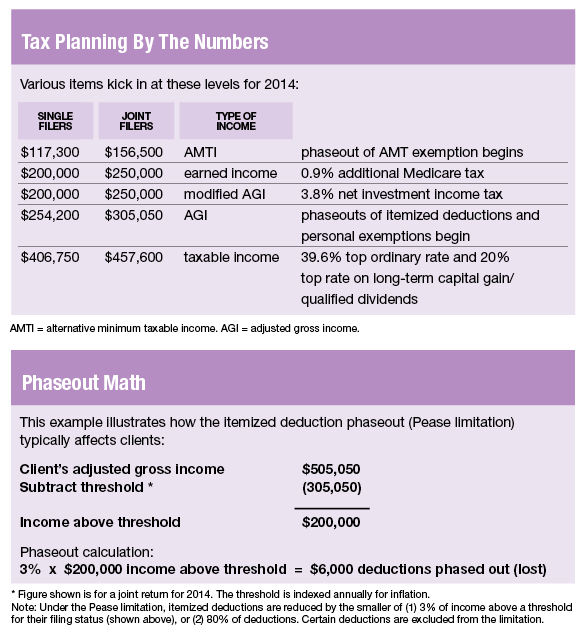

“There are five dimensions to our tax system and whenever a client is considering a transaction, you need to walk around it from each of the five dimensions,” says Keebler, founding principal of Keebler & Associates LLP in Green Bay, Wis. See the “Tax Planning By The Numbers” box for key figures.

Against this polygonal backdrop, year-end tax strategies are now taking shape. Consider how Mike Tedone of Connecticut Wealth Management is helping a client divest a large, low-basis holding. “We’re trying to manage the gains over time by planning around the 3.8% tax and the higher capital gains rate, to not pay those where we can work it,” says Tedone, a CPA/PFS and partner in the Farmington, Conn., financial-planning firm.

You don’t have to be a tax nerd to help clients with year-end planning, although if you aren’t one, encouraging folks to utilize a knowledgeable accountant who’s outfitted with sophisticated, up-to-date tax software is a great idea.

“You can’t ballpark tax estimates anymore. Clients have to sit down with their tax professional and really work through the issues because there can be a lot of savings involved,” says Tedone. Today’s higher tax rates mean planning can save more, while the law’s inscrutable complexity demands a pro’s touch, something you can tell clients who enjoy visiting their CPA’s office as much as their dentist’s.

Has a client ever neglected to tell you something important? Same happens to accountants. That’s another reason to encourage dialogue with the CPA.

Better still, insert yourself into the conversation. Tedone does. This year he’s particularly concerned about the mutual fund distributions his clients will be receiving, given the run-up in the market. “We plan to be very proactive with tax preparers to say, ‘Our mutual client may be having this issue. We’ll let you know as we find out more.’ Advisors who are not tax preparers can do their clients a great service by quarterbacking year-end tax planning,” Tedone says.

Your Projection Is Key

The best year-end planning now takes into account the client’s tax picture over several years, a portrait that is painted from the planner’s forecast of the client’s income. With a realistic earnings projection “you can take a long-term view and focus on bracket management over time,” says Keebler, the Green Bay CPA.

For example, the client may wish to convert a large traditional individual retirement account to a Roth. That would create taxable income—ugh. But a careful projection of the client’s income and tax situation lets you plan to execute, over a period of years, a string of partial Roth conversions, each just the right size to prevent the client’s income from reaching into the next tax bracket.

A good income projection will indicate whether the client is in AMT one year and not the next, or vice versa. “When you have that pattern, there’s a lot of planning you can do,” says CPA Blake Christian, a tax partner at HCVT LLP, in Long Beach, Calif.

The planning opportunities revolve around the significant difference between the top rate under the regular tax system, 39.6%, and the 28% maximum federal AMT rate that applies after the client’s AMT exemption has been fully phased out (i.e., joint filers with AMT income above $484,900, or $328,500 for single individuals).

“With a client who is in AMT this year but will be subject to a higher ordinary rate next year, you generally want to load up on taxable income now and push out most deductions into next year,” Christian says, noting that higher-income clients who retired this year or sold a business or other large asset may fit this profile.

To increase income in an AMT year to take advantage of its comparatively low tax rate, the client might exercise stock options or convert a traditional IRA to a Roth, among other things.

Education is something else advisors can offer. Clients whose itemized deductions are phased out (that is, curtailed) often wonder whether they’ll get any tax break for making charitable gifts. Yes is the answer for the majority, but it depends.

Under what’s called the Pease limitation, a client’s deductions can be phased out in two ways: by having the rare combination of an extraordinarily high income and relatively few deductions, or—as is far more common—by having income above a threshold. In the latter case, additional charitable gifts work out to be fully deductible.

Looking at the calculation at the bottom of the example in “Phaseout Math,” you can see that more income would increase the amount of lost deductions above the $6,000 already phased out. It’s also clear that the amount of charitable contributions has nothing to do with the calculation. So you could tell the hypothetical couple, “If you make more charitable contributions, you are going to get the full tax benefit because your phase-out is based on your income,” Tedone says.

On the subject of charitable gifts, Tedone is telling his clients who are over age 70 and a half to wait to donate until late in the year. He believes Congress could reinstate qualified charitable distributions, a technique allowing older clients to make tax-free distributions from their traditional IRAs to charity. This popular provision expired last year.