Few if any financial assets have the longevity and charisma of gold. The yellow metal sparkles in jewelry, is awarded to first-place finishers in athletic events and has played an important role in the world’s monetary affairs for millennia. It has long been viewed as a symbol of wealth, and it’s considered a so-called safe-haven asset during calamitous times.

The last point plays into gold’s reputation as being a store of value, yet gold isn’t immune to volatile price swings. Factors that affect the price of gold range from inflation and deflation to fluctuations in the U.S. dollar, interest rate movements and geopolitical turmoil, among other things. Think back to 2022, when the conflicting forces of the Russia-Ukraine war, soaring inflation, aggressive Federal Reserve interest rate hikes and a strong U.S. dollar took gold on a wild ride that gave it a strong start to the year before it plunged nearly 18% between early March and early November.

The precious metal rallied to finish the year with a 0.3% gain, in part because the dollar weakened in the fourth quarter, which benefited gold because it’s priced in dollars and a weaker dollar makes gold less expensive to buy. It also got a boost from strong gold demand from central banks, whose purchases offset outflows in exchange-traded funds holding physical gold. Gold’s small gain was a victory in a year when the S&P 500 sank 19% and the Bloomberg U.S. Aggregate Bond Index dropped 13%.

Astute market timers could have made a killing by correctly playing gold’s mood swings. But astute market timing is hard to do consistently for gold or any asset class, which is why gold advocates believe the metal should have a dedicated place in investment portfolios as a hedge against the vicissitudes of a fickle world.

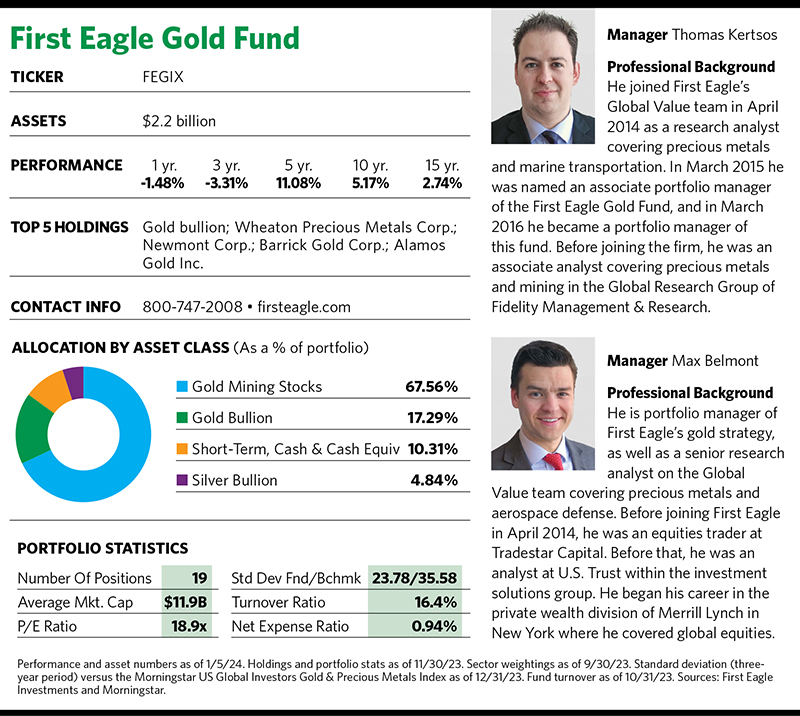

“We believe it’s important to have a strategic position in gold as a potential hedge against the unknowns,” says Thomas Kertsos, co-portfolio manager at the First Eagle Gold Fund. He stresses the importance of viewing gold as a strategic hedge rather than a speculation hedge.

First Eagle Investments, an investment management company in New York City, launched its gold fund in 1993. It sports an impressive long-term track record, including top-quartile performance in Morningstar’s equity precious metals category during every measurable period from one to 15 years (as of early January).

Kertsos has been a co-manager of the fund since 2016. His current partner, Max Belmont, came on board in 2021. When looking at the fund’s performance during Kertsos’s tenure, it’s clear that he has grabbed the baton from his predecessors and run with it. On an annualized basis the fund has been its category’s third best-performing fund during the past five years and the top fund during the past three years.

The Fed

The safe-haven angle is a big part of the First Eagle fund’s message. But what exactly is a safe-haven investment? Many people think of it as an asset that provides protection when stuff hits the fan and traditional financial assets—particularly equities—get clobbered.

Another way to frame it is that a safe-haven investment should retain its value over time so that it keeps up with inflation and provides ballast that enables investors to add risk to other parts of their portfolio.

Kertsos posits that the past 400 years of financial history has demonstrated gold’s ability to maintain its value in real terms during the biggest macroeconomic dislocations. “Gold has had big pullbacks in real terms, but historically it has shown that it comes back to its average long-term purchasing power.”

“Safe haven” sounds soothing and comforting, but sometimes that’s not enough to motivate thrill-seeking investors to add gold to their portfolios. That said, those folks might want to reconsider if the Federal Reserve follows through with its announced plans to begin lowering the federal funds target rate later this year.

That’s because Fed rate cuts weaken the dollar and produce lower real interest rates, which pushes up inflation. That’s a positive backdrop for gold.

According to Bloomberg data, bull markets in gold occurred after the Fed ended its past three rate hike cycles: Prices jumped 57% after rate hikes in 2000, rose 235% after 2006 and rose 69% after 2018.

“The Fed pivot is key for the structural outlook for the price of gold,” Kertsos says. Nonetheless, he cautions the Fed could pivot on its pivot and back off from its rate cut plans if inflation re-accelerates or if the economic momentum continues. That could create short-term volatility for gold prices.

Bullion Vs. Miners

What differentiates the First Eagle fund from competitors is its concentrated portfolio—it held 19 positions as of November 2023. “In general, competing funds often hold 50 to 60 securities,” Kertsos says.

The fund also differs from many of its competitors by holding a significant stake in physical gold. The top 10 holdings in a number of its top rivals are stocked with miners and don’t include bullion among their largest positions.

At the end of November, gold bullion was the First Eagle fund’s largest holding at 15% of its portfolio. “Traditionally, bullion has been between 15% and 23%. It’s now at the low end because we’re finding good valuations in specific miners,” Kertsos says.