Also, advisors must remember that although the federal government recognizes portability, states don’t.

Same Time Next Year

Another now-permanent feature of the tax law is that the exclusion is indexed for inflation every year. Clients who exhausted their exclusion in 2012 when it was $5.12 million per individual can now gift an additional $130,000 free of taxes, and that doubles to $260,000 for a husband and wife.

Given the already high exclusion, even 2% inflation yields a six-figure bump. That takes annual gift planning to a whole new level.

“It’s a big difference from $14,000”—the current annual exclusion from gift tax—“in terms of the planning clients can do,” says Suzanne Shier, director of wealth planning and tax strategies at Northern Trust in Chicago.

“We’re encouraging clients who have fully utilized their lifetime exclusion to regularly consider taking advantage of annual indexing with leveraged gifting techniques, such as grantor-retained annuity trusts with a near-zero remainder,” Shier says. “And we’re still able to use strategies that involve valuation discounts.” These advanced techniques are still available under the new law, despite practitioners’ fears they wouldn’t be.

Higher Taxes For Trusts

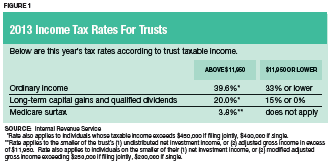

The taxpayer relief act raised the top rates trusts pay on income. For 2013, the new rates apply when the trust’s taxable income tops $11,950. And the 3.8% Medicare contribution tax further applies to trust income above that figure, says Shier. (See the chart for details.)

These tax increases likewise affect individuals, albeit at much higher income levels, which could create issues for clients with grantor trusts. The income of these popular trusts is taxed to the trust creator, rather than the trust itself. This allows the trust assets to grow without a tax burden and ultimately funnels greater wealth to the trust beneficiaries.

But with today’s higher tax rates for upper-income individuals, “grantors may not feel as kindly toward the beneficiaries as when they set the trust up,” Schmidt predicts. Such clients might consider discontinuing grantor-trust status. How they do that will depend on the specifics of each trust.

Shier adds that the grantor must be comfortable bearing the tax burden before he or she recognizes a big gain in the trust.