A burden for many, but not a systemic risk

Although there's no doubt that many are struggling on an individual basis, student loans do not appear to represent a systemic threat, based on the underlying ability of students to afford and pay back their loans.

Also acting as a safeguard against systemic problems, many, if not most, of these loans were cosigned by parents, who are also liable for repayment if the student defaults. Again, while this will certainly be a hardship for some, it does substantially reduce the potential for a crisis.

Any form of debt represents a risk, but the risk from student loans doesn't warrant the concern many are expressing. There will certainly be defaults—probably many of them—but the system as a whole should be just fine.

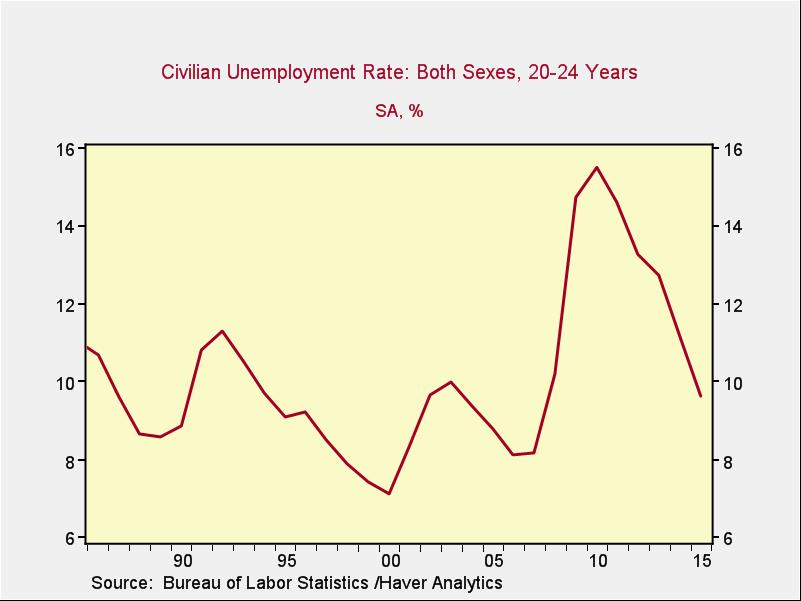

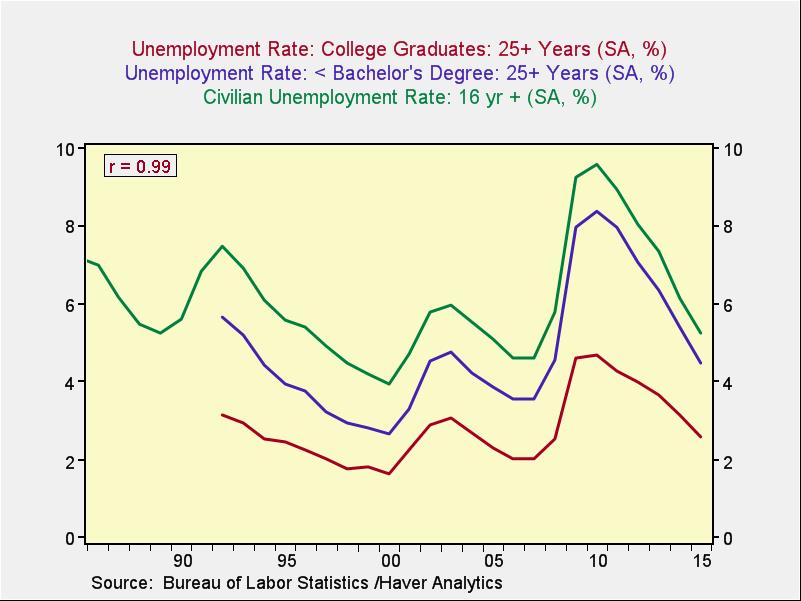

There has been a serious decline in unemployment for this cohort over the past five years, to levels consistent with much of the 1990s and some of the 2000s. Plus, for our purposes, these figures represent a worst case, since we must consider only those with postsecondary education to incur student debt. With that in mind, let’s take a look at the longer-term employment results of that education.

Clearly, younger people are doing better, and in aggregate, the more educated are doing better yet, suggesting that growing employment should help ensure student debt repayments.

Overall, the spike in student loan growth can largely be chalked up to demographics. With millennials now graduating, loan growth is normalizing. Average loans are, in general, supportable if the graduate is employed, and the employment market for the millennial cohort has improved dramatically over the past five years—and even more so for those with the education that the student loans funded.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by McMillan.

The Student Loan Problem (Or Is It?)

March 18, 2016

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

This article puts in perspective the issues surrounding student debt. No matter one’s view of the magnitude of the problem, Brad’s article should encourage financial advisors to urge clients to plan and save for college so they limit debt in the future. I am President of a consortium of more than 280 private colleges and universities (Princeton to Stanford and everything in between) that voluntarily sponsor a prepaid tuition plan, Private College 529 Plan. 529 savings and prepaid plans offer tax breaks for families and even small, regular contributions to a 529 Plan will add up over time. Bottom line: earn interest rather than pay it.