Organic growth is when wealth managers bring in new business from current clients or source new clients. While organic growth is essential to the long-term success of wealth management practices, it is relatively rare. Finding new clients is a very or extremely important concern for 79.3% of wealth managers, according to a survey of 421 of them. For long-term success, wealth managers and senior executives at wealth management firms must foster organic growth.

Finding ‘Ideal’ Clients

Wealth managers often talk about “ideal” clients, the types of clients they prefer to work with. Usually, a wealth manager’s “ideal” clients tend to be what they consider to be a great fit for their practice and are often relatively wealthier than their average clients.

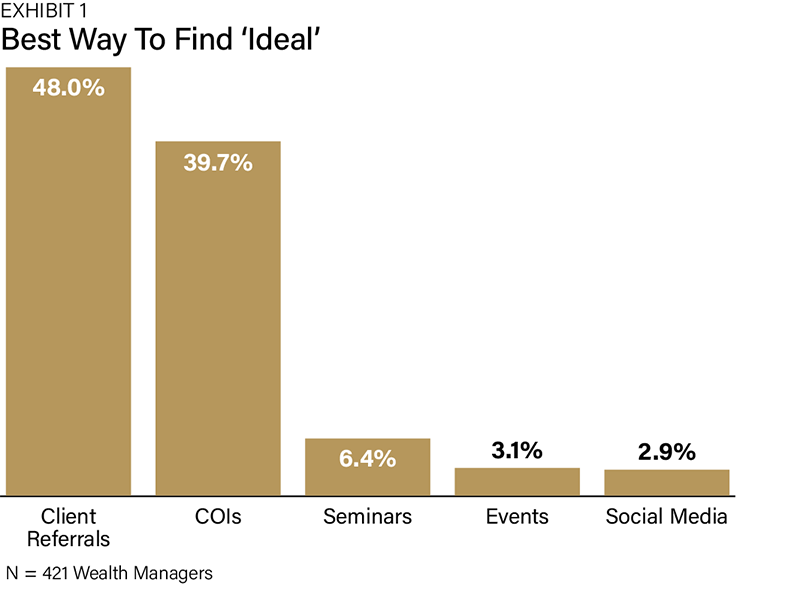

Almost half of the wealth managers surveyed find their ideal clients from client referrals (Exhibit 1). About two in five say it is from centers of influence referrals, such as accountants and lawyers. And the remaining approaches are much less meaningful.

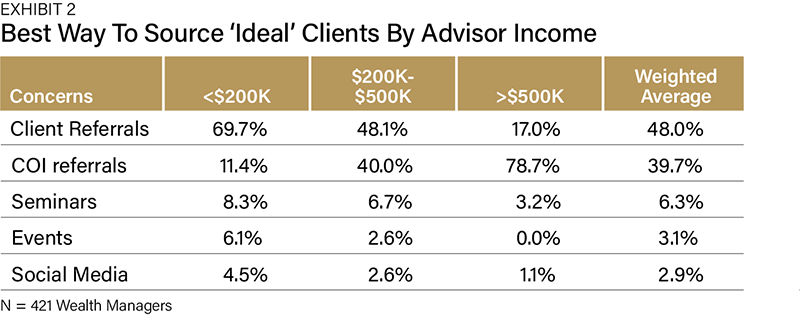

More insight is provided when wealth managers are segmented by income (Exhibit 2). We see that the income of wealth managers who get ideal clients from client referrals is significantly less than those who get them from centers of influence. There is a direct correlation between the income of a wealth manager and how they find their ideal clients. We can determine that the most effective way for wealth managers to source wealthy and ultra-wealthy clients is through referrals from accountants, attorneys and other well-connected and influential individuals.

Depending on the nature, including the wealth level of a wealth manager’s ideal clients, referrals are the most effective way to source them. However, as the wealth levels increase, the importance of client referrals diminishes while the value of referrals from centers of influence increases.

The Best Five Clients

Digging deeper into how wealth managers source their best clients, the answer is centers of influence. By best clients, we refer to their most profitable and significant clients. Commonly, these clients are one or, more likely, two standard deviations away from their usual clients.

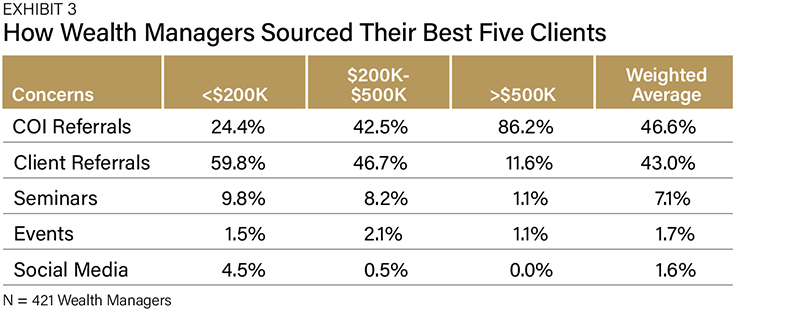

In a forced choice research scenario, a little more than 40% of wealth managers got their five best clients through referrals from other clients (Exhibit 3). Somewhat more wealth managers found their five best clients from centers of influence: other professionals such as accountants and attorneys.

The more successful the wealth managers are, based on annual income, the more likely their best clients come from centers of influence. For almost all wealth managers, most of their clients and their best clients come from referrals. When the aim is to work with the wealthy and, more so, the very wealthy, the best sources are centers of influence referrals.

Referrals Of ‘Ideal’ Clients From Centers Of Influence

These findings are unsurprising to most wealth managers, especially the more accomplished ones. Experience shows them the value of client and center of influence referrals. Moreover, it is widely known that referrals from other professionals can be extremely powerful and are more likely to be of higher quality with more significant wealth management needs and wants.

The complication is that most wealth managers are “waiting for the phone to ring” regarding client referrals. They are doing the best job with clients they can, and because of their efforts, a client refers them to a peer sooner or later. This approach works, but it is highly inefficient. There are well-established methodologies wealth managers can use to accelerate client referrals, but few do so.

The situation is worse regarding the center of influence referrals, as few wealth managers are proficient in getting introductions. While many wealth managers might get a referral now and again, enormous opportunities are being missed. However, there are processes wealth managers can employ to build a steady stream of ideal clients from centers of influence. The complication is that these processes require diligence and persistence. Patience is also necessary, as it takes time to win the trust and confidence of other professionals.

Organic growth is predicated primarily on client and center-of-influence referrals. The answer for wealth managers who want to work with wealthier clients is referrals from centers of influence. The good news is that there are proven methodologies to generate more ideal clients through referrals. Consequently, it is up to wealth managers to apply these processes, and those that do will excel.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.