In earlier times, human civilization lacked the communication networks, technology and institutions to effectively combat global pandemics. This is why the influenza pandemic of 1918 was so devastating. But we also know that human civilization is better positioned today than at any point in its history to deal with such crises. The World Health Organization (WHO), the United States Center for Disease Control (CDC), global health-care companies, world class research universities and many others are working in tandem to combat the virus. In fact, Gilead has already announced it will partner with the University of Nebraska to begin human trials on a new vaccine.

Market Impact

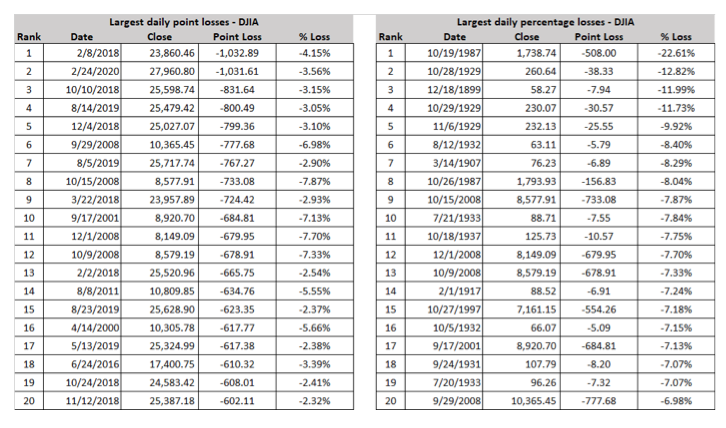

For most, a 1,000-point sell-off in the Dow Jones is alarming. Monday’s sell-off was the second largest point sell-off in the history of the Dow Jones Industrial Average. That sounds ominous. But while my intent is not to minimize the sell-off, it’s also important to note there was nothing historic about Monday’s decline in percentage terms. In fact, Monday’s decline doesn’t even rank among the top 20 market declines of all-time.

What Should Investors Do?

First, don’t panic. Clients should be careful not to make investment decisions based on hype or the unknown; investing is always about the future, which is fundamentally unknowable. And we know that investor returns suffer significantly when investors make long-term investments based on short-term information. Breathe.

Second, investors should remain globally diversified with a healthy allocation to high-quality fixed income. If investors feel the need to “do something,” they should rebalance their portfolios by selling bonds, buying stocks or putting idle cash to work. Further, given equity markets were already a bit frothy in terms of valuations, within equities investors would be wise to overweight value stocks, which tend to outperform growth stocks during market corrections. For example, the Russell 1000 Value declined 2.9% versus 3.7% for the Russell 1000 Growth on Monday.

Finally, investors should have a crisis plan in place before they need one. The worst time to draft a crisis plan is during a crisis. Investors would benefit from having a written, long-term financial plan in place that includes an action plan for how they’ll deal with market volatility. Such approaches might include a plan to rebalance your portfolio mid-cycle, reinvest dividends or delay large expenses. But regardless of the approach, the mere presence of having an action plan in place before its needed is often by itself enough to calm rattled nerves.

Donald A. Calcagni is chief investment officer at Mercer Advisors Inc.