Wage growth moving in the right direction

Another way to gauge the health of the job market is to consider wage growth. Recent wage growth has been disappointing, but there are real questions as to why that is. A recent Federal Reserve paper suggests that a big part of the reason is the retirement of highly paid baby boomers, even as millennials are being hired for good (but entry-level) jobs. At least part of slow wage growth appears to be due to that demographic shift, and not to a weak labor market.

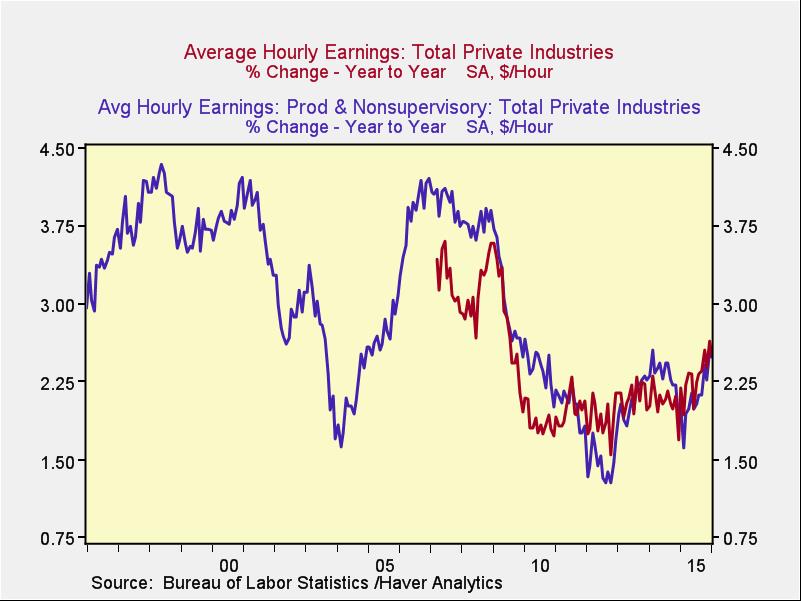

Instead of just looking at recent numbers, which is what most reports do, a better way to analyze wage growth is to look at it over time. This chart combines two data series, each with weaknesses.

The blue line covers production and nonsupervisory workers, which is only a subset of the workforce (and a shrinking one, as the economy shifts away from manufacturing). It does have a longer history, however, and suggests that wage growth is approaching (but has not yet hit) the levels of the 1990s. In any case, this metric is moving in the right direction.

The red line, which covers all workers at private companies, has a shorter history, so we can’t use it to compare directly with the 1990s. But the consistency with the blue line suggests that even the more inclusive numbers are also moving in the right direction and approaching the levels of the mid-1990s and mid-2000s.

Another point to take from this chart is that when wage growth starts—in, say, 1995 or 2004—it tends to do so from a level close to where we are right now, and it tends to be rapid. We saw exactly that kind of growth from 2012 through 2014, and we may be seeing a resumption after a pullback caused by the slowdown in 2014–2015. This chart suggests that, while wage growth is not yet at peak levels, it is reasonably consistent with the early stages of a boom.

All signs point to a boom

As job growth continues strong, layoffs are at extreme lows, and even wage growth shows behavior consistent with the early stages of a boom, it is getting harder and harder not to characterize it as such. There are still headwinds, to be sure, but I'm going to be using fewer and fewer qualifiers—and the day when I drop them entirely will probably come sooner than you might expect.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by McMillan.