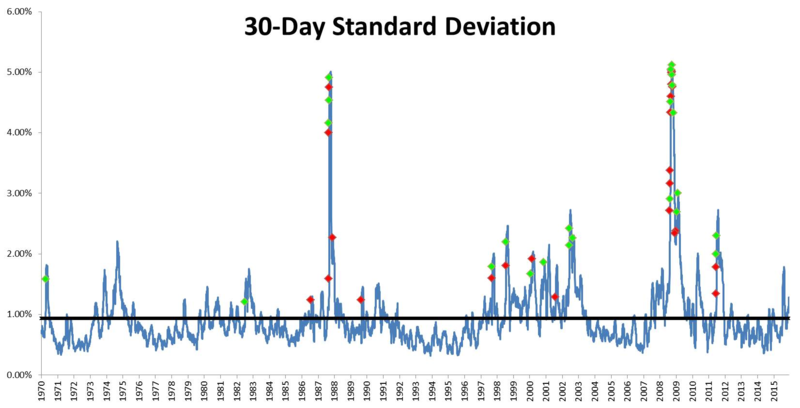

• Clustering: Perhaps the biggest challenge is that the best and worst days tend to come close in time. The reason for this is that big selloffs or huge rallies lead to wildly overbought or oversold conditions. The rubber band gets stretched too far and has to snap back.Given the relative proximity these big days have on the historical timeline (see below), and how often these occur back to back, there is little room for error. Getting most but not all of the timing right could lead to missing the big recovery or getting caught in a damaging selloff. That has the potential to seriously impact returns.

If you master all of that, you're one-tenth of the way to success at market timing. The rest is luck. Many of the best timers in history were undone when their luck ran out; Joe Granville is one of the best examples of that. Of course "luck" is an unscientific construct. To be precise: There is a strong degree of randomness that makes timing such a challenging strategy.

This column was provided by Bloomberg News.

25 Best and Worst Days Tend to Cluster Together

Source: Michael Batnick, Ritholtz Wealth Management

The Fickle Fortunes Of Market Timing

September 8, 2017

« Previous Article

| Next Article »

Login in order to post a comment