The Great Wealth Transfer sounds like a heist film or a game show. It’s neither.

It’s a (rather morbid) shorthand for the massive amount of money boomers are expected to leave to their millennial kids—making those adult children the “richest generation in history,” according to some headlines. This, we’re told, will help solve the student debt crisis; allow cash-strapped 30- and 40-somethings to finally get into the housing market; and even help them make up for lost time on saving for retirement. Thanks for the parting gift, Mom and Dad!

I don’t buy it.

“The typical boomer is not in a position to leave any money at all,” says Teresa Ghilarducci, a labor economist, one-time Bloomberg Opinion columnist and author of the new book, Work, Retire, Repeat: The Uncertainty of Retirement in the New Economy. Historically, about three out of four parents have intended to leave something to their kids, as she noted in a 2020 column. But according to data from the Federal Reserve, only about one out of four kids actually receive an inheritance—and the odds are even lower if you’re not White. Generous intentions run into hard math.

True, as a group, boomers are holding on to a huge sum—maybe as much as $90 trillion, or half the wealth in the country. So perhaps this time will be different. But I doubt it.

One thing distorting the averages: There are an awful lot of baby boomers. (The clue’s in the name.) They account for about 20% of the population, with people over 65 making up a bigger share of the U.S. than at any point since the government began keeping track a century ago.

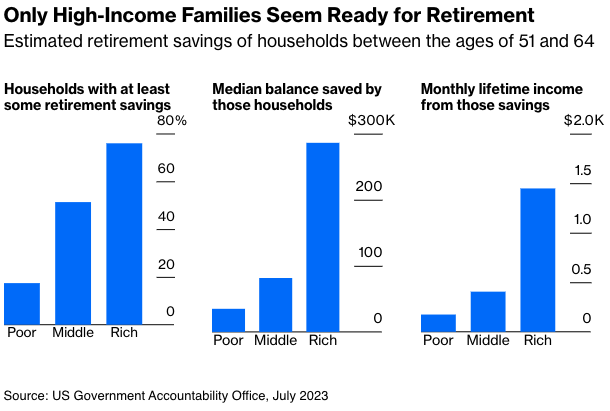

The impressive-sounding averages are also distorted by the massive wealth at the top. According to an Economic Policy Institute analysis of the Fed’s Survey of Consumer Finances, back in 2016 the average late-career couple had saved about $243,000 for retirement. Not too shabby. But the median number tells a different story: just $21,000.

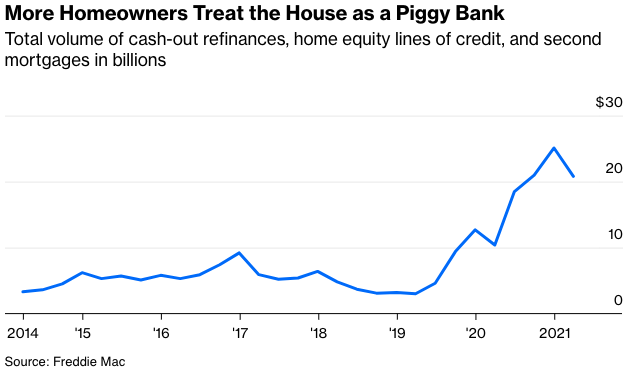

Tales of boomer wealth have also been inflated by rising home prices—again, particularly for those in the top 10%. But home prices aren’t the same as home equity. Many boomers have significant debt on their homes. Some are still paying off their original mortgage. Others have borrowed against their homes to put cash in their pockets, either with a reverse mortgage, home equity loan or cash-out refinance. That will leave less money to pass on to their heirs.

Even boomers who have dutifully socked money away for decades may find that retirement costs more than they anticipate.

Most Americans retire five years earlier than expected, according to a recent Transamerica survey, due to layoffs, health problems, or the need to care for an ailing partner or elderly parent. They’re left with less time to earn and more years to cover.

Another nasty reality: Healthcare costs are much higher for people over age 65 than they are for younger people. The majority of one’s healthcare spending happens after retirement. And Medicare doesn’t cover dental or vision care, because in the U.S. healthcare “system,” teeth and eyes are a bit like checked luggage or an in-flight meal—an optional upgrade for those who choose to splurge.

According to KFF, only half of people over 65 have saved any money for a home health aid ($60,000 a year) or nursing home ($100,000 a year). Neither are covered by Medicare. And Medicaid only kicks in if all your savings have run out.

Our focus should be on shoring up elders’ finances—particularly around healthcare and long-term care costs—not ghoulishly dreaming of how we’ll spend their money when they’re gone.

To be sure, the richest boomers will have plenty to leave to their heirs. But it’s unclear how much of a difference that will make. Those millennials probably don’t have college loans, already got parental help to buy a house, and maybe even have grandma paying for child care or tuition costs. For them, the great wealth transfer is already underway—and has been for some time.

And given the increasing life expectancy of the richest Americans, the big money isn’t likely to change hands until millennials are close to retirement themselves. They can’t live their whole working lives as if that late-life windfall is a sure thing—it’s too risky, says Anne Lester, former head of retirement solutions at JPMorgan and author of the new book, Your Best Financial Life: Save Smart Now for the Future You Want.

All these factors, taken together, should be enough to put the kibosh on dreams of a society-transforming intergenerational wealth transfer.

In fact, a significant share of older adults are experiencing a wealth transfer in the other direction, accepting money from their adult children. According to a survey by the AARP, a third of adults in midlife (millennials and Gen X) are giving money to their parents to pay for basics like groceries, housing and healthcare. Most say supporting their parents is a strain on their own finances. But Mom and Dad have run out of money. What else are they going to do?

Sarah Green Carmichael is a Bloomberg Opinion columnist and editor. Previously, she was an executive editor at Harvard Business Review.