Over a ten-year time period, those who own overpriced securities, as a group, “turn out the light” on any ability to beat the market average or earn the index return. Microsoft is just now getting back to its high of early 2000. Cisco is around $31 per share and has to go up more than 2.5 times to get back to the old high. Lucent went down and out before getting acquired in what looked like a “take-under.” Sun Microsystems got taken under at a few dollars per share (crushing what was a $100 stock) and EMC is going private at a price one third of the highs of the tech bubble. The S&P 500 Index has gain over 114% since the beginning of 2000. Please “don’t try to save me” by using the argument that it is different this time!

We believe the spread between the cheapest and the most expensive common shares needs examination because it appears like it is the highest since 1999. When it comes to historical situations like this (the Nifty-Fifty stocks of 1972, the Dow Jones Industrial Average in the summer of 1987 and 1999’s tech bubble), risks are very high for both the owners of these expensive securities and the passive indexes are loaded with them by mandate.

“I’ve been stranded in the combat zone

I walked through Bedford Stuy alone

Even rode my motorcycle in the rain

And you told me not to drive

But I made it home alive

So you said that only proves that I’m insane”

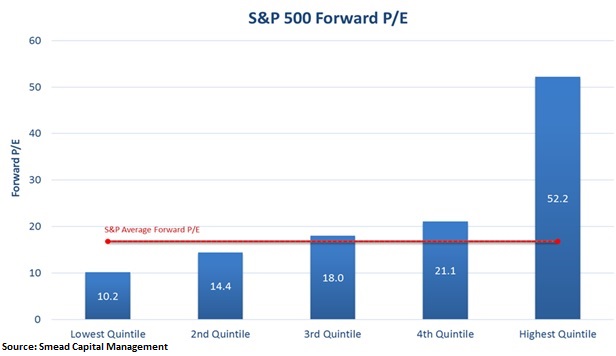

We dug into today’s S&P 500 and found a stunning disparity between the most expensive 100 stocks, the index average and the cheapest stocks in the index. To remain conservative in our examination, we avoided companies with negative earnings in the calculation and chose to equally weight the stocks. If this was done by market cap, the chart would be even more striking:

It is no wonder that we have felt like we are “stranded in a combat zone” in the stock market. Money moving into passive indexes is systematically buying drastically more of the most expensive stocks and the lack of liquidity exacerbated by an increasingly narrow market causes value managers like us to feel like we are “walking through Bedford Stuy alone.” As investors who lived through the 1999 episode, it reminds us how we can “make it home alive.” Why is the spread so immense and what could change in the stock market to see the playing field gravitate to the mean and take us back to more historical norms?

“Remember how I found you there

Alone in your electric chair

I told you dirty jokes until you smiled

You were lonely for a man

I said take me as I am

‘Cause you might enjoy some madness for a while”

The reason why academic studies on valuation agree is as simple as a truism from an old proverb; “a bird in the hand is worth two in the bush.” When investors get overly excited about technology stocks or the Nifty-Fifty in 1972 or Blue Chips in 1987, like we believe they are today, it looks like they are spending time in the “electric chair” with a “dirty joke smile.” Ben Inker, of Grantham Mayo Van Otterloo, shared the academic theory we think is connected to the current mania for tech stocks, including companies which might or might not have earnings coming far out into the future. Inker explained that the historically low interest rates have driven investors to extend the duration of their stock investments in the same way investors have extended duration in the bond market:

“Over the last six or seven years, most financial assets have done very well. The performance divide has not been between low-risk assets and high-risk assets or between liquid assets and illiquid assets, but between long-duration assets and short-duration assets. Long-duration assets such as stocks, bonds, real estate, and private equity have benefitted from a large fall in the discount rate associated with their cash flows, while short-duration assets have been hurt by the same fall. Investors tend to tilt their portfolios in favor of those assets that have done well. Today that pushes them to be increasing effective duration in their portfolios, right when the potential returns to those assets have dropped.”[ii]

For us, Inker goes on to explain that the bird in the hand has been left for dead by the two in the bush and it takes way longer to get to the bush than it did when interest rates were higher.

“Now think of all the years you tried to

Find someone to satisfy you

I might be as crazy as you say

If I’m crazy then it’s true

That it’s all because of you

And you wouldn’t want me any other way”