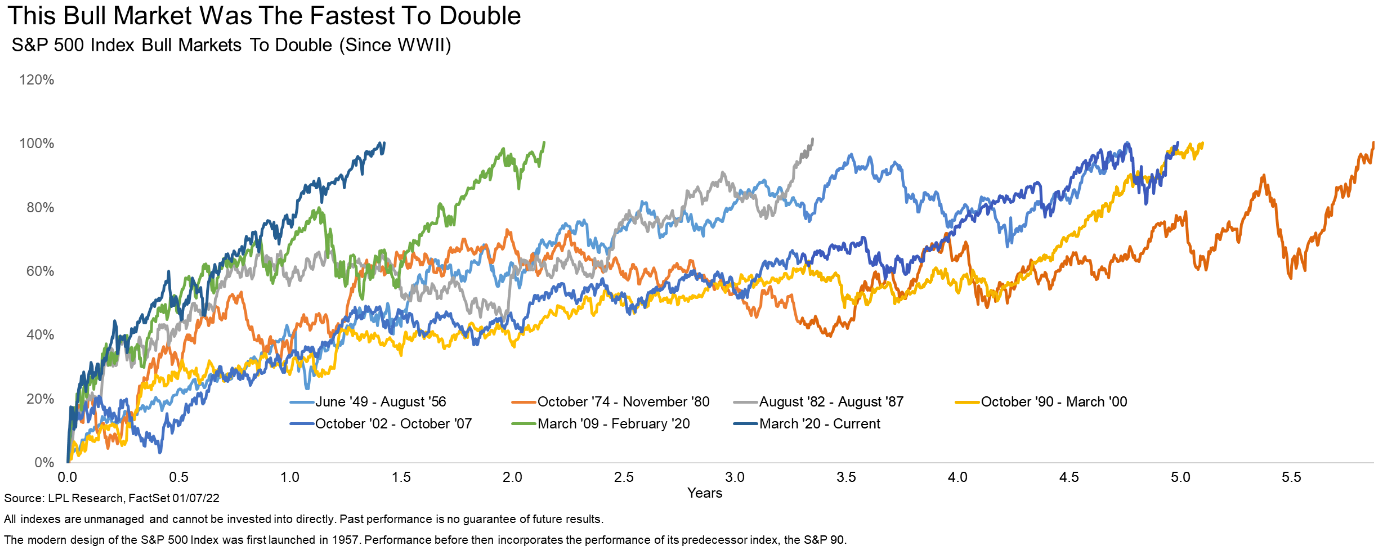

The bear market ended two years ago today and the subsequent bull market has clearly been an amazing ride. For some context, it was the fastest bull market to double ever, at just under 18 months.

Here’s where it ranks against the other bull markets that have doubled. You can see it is currently up 102%, making it the best bull market on its second birthday ever. 2009 was up 95%, coming in second.

