If your primary goal is to build a lasting relationship, then it’s not a good idea to be collecting numbers and facts before you’ve gathered a client’s personal story. And that story can be gleaned by asking the three big money/life questions.

Third Objective: The Big Money/Life Questions

At ROLAdvisor.com, we have developed a digital discovery process to help clients answer these three questions. We have a “Fiscalosophy” profile designed to discover their specific financial philosophy on key money issues such as managing debt, investing, saving, retiring, supporting children and managing risk.

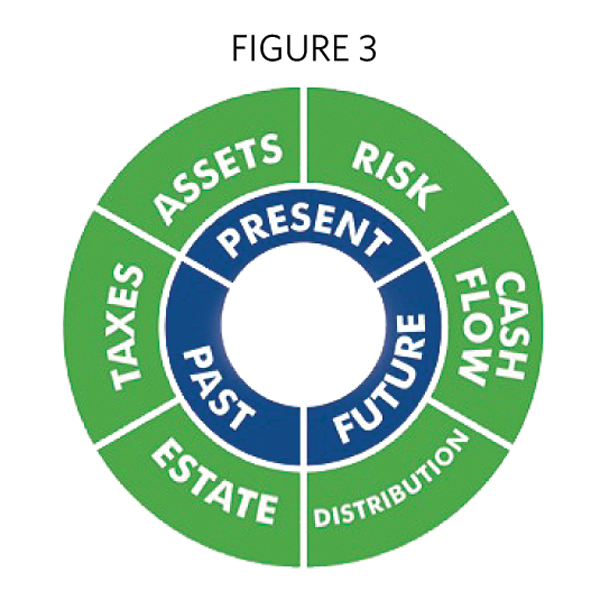

To better understand the present, we administer the “ROLIndex”—a reflective exercise for clients to rate the level of satisfaction they are deriving from the application of their money into 10 aspects of life: work, residence, leisure, health, relationships, achievement, learning, purpose, security and autonomy. This exercise gives clients a highly personalized portrait of their progress with money, as well as an actual number for how they rate their “return on life” at present. This places the emphasis not on how they’re doing against the markets, but instead on how they’re doing against their potential.

Their story is ongoing. But the future will be determined by the transitions the clients are facing now. Money goes into motion when life goes into transition, so it is imperative that life-centered planners understand exactly the transitions their clients are facing. There is no better track for pertinent planning and relationship-building than helping clients financially navigate every meaningful transition in their life.

This means advisors need a more sustainable value offering. For that, I’ll close with a fitting acronym: AUM.

• Align your client’s means with their meaning.

• Understand their unique story.

• Monitor their life’s transitions.