To the bubble hunters, signs of excess aren’t hard to find, with cryptocurrencies roaring back and Nvidia Corp. surging nearly 80% since the year began.

But if there’s some irrational exuberance sweeping across Wall Street, it hasn’t trickled down to one of the most speculative corners of the U.S. stock market: unprofitable technology companies.

Twilio Inc., the maker of communication software, and cybersecurity company SentinelOne Inc. are among those that have tumbled this year even as a rally in the biggest tech companies pushed the Nasdaq 100 and the S&P 500 to fresh all-time highs. Both have dropped more than 70% from their peaks in 2021, when the Federal Reserve’s easy money policy was fueling big gains in virtually everything.

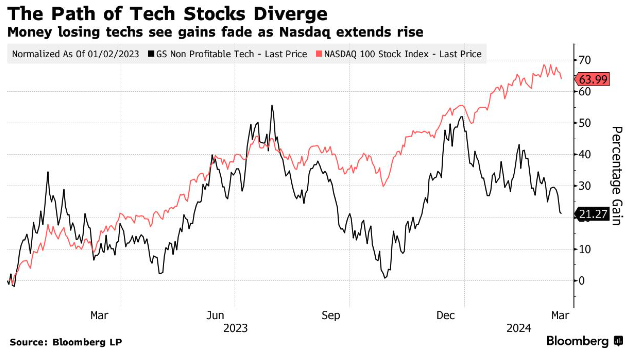

They’re not just outliers: An index of money-losing tech companies tracked by Goldman Sachs Group Inc. has fallen 18% this year and is on track for its worst quarter since mid-2022.

The slide indicates there’s a limit to the optimism that has raced through markets for much of this year. That, in turn, is providing support to those on Wall Street who see rational forces at work—like solid earnings and artificial-technology breakthroughs—not a bubble that’s poised to burst. Instead of being pulled up along with the industry’s Goliaths, the money-losing tech companies have been punished by profit-focused investors and elevated interest rates that are still weighing on growth-stock valuations.

“Profitless tech stocks’ declines indicates that this is not an AI-fueled bubble,” Kathryn Rooney Vera, chief market strategist at StoneX Group Inc.

The market’s rise this year is fueling a growing debate over whether prices have run too far ahead of the economic fundamentals, and the advance has largely paused over the last two weeks as investors weigh whether the Fed will start cutting interest rates as soon as had been expected. Much of the gains have come from big tech companies poised to benefit from AI.

Strategists including Bank of America Corp.’s Michael Hartnett and JPMorgan Chase & Co.’s Marko Kolanovic have said they see evidence of a bubble forming. But others see support for recent stock valuations, and strategists at Societe Generale SA recently reckoned that the S&P 500 could rise some 20% more before it hit valuation levels seen during the dot-com bubble.

“We think the current rally has been driven more by rational optimism than irrational exuberance,” Manish Kabra, SocGen’s head of U.S. equity strategy, said in a note to clients, citing solid corporate earnings and an upturn in global economic indicators. “We expect these drivers to maintain their momentum.”

The recent dynamic stands in contrast to the pandemic’s stock-market frenzy, when low interest rates and a rise in day-trading pushed up the price of the most speculative assets, like meme stocks and special-acquisition companies. Goldman’s index of money-losing tech companies rose over 200% in 2020.

The fact that they haven’t been swept up in the latest rebound shows that if there is a bubble forming, it’s far from affecting every sector equally.

Moreover, recent gains have been stoked by strong profit growth as the economy continues to defy once widespread expectations of a recession.

Some of this year’s best-performing stocks, such as Meta Platforms Inc. and Amazon.com Inc., have boosted profits by curbing spending and cutting jobs. Rather than speculative bets, Nvidia’s stock price reflects its currently surging earnings as others buy its chips for AI computing. By contrast, Tesla Inc., a pandemic-era darling that recently issued a disappointing outlook, has seen its shares tumble 34%.

“Companies that were more focused on growth versus profitability got the message during 2022 that investors really wanted to see profitability,” said Walter Todd, chief investment officer at Greenwood Capital Associates. “Companies that have not been able to do that, they’re in pretty big trouble.”

—With assistance from Alexandra Semenova

This article was provided by Bloomberg News.