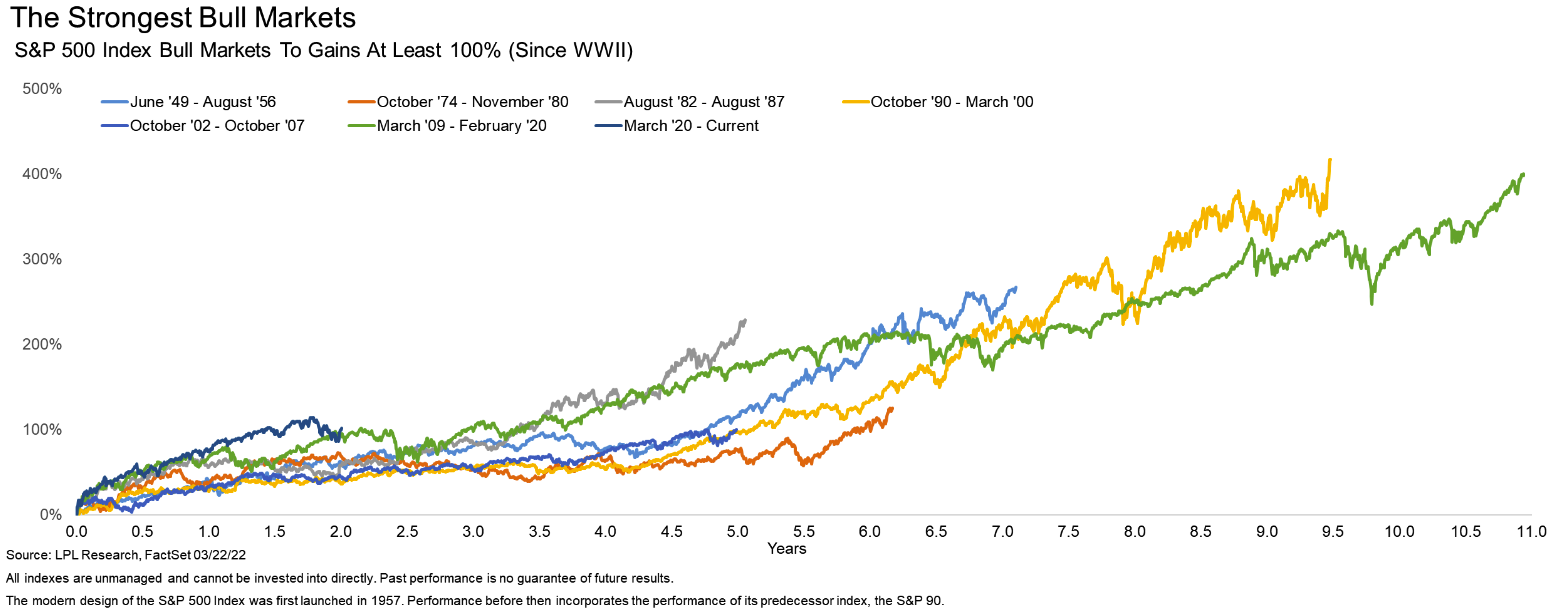

At the recent peak in early January, the S&P 500 Index was up 114%, making it the seventh bull market to double. The annualized return of 53.4% shows just how explosive this move was off the lows and does imply some type of break could be warranted.

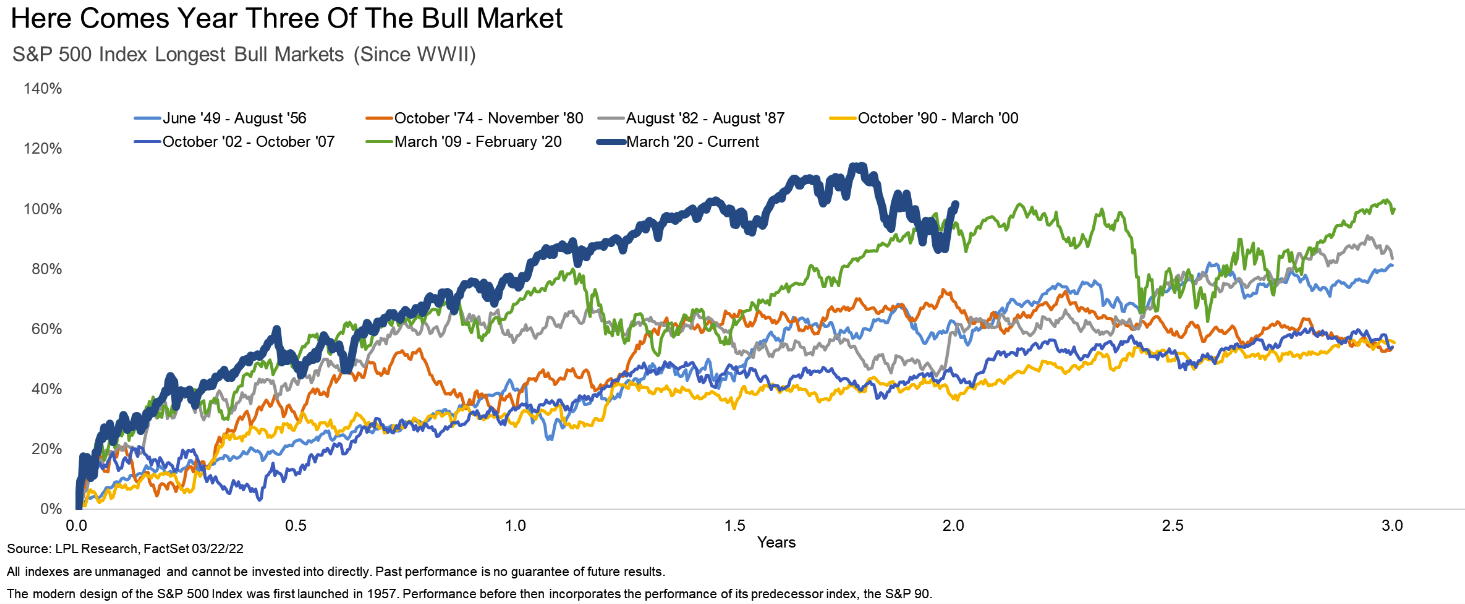

Here’s another way to look at this bull market as it starts year three. Previous strong bull markets saw modest gains and really spent much of the third year consolidating the previous big gains.

