Morningstar Inc. is sounding a warning to Wall Street money managers looking to pounce on one of the hottest trends of the past few years: the breakneck rush into active exchange-traded funds.

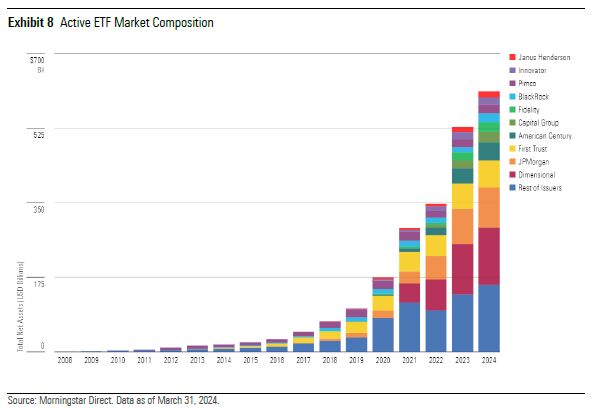

While this breed of fund has attracted record sums of cash in recent years, it’s no “panacea” for managers, according to a Morningstar report published this week. In fact, 74% of the nearly $630 billion in US active ETFs is controlled by the top 10 issuers in a field of about 320 firms that have embraced the wrapper — meaning that the pool of companies benefiting from the asset boom is exceedingly small.

The research is a cautionary tale to money managers who have watched billions of dollars drain from actively managed mutual funds in favor of the lower cost, tax-efficient ETF wrapper. That dynamic has spurred an arms race among issuers seeking to grab share of a rapidly growing pie, spurring record fund launches. But while it’s true that actively managed ETFs have posted record-breaking inflows at the expense of their mutual fund peers, the reality is that the leadership in the active ETF industry is very concentrated and success is far from guaranteed, Morningstar said.

“Many strategies have adopted ETF wrappers looking for salvation only to find struggle,” Morningstar analysts led by Bryan Armour wrote in the report. “There are many active ETFs, but only a few funds from a handful of issuers have been successful, so far.”

Dimensional Fund Advisors and JPMorgan Asset Management are the two largest issuers with a combined $228 billion under management, accounting for about 36% of total active ETF assets alone, data compiled by Bloomberg show. Dimensional got an early boost by being one of the first issuers to convert mutual funds into ETFs in 2021, while JPMorgan’s popular income-oriented funds have inspired a wave of copycats.

In addition to the top-heavy league table, money managers should also be mindful of the fact that the ETF vehicle isn’t suitable for all types of active strategies, Morningstar said. For starters, ETFs can’t close to new investors in the way that mutual funds can, which could theoretically mean that the fund becomes too big for it to effectively invest. Those potential capacity constraints mean that investors need to keep an eye on concentrated strategies, particularly those that “play in small sandboxes” or illiquid assets, the report said.

Even still, asset managers continue to pursue active ETFs. Just last week, MFS Investment Management — home to the world’s first mutual fund — submitted applications for its inaugural such funds, while BlackRock Inc. filed plans to flip an actively managed mutual fund into an ETF. Meanwhile, industry newcomers such as TCW Group are committed to the space against a backdrop of high interest rates.

“If money’s free, it’s a little harder for maybe one company to differentiate versus another. But with higher rates and higher costs of capital, we have a very strong conviction that we’re able to understand how a system like power and energy changes, but then we’re able to find the best managed company with the best prospects and they’re going to pull away,” TCW global head of distribution Jennifer Grancio said. “The next 10-plus — however many years — where money’s not free, this is a great market for active.”

This article was provided by Bloomberg News.