It's the CEOs job to align the vision, strategic directives and goals to move their companies along their intended path. That means they must create a business vision and strategic directives for their firms over the next three to five years. The goals must be specific and their success measurable; they must also be realistic, with defined deadlines.

Although most advisors find tracking clients' financials as natural as breathing, the instinct does not kick in when it comes to monitoring their own. The business plan also needs to focus on financial projections for the firm.

Among the quantitative, financial components of this plan are the revenue forecast, which includes, at a minimum, a review of client segments, products and fees, and anticipated expenses and budget tracking throughout the year. While all firms should address profit and operating margins, in reality, the larger the firm, the more likely it is to track gross profit and operating profit margins, as well as productivity ratios such as households and household revenue per advisor. Margin and productivity analyses are used to assess the firm and how well it is managed. The sophisticated firm must also identify a formal benchmark it can use to compare itself against companies of similar size.

In the past, financial advisory entrepreneurs didn't require as much business acumen as they will in the future. With the trend toward ensemble organizations, more business models and stronger competition, advisors must make more conscientious decisions about both the quality and the quantity of their business.

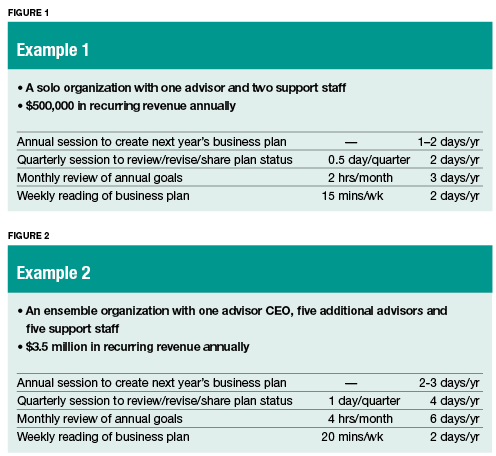

For a firm's plan to be useful, it has to be used. A simple formula for putting a business plan into action is to read it every week, to assess the performance on articulated goals every month, to communicate the status to the entire firm every quarter and to pursue the planning process anew every year.

The Corporate Culture

Another job for the CEO-one whose success is hardest to measure-is to create the firm's corporate culture. Though this concept is "touchy-feely" to some people, it cannot be ignored.

Think of words that describe different organizations you've encountered: "professional," "stuffy," "casual," "fun," "flat," "structured," "formal," "laid back." Every firm develops a culture whether or not the CEO plans it, but it is his or her responsibility to harness that culture to help the firm achieve its business plan. Culture is part of the organizational glue, something hard to put into words for employees, but something they contribute to.

Other Roles

CEOs wear other hats, too, especially in smaller firms. They may act as the HR manager, focusing on hiring, job descriptions, performance reviews and employee handbooks. Or they could be operations managers, attending to efficient processes, policies and technology. They could act as marketing managers or as sales managers, motivating, training or tracking advisor activity. While these are important roles that an advisor plays, they are not central to the CEO's job.

Many advisors will declare that they don't have time to be a CEO. In fact, at most small financial advisory firms, the idea of a full-time CEO is ridiculous, since the advisor would only wear the hat some of the time. But how much time is that?

If we acknowledge that creating and using a business plan are essential tasks of the CEO, how much time do they realistically require?