Of course, it’s not all about the measurement, and it’s important to note how clients engage with the process and the tools. Firms that engage in end-user testing know that investors relate to managing towards short-term micro goals and seeing the impact of daily activities. Suggesting that an investor track themselves against a goal with a 30-year time horizon is too amorphous. Rather, a broader goals-based approach lets an advisor focus on smaller short-term goals to demonstrate “wins” along the way, such as fully funding a 529 plan or making that last mortgage payment. This approach provides opportunities for celebration and achievement as investors move towards their ultimate goals.

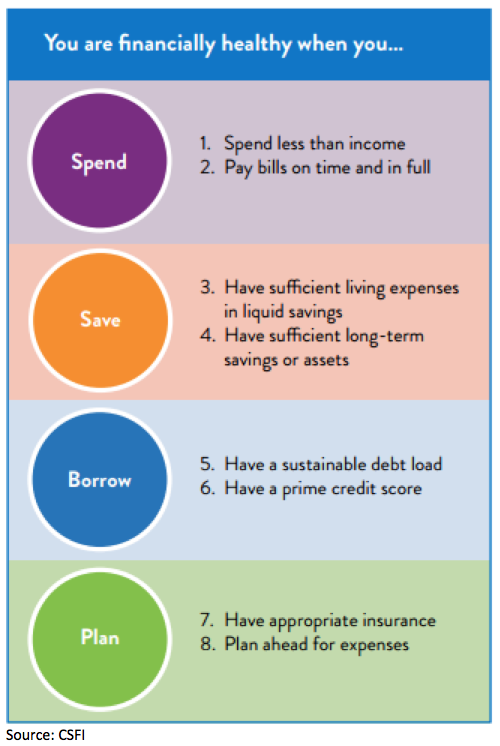

Another observation is that too many advisors focus only on investable assets. Many consumers struggle with daily goals and budgeting, which may prevent them from meeting their longer-term finance goals. The Center for Financial Services and Innovation (CFSI) has created a framework to expand this conversation that includes four components and eight indicators of financial health. The eight indicators focus both on outcomes and behaviors. Outcomes tend to be more stable or static, while behaviors tend to fluctuate more over time. It is important to monitor the fluidity of both to get a full picture of a client’s financial health within the context of their risk and ultimate financial goals.