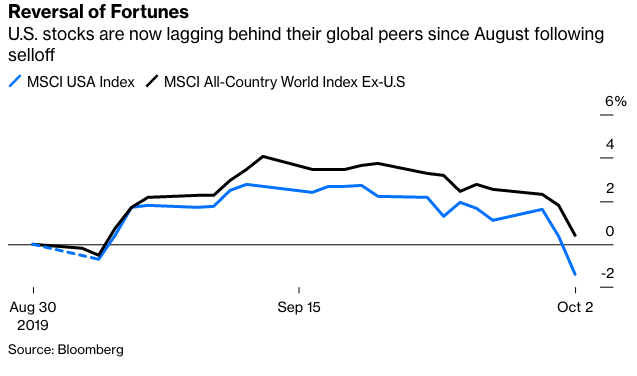

The global stock market fell for a second straight day Wednesday, posting its biggest back-to-back loss since early August. Why this is happening is well known: The outlook for the worldwide economy is getting worse. But what’s really worrisome is that suddenly the declines are being led by U.S. equities.

The MSCI USA Index tumbled 2.98% over the past two days, compared with a drop of 1.45% for MSCI’s index tracking equities outside America. As a result, U.S. equities have now unperformed their global counterparts since August after trouncing them in the first eight months of year. This reversal of fortune suggests investors are increasingly concerned that the U.S. economy, which has been able to weather the global slowdown better than most of its major peers, is finally starting to buckle. And if it does, the odds are slim that the global economy will rebound anytime soon. These worries were fanned by Tuesday’s Institute for Supply Management report, which showed factory output falling deeper into contraction. Yes, manufacturing was known to be weak – but put that together with the poor vehicle-sales data that have come out the last couple days, and suddenly there’s reason to doubt whether the consumer will continue to carry the economy. “We haven’t seen enough to say ‘Yeah, the consumer is folding,’ but questions are starting to intensify,” Willie Delwiche, an investment strategist at Baird, told Bloomberg News. And then there’s the domestic political situation, with the impeachment inquiry into President Donald Trump and increasingly alarming rhetoric from the president and others further stirring things up. “The fact that stall speed is becoming an issue of common interest illustrates that the basic trust in the U.S. as a safe haven (in times of global recessions) is eroding,” Ulrich Leuchtmann, head of currency strategy at Commerzbank, wrote in a research note. Trump’s “constant Twitter feeds on ‘coup’ and ‘civil war’ do not exactly make the U.S. a safe investment target,” he added.

As for earnings season, don’t expect companies to deliver a magic bullet for stocks when they start reporting in the days ahead. Analysts are projecting companies to say that profits fell 3% in the third quarter from a year earlier, according to Bloomberg Intelligence. This is troubling because companies were expected to be showing earnings growth by now, with forecasts for a 5.3% gain this quarter at the start of the year. But the folks at DataTrek Research point out that this is the time when companies, investors and analysts start focusing on the year ahead. And with analysts having neglected to trim their estimates for 2020, still looking for 10% earnings growth, the potential for disappointment and another leg lower in stocks is high.

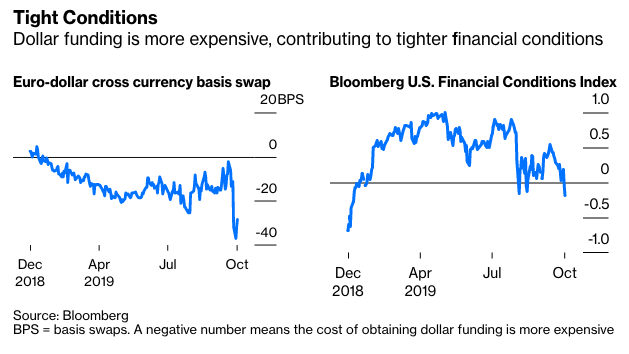

Financial Conditions Are Tightening

What’s also concerning about the market action is that financial conditions as measured by data compiled by Bloomberg are the tightest since the aftermath of the gut-wrenching sell-off in equities last December. They are even tighter than during this year’s big declines in stocks, in May and August. Financial conditions are determined by many different factors, including the level of equities and their related volatility, credit spreads, the Treasury market’s yield curve, and money market rates, to name just a few. But of all the factors, the one that really worries Medley Global Macro Managing Director Ben Emons is the cost of dollar financing by way of the derivatives market. More specifically, he notes that that the cost to convert foreign cash flows into dollars with cross-currency basis swaps has suddenly surged, and is now at its highest for a basket of Group of 10 currencies since November. Yes, demand for dollar funding typically rises into year-end, but the unusually quick jump higher in demand for greenbacks coupled with the recent turmoil in the repo market may be a sign that the final three months of the year will be anything but smooth for markets.

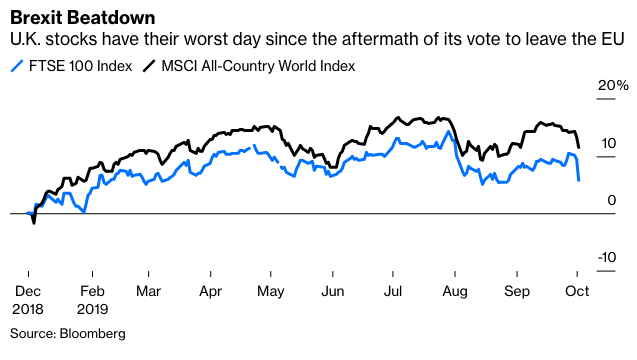

A Brexit Slump

Speaking of political turmoil, U.K. Prime Minister Boris Johnson’s latest blueprint for leaving the European Union in a process known as “Brexit” isn’t winning over investors. The FTSE 100 Index, which covers larger U.K. stocks, plunged 3.23% Wednesday to cap its worst day since the session immediately after British citizens voted in mid-2016 to leave the EU. It’s also double the decline in the MSCI All-Country World Index. It didn’t help that European Commission President Jean-Claude Juncker said there are “problematic points” in Johnson’s proposal that need more work. Time is running out on one of the most important developments hanging over the global economy and markets. Although the official deadline for reaching a deal to leave the EU is Oct. 31, Johnson told The Sun newspaper that he gave EU negotiators an Oct. 11 deadline for agreeing to the broad outlines of an agreement. That means there’s not a lot of room – or time – for error. The uncertainty over Brexit has taken its toll on the U.K. economy. The ECD said two weeks ago that it sees growth slowing from 1.4% to 1% this year and to 0.9% in 2020. That compares with 3.8%, 3.1% and 3.2%, respectively, for the Group of 20 economies overall.