Higher risk assets are sending a concerning message to the Federal Reserve: the central bank either needs to move more quickly and aggressively to tighten monetary policy, or the fallout from impending interest-rate increases will get even worse. As troubling as that sounds, consider that either way it’s looking less likely that the world’s most important central bank will be able to keep the economy from a dreaded hard landing.

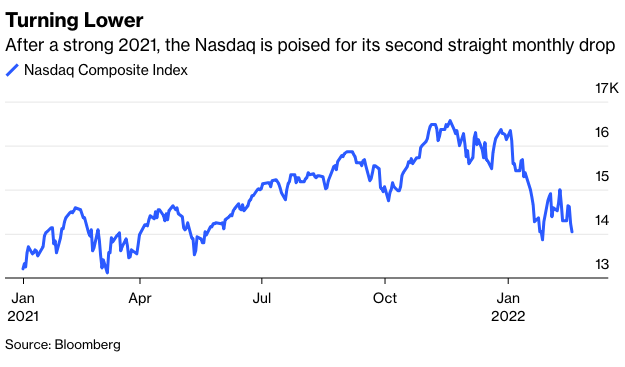

Rates traders have now priced in six rate hikes from the Fed before year-end. U.S. stocks have had a bumpy ride, with the once highflying Nasdaq Composite Index down 15.6% from its high in November. Such well-known companies as Netflix Inc., Meta Platforms Inc. and Zoom Video Communications Inc. have fallen even harder, dropping some 40% or more over the past three months.

Corporate bonds have now started to sell off, with yields on U.S. investment-grade bonds rising to the highest since July 2020 relative to those on U.S. Treasuries. The good news—at least for now—is that speculative grade companies are having little trouble borrowing despite six straight weeks of outflows from high-yield, high-risk funds. This suggests that bond investors are not staging a “buyer’s strike” that would threaten to bring the all-important credit markets to a standstill.

U.S. government debt, though, rallied last week amid a buildup of troops by Russia along the border with Ukraine. Yields declined and the number of expected rate hikes eased a bit even though the escalating conflict stands to support recent inflationary trends. That’s because any altercation would likely interrupt oil supplies, making a tight European energy market even tighter and sending crude prices higher globally. To be clear, such a scenario would not encourage the Fed to hold off on raising rates; quite the opposite.

At the same time, inflation data have come in surprisingly hot. After the most recent consumer price index report showed a 7.5% rise in January from a year earlier, last week’s producer price index reading also surprised to the upside, jumping 9.7% versus the expected 9.1% increase. Although consumer sentiment has deteriorated, Americans are still spending money at a torrid pace, as evidenced by the surprisingly robust January retail sales numbers and earnings from Gucci owner Kering SA to Walmart Inc. Housing rents are surging, and demand to buy homes still outstrips supply, despite the fact that mortgage rates have risen to the highest since 2019.

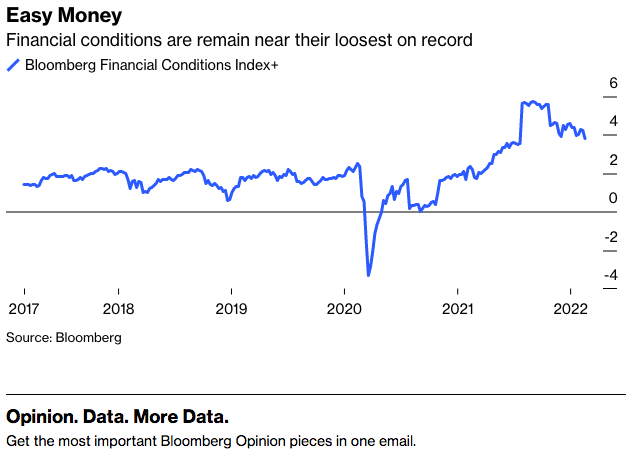

In a nutshell, financial conditions haven’t tightened enough to curb inflation. And it’s unlikely credit-market rates that are still far below historic averages and the current selloff in stocks are enough to restrain consumer demand and corporate activity in the coming months.