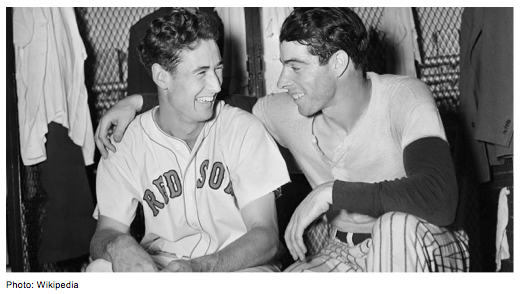

Ted Williams and Joe DiMaggio each hit a single on this date in 1941. It would turn out to be the beginning of career-best, longest hitting streaks for both. Ted Williams’ hitting streak ended after 23 games. Joe DiMaggio, of course, went on to hit in 56 consecutive games—a record that still stands 78 years later.

DiMaggio won the MVP that year while Williams finished second, by a vote total of 291–254. Their 1941 accomplishments are widely considered to be two of the greatest performances in baseball history.

Despite missing out on the triple crown by five RBI (Joe DiMaggio led the league with 125 RBI), Ted Williams set his own record in 1941 that still stands today. He was the last baseball player to finish a season with a batting average above .400. Ted Williams’ batting average was .339 when his hitting streak began and rose to .431 when his streak ended on June 7. His average would briefly dip below .400 in July but remained above .400 in August and September. He ended the season batting .406.

In an amazing feat of consistency—Williams’ longest hitless stretch in 1941 was seven at-bats. And yet he was hitless in 30 of the 143 (21 percent) games he played in that year.

Which leads us to the importance of the sequence of returns when evaluating investments. Hitting .406 for the season is equivalent to going two for five every game. But they are equivalent, not the same—especially for the fans who attended one of his 30 hitless games. Williams went two for five in only four of the 143 games he played that season.

Similarly, using Dr. Roger Ibbotson’s long-term stock market returns, the rolling annualized 30-year total return of large company stocks has averaged 11.2 percent since 1926. And yet none of the 92 years had a calendar year return of exactly 11.2 percent.

In fact, large company stocks returned between 10–12 percent in only six calendar years.

Real world results for individual investors may have deviated from long-term averages depending on their entry point and the sequence of returns. In individual calendar years, investors were just as likely to see returns of -20 percent and much more likely to see returns of +20 percent.

Ted Williams And The Sequence Of Returns

May 17, 2019

« Previous Article

| Next Article »

Login in order to post a comment