The market sell-off that started last week has made investors nervous. A quick skim of the headlines reflects fears that the bull market is over and that this is more than a mere blip. Futures suggest there will be more red on screens today.

It is too early to definitely declare this the start of a correction (a 10 percent decline that quickly reverses) or the end of the bull market. But rather than rely on gut instinct, we should instead look at the data to help us understand the details of this rally. It is as a good time as any to discuss how market tops and bottoms are made, and why they tend to be such different events.

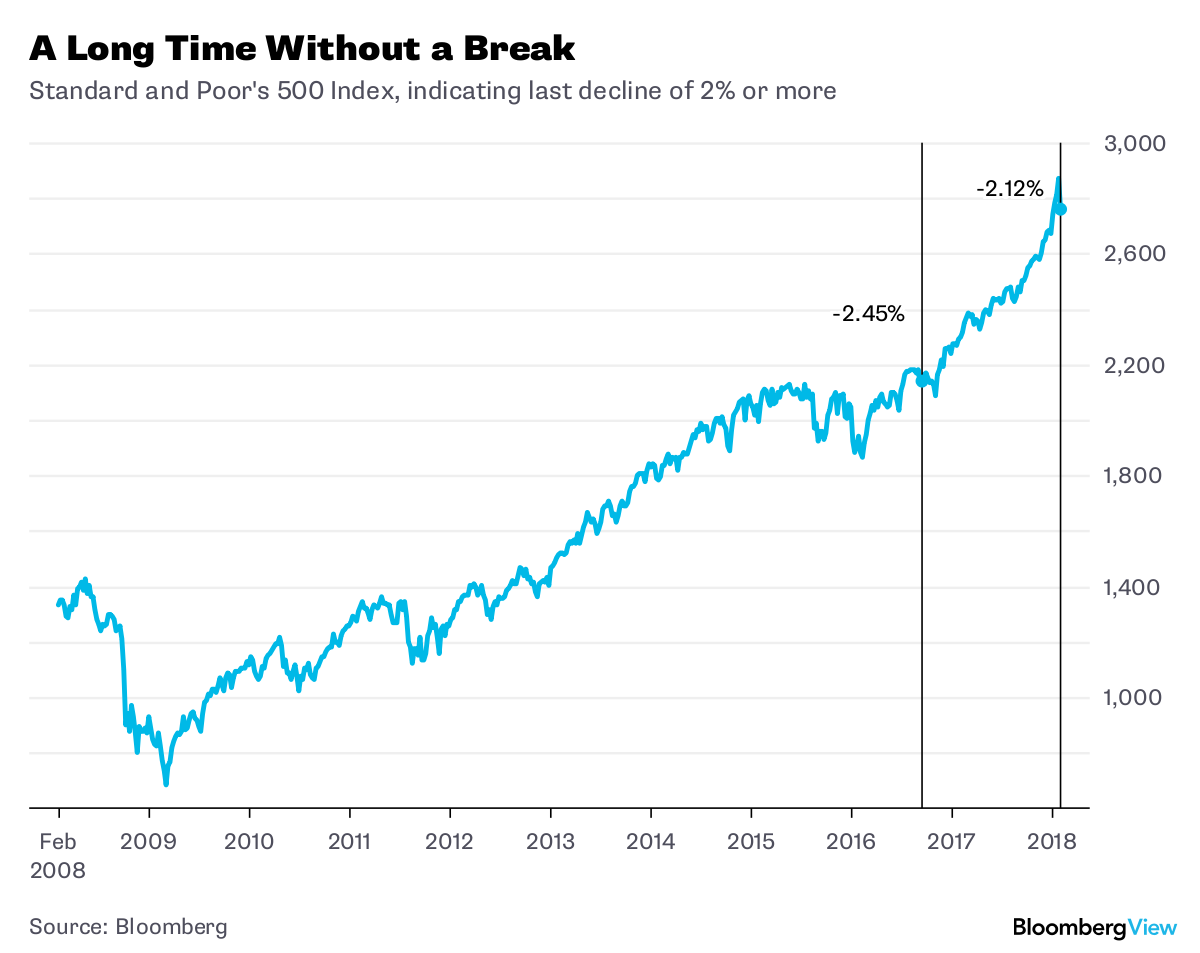

Let’s begin with a few stunning data points: before last week, the Standard & Poor's 500 Index had gone 112 trading days without closing down 1 percent in a single day. That is the longest such streak in more than three decades.

The S&P 500 hasn’t had a two-day 2 percent decline since September 2016. That was 349 days before the most recent prior fall. Similarly, U.S. markets haven't seen a streak that long without a 2 percent decline in more than three decades.

What does this have to do with tops and bottoms? In a word: psychology. The turning points in markets reflect very different investor emotional states. It is the classic tale of fear and greed. This manifests itself thusly: Tops are a process, while bottoms are an event.

Pardon my narrative explanation, but I find it the best way to explain this mindset.

Think about investor psychology during bull markets. Sales of shares turn out to be a mistake. Dips should be bought, as selloffs eventually recover and are surpassed. The muscle memory of buying gets strengthened. Bull markets tend to run further and go on for longer than most people expect.

What happens in the late innings of a bull run is that people take it for granted and almost lose interest. Gains become de rigueur, and we adapt to them as our frame of reference. Elie Wiesel once said, “The opposite of love is not hate; it's indifference.” That is certainly true for investors.

Tops are a long process, involving not so much selling, as a gradual reallocation of capital toward other assets. The enthusiasm fueling further gains starts to slowly fade. Greed gets replaced with something much less amorous -- complacency and inaction.