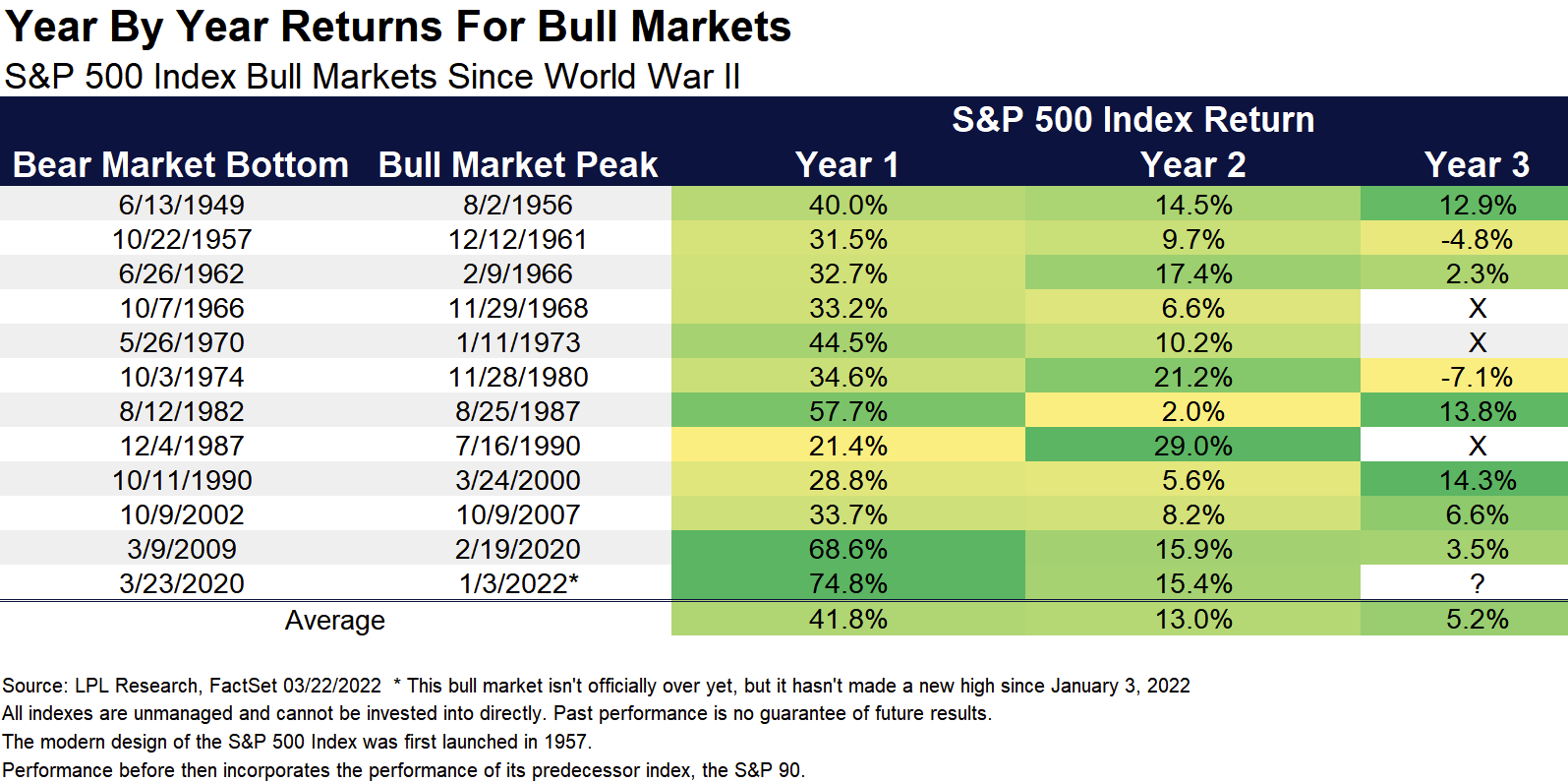

“As this bull market reaches the third year of life, investors need to remember that year three of bull markets tend to be a little tamer, with the larger gains happening in year one and two,” explained LPL Financial Chief Market Strategist Ryan Detrick. “In fact, out of the 11 bull markets since World War II, we found that three of them ended during year three, while the ones that didn’t end saw an average gain of only 5.2%.”

As shown in the LPL Chart of the Day, year three of bull markets have returned only 5.2% on average for the S&P 500, versus first year gains of 41.8% and second year gains of 12.8%, while three bull markets outright ended in year three.

We expect the bull market to continue, but some bumps in the road are normal. As the bull ages, year three could provide some of those bumps.

Ryan Detrick is chief market strategist for LPL Financial.