The Football Remains Unkicked

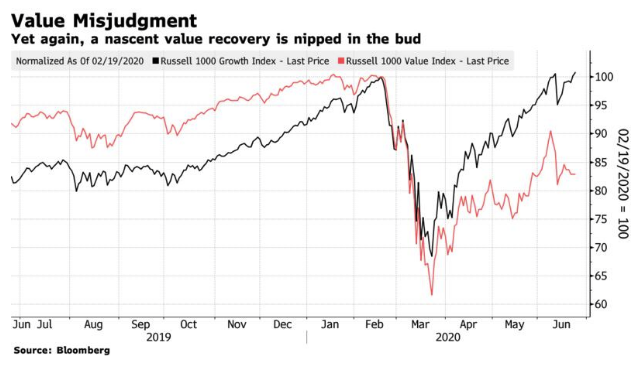

Charlie Brown is flat on his back once more. At the end of last month, you may remember I wrote a newsletter rather nervously arguing that it was time for value (buying stocks which look cheap compared to their fundamentals) to start beating growth companies (chosen for their rising earnings), after a losing streak that had lasted more than a decade.

Since then, as recorded by the Russell indexes, value stocks have taken a leg back down again, while the growth stocks in the Russell 1000 index of large U.S. companies hit a new all-time high Tuesday:

Since then, as recorded by the Russell indexes, value stocks have taken a leg back down again, while the growth stocks in the Russell 1000 index of large U.S. companies hit a new all-time high Tuesday:

To put this into further more startling historical context, we need to make comparisons with 2000, the year when arguably the greatest-ever growth rally peaked. Growth is doing even better relative to value than it did then:

The risk that growth stocks will tank as they did in the latter part of 2000 remains very real. It hasn’t happened yet. And this should be a matter of some concern. The widening of the market, with the brief strong performance of value, suggested genuine confidence in a broad economic recovery. In such conditions, cheap companies that might have appeared risky are able to survive and flourish, while growth is in broader supply so the companies with growing earnings do not stand out as much. Growth and tech stocks may have hit all-time highs again, but this has come against a background of falling real yields, higher gold prices, and a narrowing market. These are all signs of lower confidence.

For another comparison with 2000, look at the performance of the S&P 500 information technology sector compared to the rest of the S&P 500. At the beginning of 2000, tech was nearing the end of a historic bull run. But as of Tuesday, the tech sector is beating the rest of the S&P 500 for the millennium so far. This is the first time this has been true in more than 19 years:

Of course the technology sector has changed a lot in the last two decades, even if Microsoft Corp. remains one of the biggest names. The dominance of a small group of internet platform companies is a relatively recent one, and it has been critical to the overall performance of the market. Neither Amazon.com Inc. nor Netflix Inc. are technically classified as information technology companies but tend to perform in line with fellow “Fang” companies such as Apple Inc., Facebook Inc. and Google’s holding company Alphabet Inc.