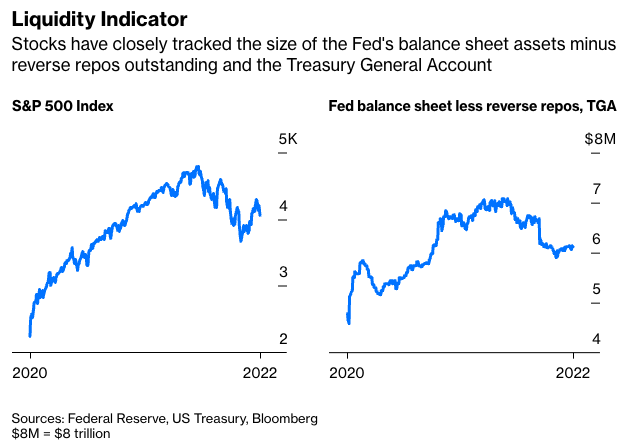

By combining the size of the Fed’s balance sheet with the amount of reverse repos outstanding and the TGA balance, we can create a liquidity indicator that better explains movements in stock prices than just the Fed’s balance sheet alone.

There is worry about the scheduled increase in QT could have on stock prices, but the unique situation with the large reverse repo balance could mute any potential affect. If the Fed had securities on its balance sheet that matched the maturity profile demanded by the institutions engaging in reverse repos, it could sell an amount equal to the total reverse repo balance to these institutions, reducing the need for reverse repos and elicit no change in the financial or real economy. Though there might be a duration mismatch in the type of assets demanded, an actual withdrawal of liquidity is not the problem.

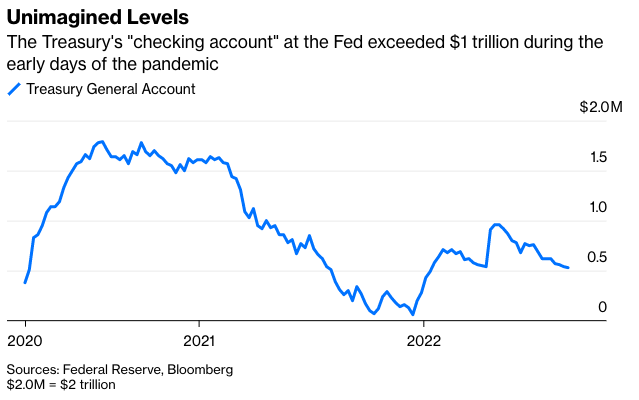

On top of that, the actual amount of monthly QT is not that large. Given that the reverse repo balance is $2.18 trillion, and the Fed is scheduled to reduce its balance sheet by $95 billion per month, it would take almost two years to work off reverse repos solely though QT. Plus, the variability of the TGA balance shows that the economy can handle the scheduled liquidity withdrawal. From the end of November 2021 to April 2022, the TGA increased by $816 billion. That was equivalent to a QT of $163 billion per month, far below the scheduled and well-telegraphed increase next month.

Although throughout history there have been a few times when central banks had successfully reduced their balance sheets assets, this is an unusual time. The extraordinarily large reverse repo balance shows the true extent of the extra liquidity in the financial system. So as QT unfolds, it will be important to watch whether the reverse repo balance declines and how fast. The QT numbers appear large, but when compared to the fluctuations from the TGA account and the reverse repos, the scheduled increase is rather tame.

Kevin Muir is a former institutional equity derivative trader who now writes the MacroTourist newsletter.

The Fed Is About To Go Full Throttle On QT. Fear Not.

August 31, 2022

« Previous Article

| Next Article »

Login in order to post a comment