Nonfarm payrolls rose at a moderately strong pace in the initial estimate for September, a bit less than expected, but well within the usual range of uncertainty. The pace of job growth appears to have slowed this year, but we’re still adding jobs beyond a long-term sustainable pace.

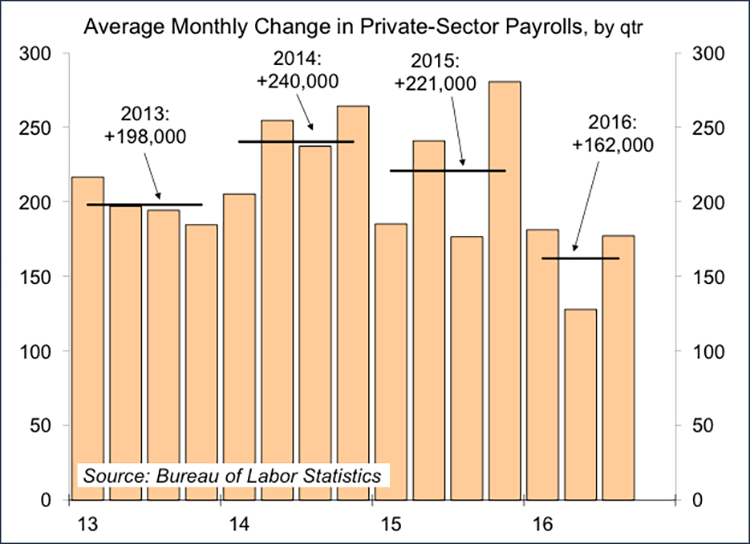

With the start of the school year and the end of the summer travel period, seasonality is a major issue in September. One should take the reported the data with a grain of salt. That said, the nonfarm payroll figure (+156,000) was not far off the mark. The impact of noisy data can be reduced by looking at averages. Payroll gains were moderately strong in 3Q16, slower than last year, but we only need about 100,000 per month to be consistent with population growth.

The mild uptick in the unemployment rate (to 5.0%) reflected an increase in labor force participation. There is a long-term downtrend in participation, but we may have recovered much of the cyclical decline, at least for the key age cohort (25-54 yrs.).

.png)

Average hourly earnings rose 2.6% from a year ago, still moderate by historical standards, but better than in recent years. Wage gains have varied across industries.

.png)

While nominal wage growth has picked up, energy prices have stopped falling, leaving a smaller year-over-year gain in real earnings (and less firepower for consumer spending growth).

.png)

Fed officials will look at these data, but each may come away with a different conclusion. The job market is getting tighter, but the pace of improvement appears to have slowed relative to the last couple of years. Slower job growth may be due to tighter labor market conditions. If so, wage growth ought to be picking up. Average hourly earnings are rising at a faster pace relative to the last couple of years (2% per year in 2014 and 2015), but that’s still moderate by historical standards.

Two more job reports arrive before the mid-December Fed policy meeting. We should see evidence of further tightening, but improvement that is not too rapid, consistent with another modest removal of policy accommodation. Of course, there are a lot of other things for the Fed to worry about.

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.