Key Points

1. We see room for a further recovery in emerging market (EM) assets, particularly equities, after an unexpectedly prolonged selloff.

2. The Fed raised rates last week, and Italy released a draft budget that was more expansionary than expected. Brent crude hit a four-year high.

3. Polls suggest Brazil’s election on Sunday will result in a second round with two far-from-center candidates. Local assets look set for volatility.

The prospects For Emerging Markets

We see room for last week’s EM recovery to persist, especially in equities. The rebound came after an unexpectedly persistent selloff in EM assets this year, despite a solid near-term global growth outlook. Country-specific shocks and tightening global financial conditions have pressured EMs with the greatest external vulnerabilities. Yet we do not see the EM swoon as a broader threat to global markets.

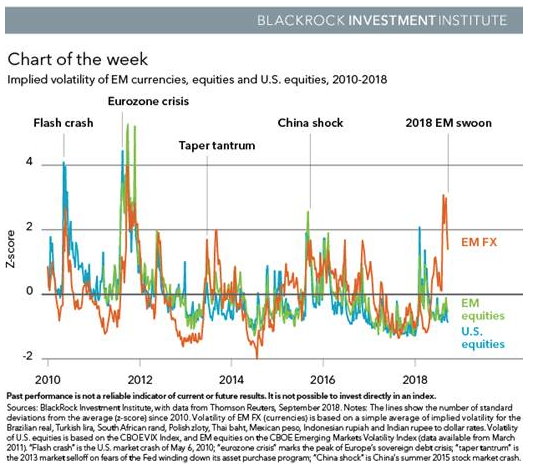

EM currencies have borne the brunt of the recent selloff. Volatility in EM currencies recently spiked to higher levels than the 2013 "taper tantrum" — when then Federal Reserve Chair Ben Bernanke signaled the beginning of the end of new central bank asset purchases. See the orange line above. Yet volatility in other asset classes has remained more muted, both in EMs and developed markets, as the chart shows. Currencies have also shown some signs of stabilization, with emergency rate hikes in Turkey stemming a sharp selloff in the lira. We see this as a positive sign for EM assets overall.

A Canary In The Coalmine?

This year’s EM troubles stem from a potent cocktail of negatives. Catalysts include country-specific factors (Turkey’s credit-fueled growth running out of steam; Argentina’s policy missteps); worsening trade tensions; a crowded EM election calendar; and moderately tighter global financial conditions. Higher U.S. interest rates are adding to the EM stress by creating competition for capital and leading investors to reset their return expectations for riskier assets, especially EM assets and equities. The biggest casualties: currencies of EM economies with the largest current account deficits and highest external debt burdens. Countries with surpluses, such as South Korea and Thailand, have largely been spared a currency crunch.