Consider this proposition: your wealthy clients own twice as much as you think. Three recent studies cited below validate this assertion. Their liquid assets (the stocks, bonds and cash advisors tend to focus on) represent less than half (45 percent) of a typical millionaire’s portfolio. The other 55 percent consists of illiquid assets such as real estate, stock in privately owned companies, artwork etcetera.

It takes specialized skills to preserve the value of illiquid assets, skills their owners often lack. Most owners need help, and know it: they are more apt to worry about their illiquid assets than, say, mutual funds. Yet most advisors offer no help: when it comes to this half of the portfolio, their clients hear nothing but crickets.

Advisors routinely ignore this “hidden half.” This article explains why advisors should take illiquid assets more seriously; and suggests how even advisors with limited illiquid asset experience can add value.

More Important Than Liquid Assets

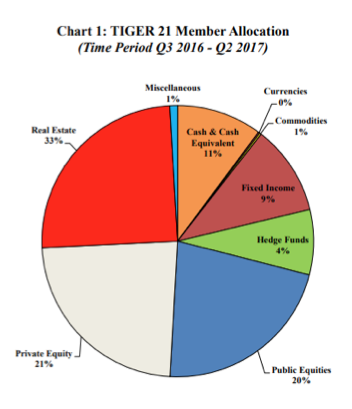

Some recent studies document the importance of illiquid assets. TIGER 21 is an association with over 500 extremely wealthy members, who collectively manage more than $50 billion in personal assets. Each member is required to present his or her personal investment portfolio annually. The association publishes quarterly reports detailing the holdings, which form a fascinating insight into how ultra-affluent families invest their money. The TIGER 21 Member Allocation Report details how in Q3 2017 55 percent of the TIGER 21 household investments were in illiquid assets; just 45 percent consisted of liquid assets.