“Nothing is more dangerous than an idea when it is the only one we have.” – Alain, 1868-1951, French philosopher

The word encore is a French word, meaning “again, some more.” We typically think of it as coming after a concert is over, where the band returns from backstage to play some of the most crowd-pleasing hits. As the stage temporarily goes dark, the band is encouraged by the masses to reemerge through their loud applause, cheering and chanting. When new to the American scene, the spontaneity of this phenomenon would often result in multiple encores for an unrelenting crowd.

The stock market has put on quite a show over the last decade. Including dividends, domestic stocks have nearly quadrupled since the bottom in March 2009. Most of the crowd missed the best parts of the broader show, but that hasn’t stopped the excitement being built around the encore. It is typically the most exciting part of the show and we’ve all learned these tunes before. Even so, as the hit songs may fill the air, the contemplative part of the market is debating what future market leadership may look like.

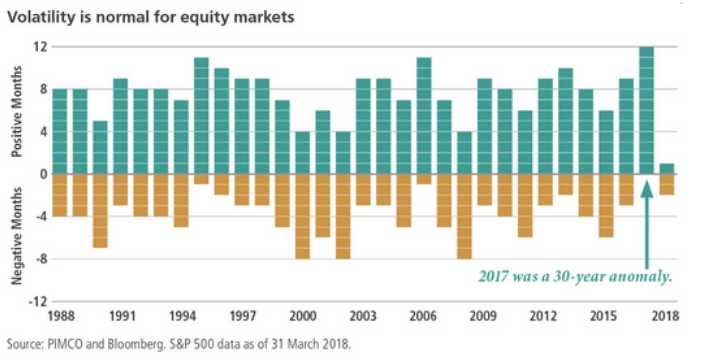

As the French philosopher Alain points out above, nothing is more dangerous than a market operating exclusively on only one or maybe two ideas, which it has increasingly been doing. We see ample evidence that current market leadership is getting tired. We’ve highlighted the market’s narrowness in our recent writings, and we know we are at the tail end of the longest period where “growth” stocks have beaten “value” since 1929, doing so by the widest margin ever. The complacency that has been bred by low volatility has only recently been shaken, but only back up to historical norms for equity markets:

The challenge of a complacent one-direction market can be seen in the lack of sector outperformance persistency:

These hints of a leadership change are being offered at an opportune time for value investors. The chart below should look downright scary when considering that today’s levels of gorging on growth has not been seen since the tech-boom of the late ‘90s that gave us a herculean blow-off top.